- Previous golden crosses have driven significant gains, such as a 60% surge following Trump’s reelection and a 45% rally during Bitcoin ETF euphoria in 2023.

- Bitcoin’s rally faces key resistance at $106.6K, where 31,000 BTC remain unmoved. While retail selling is evident, strong whale absorption has kept prices steady.

Bitcoin’s price once again continues to gather strength, with a 3% upside today and moving past the crucial resistance of $105,000. Crypto analyst Benjamin Cowen noted that BTC is yet again approaching the ‘Golden Cross’ pattern, setting up the stage for another 45-50% rally ahead.

As of May 20, Bitcoin’s 50-day simple moving average (SMA), represented by the red wave, is on track to cross above the 200-day SMA for the first time since October 2024, signaling the formation of a golden cross.

Previously, Bitcoin’s price surged over 60%, driven in part by Donald Trump’s reelection as the U.S. president. In October 2023, a golden cross preceded a 45% rally in BTC, fueled by excitement surrounding Bitcoin ETFs. Similarly, in September 2021, a comparable SMA crossover led to a 50% price gain.

Bitcoin Investors Should Maintain Caution In The Short Term

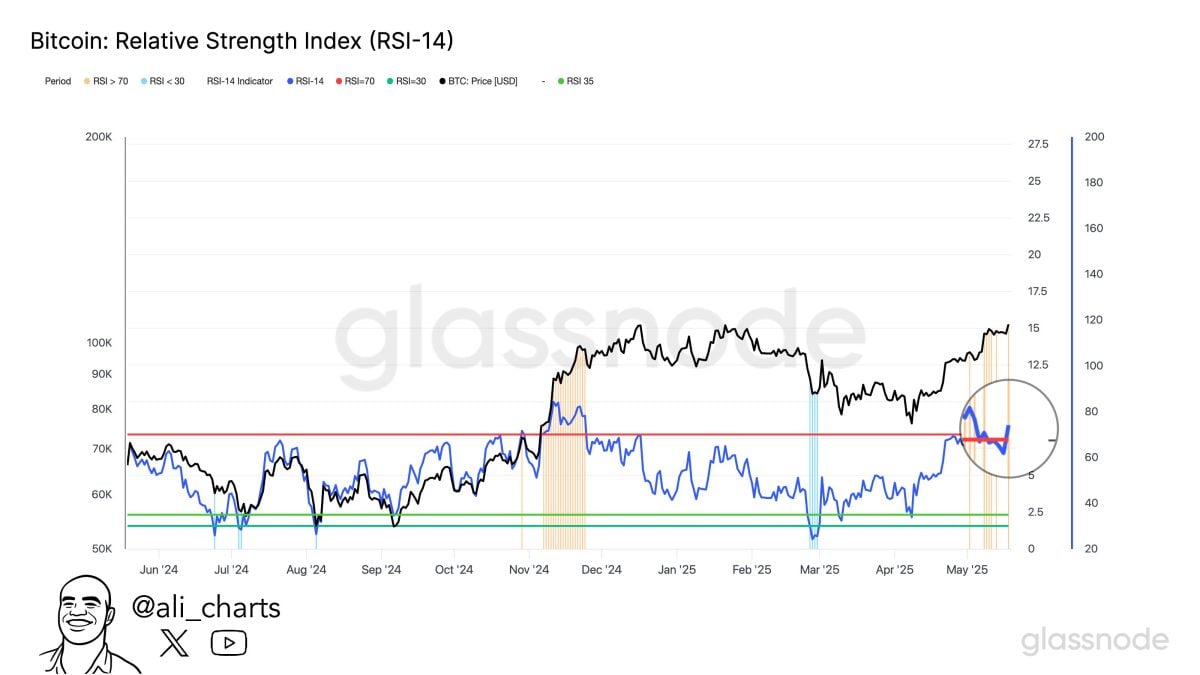

However, the formation of this “Golden Cross” on the technical chart is not a guarantee. Bitcoin is showing signs of a potential correction, as its relative strength index (RSI) climbed above the overbought level of 70 earlier in May.

