Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Bitcoin dominance has hit a new cycle high, providing a bearish outlook for altcoins and any potential altcoin season. Crypto analyst Finsends has commented on this development and how it could affect the altcoin season moving forward.

What’s Next As Bitcoin Dominance Hits New High?

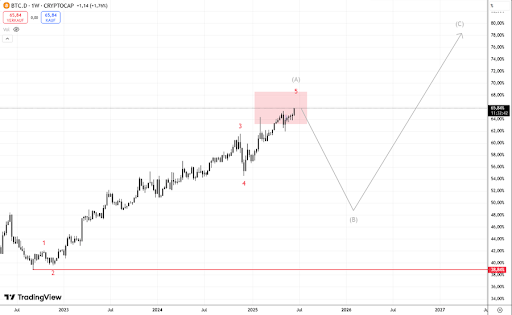

In an X post, Finsends stated that the Bitcoin dominance has made a new high and that it feels like it can never go down again. However, he opined that there should be a bigger correction starting somewhere around the current levels. The analyst added that the potential target area for a top in this scenario goes up to 68.56%.

Related Reading

His accompanying chart showed that the Bitcoin dominance could hit this projected top of 68.56% in July, after which a decline would begin. Based on the chart, the BTC.D could drop to as low as 48% on this decline, paving the way for a potential altcoin season. If so, then altcoins could witness significant gains in the second half of the year and outperform BTC in the process.

In an X post, crypto analyst Michaël van de Poppe also commented on the rising Bitcoin dominance and a potential altcoin season. He noted that the altcoin season indicator has hit its lowest number in two years. The analyst added that the lows of this indicator over the last six years were in June or July.

Based on this, he remarked that there seems to be a pattern since the indicator has hit a low again this June. Michaël van de Poppe didn’t predict when exactly altcoin season could begin or if the Bitcoin dominance would top anytime soon. However, before now, he had expressed confidence that the alt season would still happen. The analyst noted that the last cycle was also called a Bitcoin cycle until altcoins started to run and heavily outperformed.

What Needs To Happen For Altcoins To Take Off

In another X post, Michaël van de Poppe stated that altcoins are in need of an upward push from Ethereum, and that this needs to happen through a push of Bitcoin. He further remarked that once the BTC price bottoms out, that is a very likely moment for Ethereum to continue outperforming the flagship crypto, with the Bitcoin dominance declining.

Related Reading

The analyst believes that altcoins would start “shining” when the next leg upwards for Ethereum takes place, possibly ushering in altcoin season. He declared that once altcoins start to shine, market participants can expect them to heavily outperform the markets. However, for now, Michaël van de Poppe believes investors need to have some more patience.

At the time of writing, the Bitcoin price is trading at around $101,700, down in the last 24 hours, according to data from CoinMarketCap.

Featured image from Pixabay, chart from Tradingview.com

Credit: Source link