Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin prices have jumped to $85,020 in the last 24 hours, marking a 1.2% increase that reverses some of the recent downward momentum. The cryptocurrency is now testing a key resistance level that dates back to its January peak of $110,000, according to market analysts.

Related Reading

Signs Of A Rebound Emerging

While Bitcoin still shows a 3.4% drop over the past week and a 9.5% decline over the last month, signs of recovery are emerging. Technical analysts have spotted a strong one-day price candle that has completely erased the losses from the previous three days.

The Relative Strength Index (RSI), a popular momentum indicator, has bounced off its support line. This technical signal often suggests building momentum for an upward price movement.

According to reports from TradingView analysts, Bitcoin faces its most significant challenge at the falling trend line that began on January 20. This resistance coincides with the 50-day moving average, and Bitcoin has already tested this level four times previously.

$100,000 Target Within Reach If Resistance Breaks

Market watchers eye a target just below $100,000 if Bitcoin can break its current wall. This goal sits near the top of February’s barrier zone and matches the 2.0 Fibonacci extension level, a key mark used by traders.

A breakthrough could signal a move toward a long-term bullish trend for the cryptocurrency, which has faced big hurdles in recent weeks.

The fifth test of this resistance level could prove decisive for Bitcoin’s near-term price direction. Traders are watching closely to see if this attempt will be successful where previous ones have failed.

Large Holders Show Growing Confidence In Bitcoin

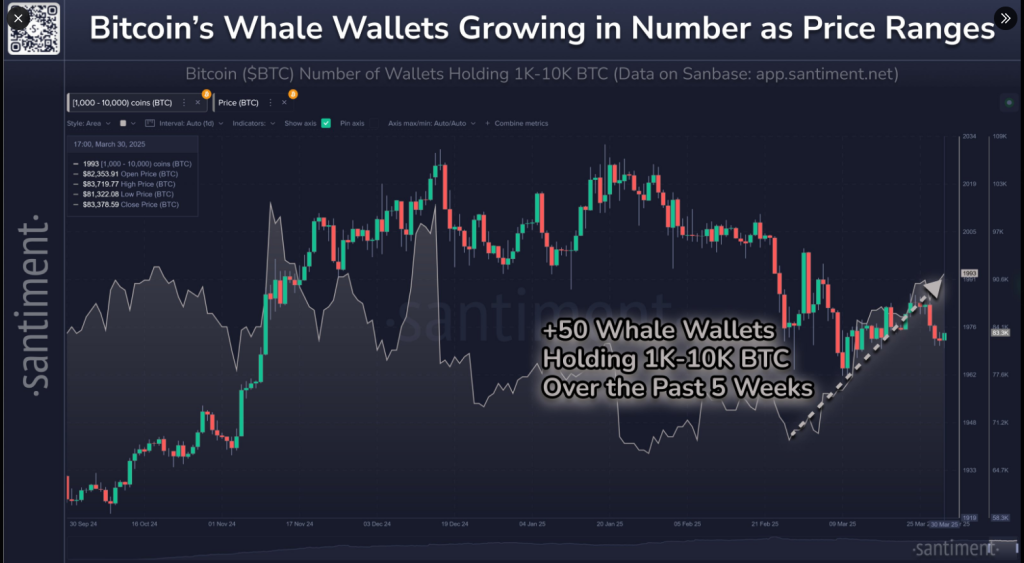

According to figures supplied by Santiment, the wallets holding between 1,000 and 10,000 Bitcoins increased to 1,993 by March 31. It is the biggest since December of 2024 and a rise by 2.5% within a five-week period when 50 large wallets joined the market.

Bitcoin’s market value has fluctuated between $81K to $84K Monday. And while prices continue ranging as March draws to a close, whale wallets (specifically 1K-10K $BTC holders) continue growing in number.

There are now 1,993 #Bitcoin wallets of this size, which is the highest… pic.twitter.com/iVYj9XdxAj

— Santiment (@santimentfeed) March 31, 2025

This accumulation pattern by large holders tends to decrease the supply of Bitcoin in circulation. When demand stays constant or increases while supply decreases, prices tend to go up.

Related Reading

Exchange Outflows Signal Short-Term Bullish Outlook

The activity of these “whale” wallets is a primary gauge of market sentiment because these large holders tend to be privy to sophisticated research and market analysis that guide their investment choices.

Meanwhile, Bitcoin’s movement to and from exchanges shows a 38% decline in net flows over the past 24 hours. According to IntoTheBlock analytics, this suggests traders are moving their Bitcoin off exchanges rather than preparing to sell.

Featured image from Gemini Imagen, chart from TradingView

Credit: Source link