Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

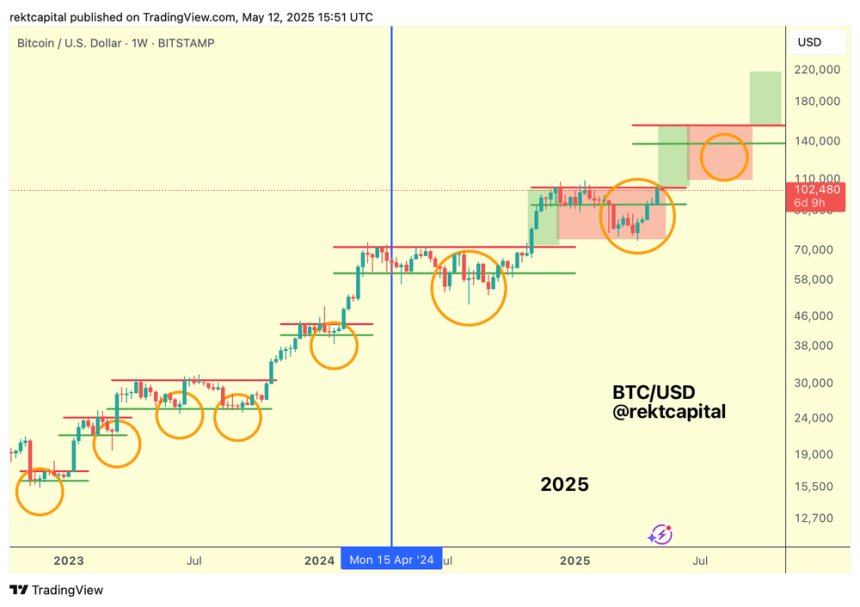

After jumping by 10% over the past week, Bitcoin (BTC) has hit a crucial resistance level, which could push or momentarily halt the flagship crypto’s rally toward a new all-time high (ATH).

Related Reading

Bitcoin Hits Key Level

Bitcoin recently jumped above the $100,000 barrier for the first time since February. During its significant weekly performance, BTC has surged over 10% to hit a three-month high of $105,500 on Monday, fueling investors’ sentiment regarding a new ATH rally.

On Monday, Analyst Rekt Capital highlighted that the flagship crypto rallied across the entire re-accumulation range, concluding its downside deviation and the first price discovery correction. After surging to its range high of $104,500, Bitcoin has faced rejection from this key level, momentarily pausing its rally.

He pointed out that Bitcoin already had its first Price Discovery Uptrend and Price Discovery Correction. The cryptocurrency is now attempting to confirm its second Price Discovery Uptrend, but needs to reclaim the $104,500 level as support to confirm this phase.

As the analyst explained, this level is currently acting as resistance after it closed the week at $104,118, just below the range high. He added that “technically BTC can try to confirm an uptrend beyond this point by Daily Closing above $104.5k and then holding it as support, so it will be worth watching for this lower timeframe confirmation.”

However, “until that confirmation is in, this resistance will continue to act as one. And as resistances do, they tend to reject price.”

According to Rekt Capital, Bitcoin has repeated some key elements from its Post-halving range in its current range, suggesting that if BTC continues to reject from this level, it could face a post-breakout retest of its lower high resistance.

One Dip Left Before ATHs?

Previously, the analyst detailed that BTC could be repeating its Q4 2024 performance, where the cryptocurrency recovered from its downside deviation to hit a new ATH.

BTC initially got rejected at its lower high resistance and fell to the range’s lows before breaking above the lower high, retesting it as support, and soaring to a new ATH.

For history to repeat, BTC must get rejected at $99,000, hold $93,500 as support, and break the $97,000-$99,000 range before being rejected at the $104,500 resistance, which is the level “to turn into support for Bitcoin to breakout into its second Price Discovery Uptrend.”

Notably, BTC followed this path closely over the past week, getting rejected near $99,000 and retesting the $93,500 support before jumping above the $100,000 mark. To continue this performance, the cryptocurrency must fall to the $97,000-$99,000 range and hold it as support for a similar breakout to new ATHs.

Related Reading

In his Monday analysis, Rekt Capital shared that BTC’s lower high resistance is at the $98,500 level, signaling that a 5% drop could be ahead. However, he noted that the retest “doesn’t need to happen at all,” as Bitcoin could Daily Close above the key resistance, hold this level, and rally to new ATHs.

“But in the event of a dip, turning the Lower High resistance into a new support could fully confirm the break of this Lower High, turn it into new support, and in doing so, solidify BTC’s positioning in the $98.5k-$104.5k portion of the ReAccumulation Range,” he concluded.

Featured Image from Unsplash.com, Chart from TradingView.com

Credit: Source link