Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Retail participation in the Bitcoin (BTC) market is on the rise, as on-chain data indicates that smaller investors are gradually re-entering the space. This renewed activity is often a sign of growing confidence in the asset and can act as a catalyst for the next leg up in price.

Bitcoin Witnesses Rise In Retail Participation

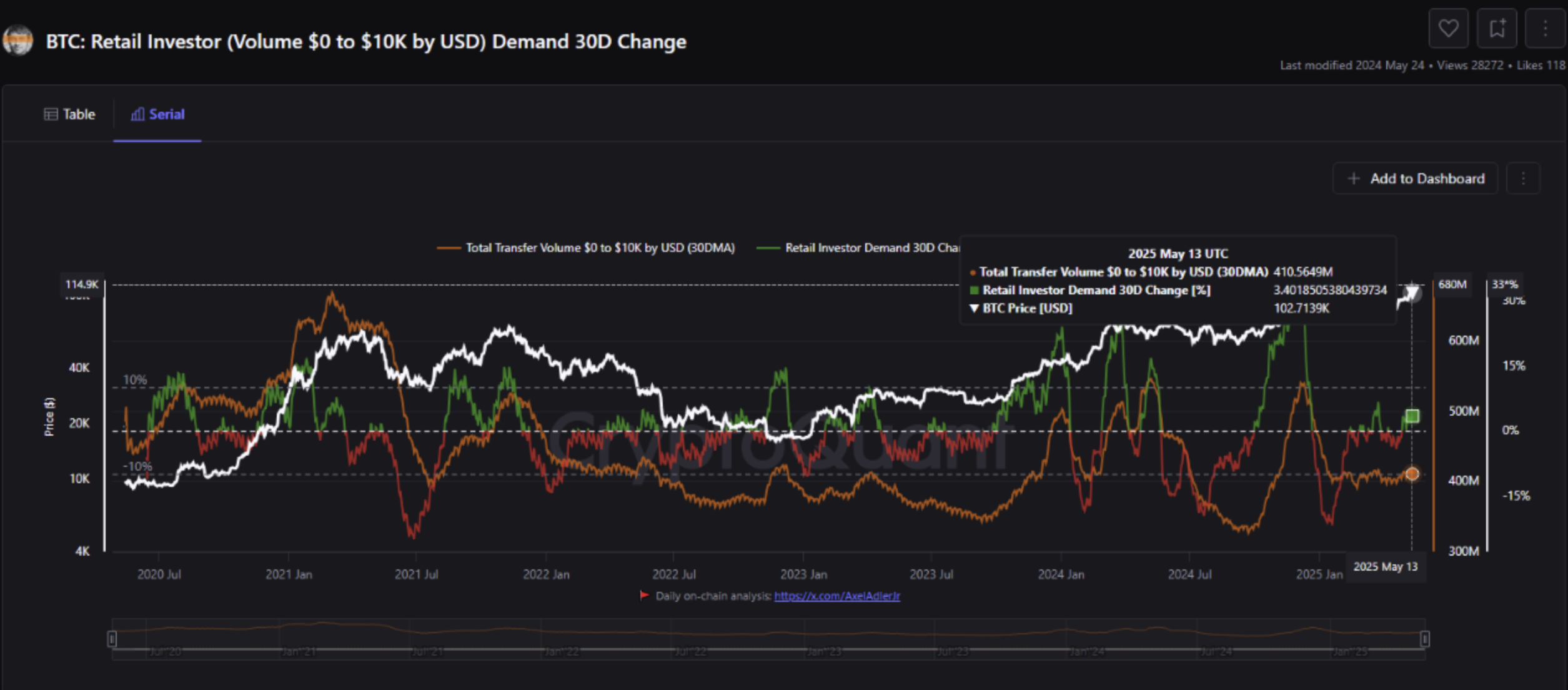

According to a recent CryptoQuant Quicktake post by on-chain analyst Carmelo Aleman, retail investors – defined as wallets holding less than $10,000 worth of BTC – are steadily returning to the market. These participants are typically the most reactive to market movements.

Related Reading

Aleman noted that while retail investors may not always time the market as effectively as institutional players, their behavior remains a key barometer of broader market sentiment. As more retail investors join, they tend to create a positive feedback loop, reinforcing bullish narratives and driving increased buying pressure, which can attract even more participants.

The BTC: Retail Investor 30-Day Change indicator reflects this trend. Since turning positive on April 28, the indicator has shown a 3.4% increase in retail buying through May 13, signalling a strong resurgence in small-investor activity.

Aleman added that if Bitcoin maintains its upward momentum, the broader crypto market could benefit, as retail investors may begin diversifying into other assets in search of higher returns. He wrote:

This could benefit the entire crypto space, as small investors are likely to diversify into other projects, including DeFi, staking, futures, and other instruments. All signs point to this shift in retail behavior being the start of a new wave of mass adoption in the cryptocurrency market.

Aleman also emphasized monitoring other on-chain indicators such as active addresses, unspent transaction output (UTXO) count, new addresses, and transfer volume, which often rise in tandem with growing retail activity.

A Few Warning Signs For BTC

While rising retail interest is encouraging, a few red flags suggest caution. Notably, the Exchange Stablecoins Ratio (USD) recently surged to 5.3 during Bitcoin’s rally to $104,000. This suggests that BTC reserves on exchanges now exceed stablecoin balances – a signal that selling pressure could be building.

Related Reading

According to CryptoQuant contributor EgyHash, a reading above 5.0 is historically significant. A similar spike to 6.1 in January was followed by a sharp price correction, indicating that investors may be rotating from BTC back into cash.

Despite some cautionary indicators, Bitcoin continues to exhibit bullish momentum. The Stochastic RSI is showing renewed strength, and other technical signals suggest the rally could continue. At press time, BTC trades at $103,993, up 0.3% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and Tradingview.com

Credit: Source link