Rather than an immediate rally following the golden cross, Bitcoin may retrace toward its SMA support levels, currently in the $92,400–$95,000 range as of May 20. A growing bearish divergence between Bitcoin’s rising price and its declining RSI adds to the likelihood of a short-term pullback.

Prominent crypto analyst Ali Martinez has highlighted that Bitcoin (BTC) is currently trading in overbought territory, as indicated by its daily relative strength index (RSI). This metric could signal a need for short-term caution among traders.

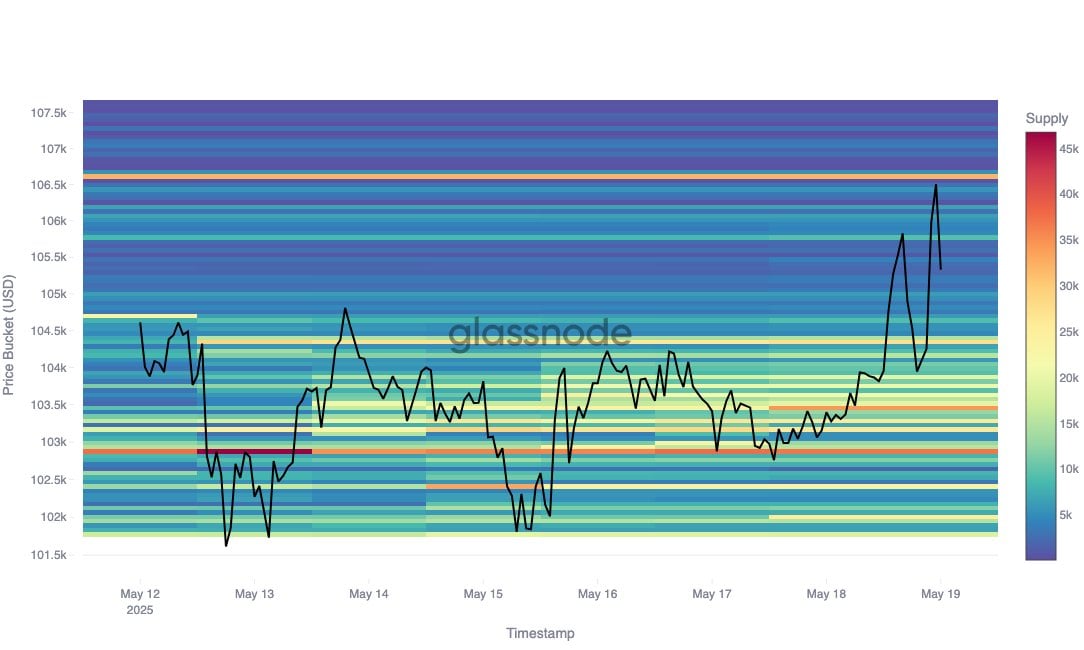

Blockchain analytics firm Glassnode also noted that Bitcoin’s recent price surge has paused just below the $106.6K mark—a critical level where 31,000 BTC are held at that cost basis. Established in Decemeber 2024, this supply cluster remains intact with holders neither redistributing nor averaging down. The $106.6K level is emerging as a significant resistance to monitor in the short term.

Analyst Notes Divergence in Bitcoin Selling Trends

Crypto market analyst Kyledoops observes a divergence in Bitcoin activity, with retail investors offloading BTC while whales remain unmoved. This steady absorption has helped sustain Bitcoin’s current rally, preventing significant price declines.

Kyledoops cautions that historical trends show a sharp downturn when both retail and whales sell simultaneously. He warns that if whales begin offloading near the $110K mark, it could swiftly shift market sentiment and trigger a deeper correction.

On the other hand, corporate Bitcoin holders like MicroStrategy and Metaplanet have continued to make aggressive BTC purchases. Also, inflows into spot Bitcoin ETFs have skyrocketed to $667 million on Monday, but veteran investor Robert Kiyosaki advises against holding these ETFs.

Credit: Source link