- SEC’s crypto involvement raises questions about partisan regulation in upcoming elections.

- Darius Dale expects Biden-aligned policies in budget deficit financing.

Apart from the Bitcoin [BTC] halving, the US 2024 election stands as one of the most anticipated events of this year.

Despite remarkable progress within the crypto industry under President Joe Biden’s administration, regulatory challenges persist.

Notably, the Securities and Exchange Commission’s (SEC) increased involvement in the crypto sphere prompts speculation: Will the widening partisan gap in crypto regulation influence the approach taken in the 2024 elections?

Senator Lummis criticizes DOJ’s Bitcoin stance

Amidst these looming concerns, U.S. Senator Cynthia Lummis recently criticized the Department of Justice (DOJ) for its interpretation of regulations concerning non-custodial software wallets.

Voicing her apprehension on the same, Senator Lummis took to X (Formerly Twitter) and noted,

“I am deeply concerned by the Biden administration criminalizing core tenants of the Bitcoin network and decentralized finance.’

She added,

Source: Senator Cynthia Lummis/Twitter

The dispute emerged when the DOJ charged developers linked to Bitcoin mixers like Samourai Wallet and Tornado Cash. These activities were deemed unauthorized money transmission by the DOJ.

Senator Lummis’s comment highlights the contradictory DOJ’s approach against past Treasury guidance, potentially criminalizing core aspects of Bitcoin and DeFi operations.

Insights from Darius Dale

Separately in an interview with Anthony Pompliano, Darius Dale, CEO of 42Macro, discussed the impact of various developments on the crypto market and elections.

Shedding light on the potential influence of President Biden’s administration on Treasury policy, particularly regarding how the budget deficit is financed. Dale said,

“The Treasury knows the budget deficit is going to be, but how they choose to finance the budget deficit is sort of a discretionary.”

This underlines the positive relationship between Secretary Janet Yellen and Joe Biden, and an expectation for policies that align with the administration’s objectives.

Stock market trends

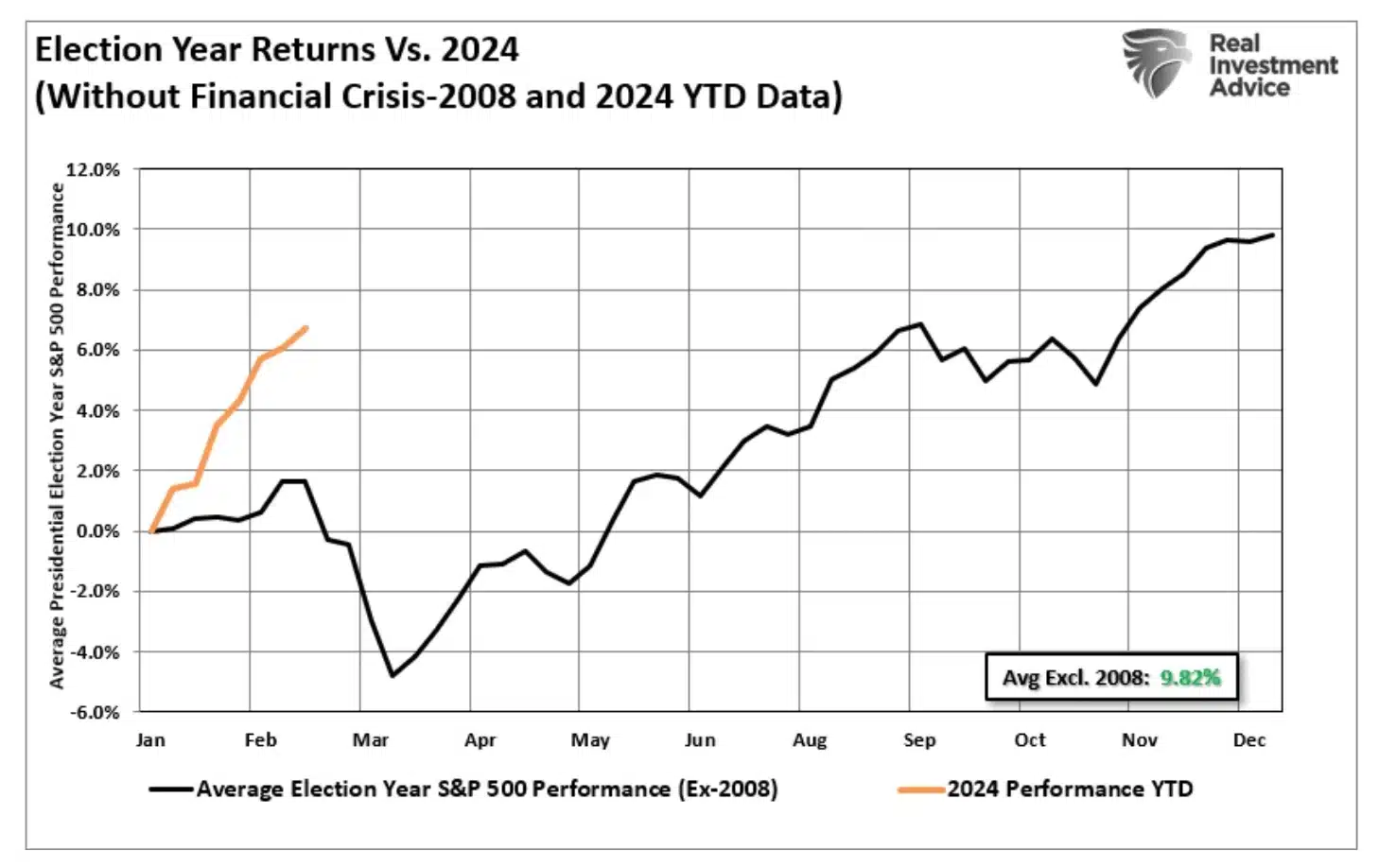

Historical data indicates that the stock market tends to exhibit strong performance in the period leading up to the presidential elections. In 2024, this trend is notably exceeding historical averages.

Source: Investing.com

Needless to say, Dale emphasized the importance of understanding the interplay between sticky inflation and Treasury policy responses and claimed,

“We know we’re kind of very much in that debate process, but the early indications of that debate process are certainly moving in a hawkish direction.”

Credit: Source link