- 67% of Binance accounts have bet long on XRP after the asset showed signs of a bullish reversal on its weekly price chart.

- An analyst has predicted that XRP could hit $71, as he claims the asset appears to be imitating some movements in the previous cycle.

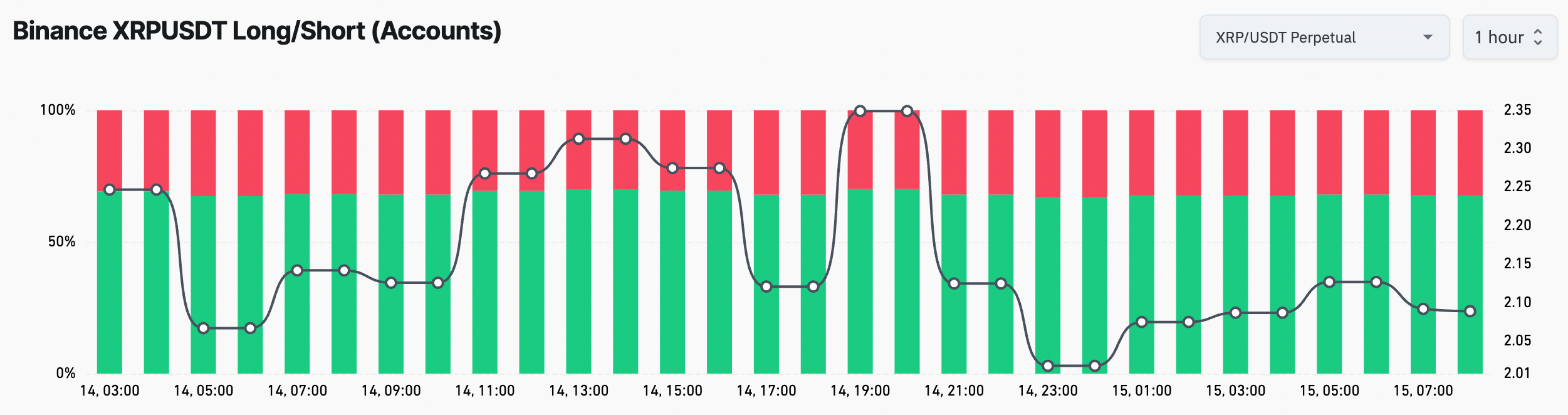

Traders on Binance have expressed strong confidence in XRP with a long/ratio of 2.09 after 67.6% of the accounts bet long. According to the report first disclosed by Coinglass, the top 20% of Binance’s users by margin balance have made similar decisions. While this appears encouraging, it is also a decline from the previous level where more than 70% of Binance traders bet long on XRP, as previously explored by CNF.

Situations on the General Trading Platforms

To find out whether this is happening across the broad crypto market, we explored the trading activities around Bitcoin and discovered that it is being shorted by almost 55% of the accounts on Binance.

Extending our research to almost all the top exchanges, we discovered that the bullishness of XRP is only limited to Binance and others, including BitMEX. According to the overall data, almost 51% of accounts on all exchanges are betting against XRP.

Looking at the Open Interest (OI) for XRP, CNF also observed that there has been a 4% decline in the last 24 hours as the total number of open derivatives contracts stood at $3.15 billion. In a more bizarre situation, $4 million in XRP has been liquidated in the past day with 61.5% of the affected amount being long positions. However, a similar bearish effect was barely felt in the spot market.

XRP Price Analysis

At press time, XRP was trading at $2.1 after surging by 0.5% in the last 24 hours and 14.4% in the last seven days. This marginal daily surge was not supported by the current trading volume which has declined by 26% with $3 billion changing hands.

According to a TradingView analyst known as RizeSenpai, XRP could continue this run to hit at least $71 in the long term. Per our calculations, this would represent a 3,281% surge from the current level.

Elaborating on his point, the analyst referenced the similarities between XRP and Bitcoin in the previous cycle. According to him, Bitcoin’s accumulation phase in the 2015-2017 cycle mirrors the current structure of XRP.

Pointing out to an earlier scenario, the analyst highlighted that Bitcoin surged by 5,424% after consolidating between 2013 and 2016. Similarly, XRP consolidated after its listing on Poloniex in 2014 to record its “big run” in the late 2017 and early 2018 period.

Speaking on the major target this cycle, the analyst disclosed that the $27 to $30 range is more realistic. According to him, the asset could also hit anywhere between $71 and $120 once it accurately imitates the movement of the previous cycles.

Other analysts, including Standard Chartered, have come up with a more realistic estimate for XRP in the last few months. As previously mentioned in our report, the bank tips the asset to hit $5.5 this year and $8 next year. Another analyst identified as Egrag Crypto has also predicted that XRP could hit $33, as reviewed in our recent publication.

Recommended for you:

Credit: Source link