Este artículo también está disponible en español.

According to a recent Quicktake post by CryptoQuant analyst abramchart, short-term Bitcoin (BTC) investors are incurring losses, suggesting that the crypto market may have hit its bottom and a trend reversal could be on the horizon.

Has Bitcoin Bottomed?

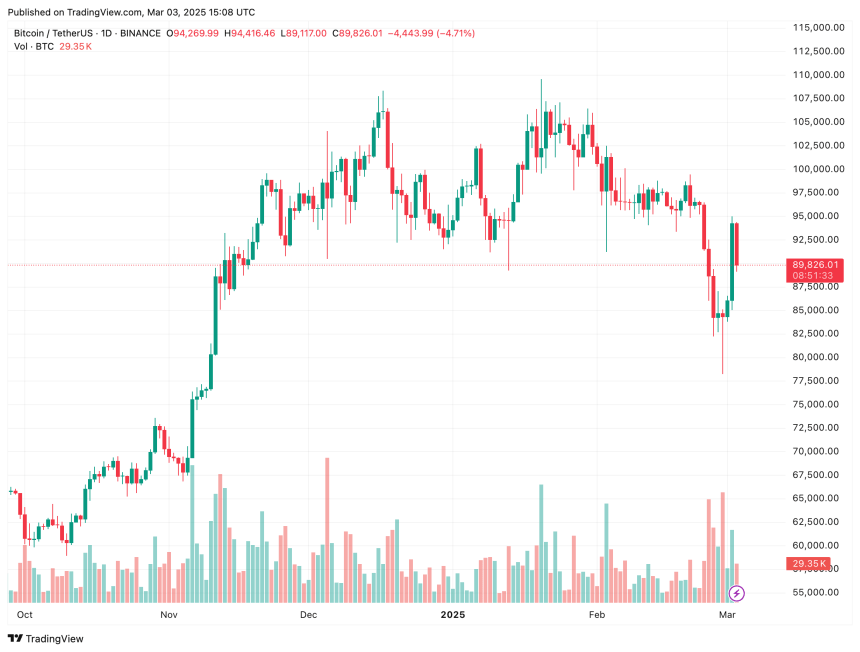

Bitcoin experienced significant volatility over the past week, dropping from $96,000 on February 23 to $78,258 on February 27. However, it recovered most of its losses yesterday, rebounding to as high as $95,000.

Related Reading

In the Quicktake post, abramchart highlighted the declining Spent Output Profit Ratio (SOPR) for BTC holders. For those unfamiliar, the SOPR measures the proportion of BTC wallets that have held the cryptocurrency for more than one hour but less than 155 days.

According to SOPR, any value greater than 1 indicates that short-term investors are selling at a profit. Conversely, a value below 1 suggests that short-term investors are incurring losses.

While a value under 1 may indicate bearish sentiment, it can also be seen as a sign of market capitulation, often followed by a potential trend reversal. The total crypto market cap surged by more than $200 billion yesterday, driven by US President Donald Trump’s announcement regarding the creation of a crypto reserve.

As of today, the SOPR sits at 0.95, the lowest it has been since August 2024 when BTC was trading within a consolidation zone around the mid-$50,000 range. The post concludes:

We have likely reached good accumulation zones for Bitcoin and are close to the bottom of the current wave.

BTC Showing Signs Of Trend Reversal

While predicting crypto markets can be difficult, some indications suggest that Bitcoin may be on the verge of a trend reversal after prolonged selling over the past month.

Related Reading

For example, during its potential local bottom at $78,258, BTC partially filled a long-standing CME gap between $78,000 and $80,000. CME gaps often act as price magnets, and once filled, BTC typically moves in the opposite direction.

Additionally, seasoned crypto analyst Ali Martinez pointed out that BTC has reached its most oversold level since August 2024. Martinez suggested that the high selling pressure on BTC might be nearing its end, potentially signaling a trend reversal.

In related news, Andre Dragosch, European Head of Research at Bitwise, noted that despite the market pullback, BTC is flashing a massive contrarian buy signal, presenting an attractive risk-reward opportunity at current prices.

On the other hand, Geoff Kendrick of Standard Chartered predicted that BTC may still experience further downside before resuming its bullish momentum. At press time, BTC is trading at $89,826, up 5.3% in the past 24 hours.

Featured image from Unsplash, Charts from CryptoQuant and TradingView.com

Credit: Source link