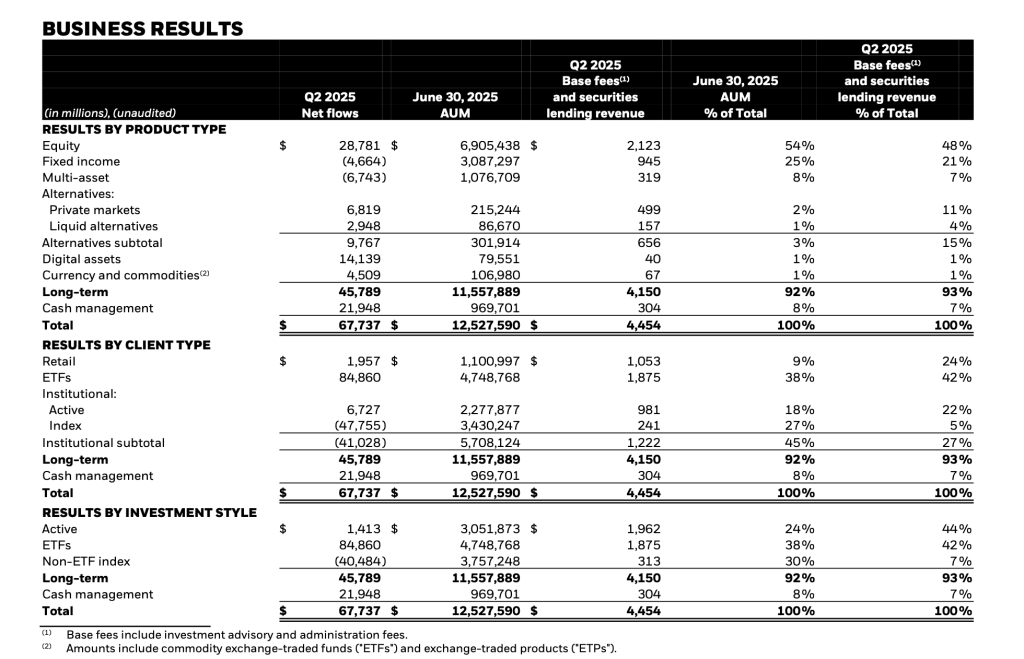

BlackRock reported $14.1 billion in digital asset net inflows for the second quarter of 2025, pushing the firm’s total assets under management (AUM) in this segment to $79.6 billion.

Although digital assets still represent just 1% of BlackRock’s $12.5 trillion in total AUM, the category is emerging as one of its fastest-growing product lines.

Digital assets contributed hugely to BlackRock’s broader ETF performance. Within the firm’s $85 billion in total ETF inflows during Q2, digital products alone accounted for $14 billion.

Year-to-date, digital asset net inflows have reached $17 billion, showing persistent institutional interest despite a complex macroeconomic backdrop.

Revenue Contribution Remains Modest—For Now

Digital assets generated $40 million in base fees and securities lending revenue in Q2 2025, also accounting for 1% of BlackRock’s total revenue from investment advisory and administration services.

While modest compared to traditional asset classes, the figure reflects a growing stream of yield-generating exposure from crypto-related products.

CEO Larry Fink attributed some of the firm’s performance momentum to digital assets, along with custom strategies and technology-led platforms like Aperio.

BlackRock Shows Long-Term Commitment to Digital Finance

In a statement accompanying the results, CEO Larry Fink emphasized the growing role of digital assets in attracting a new generation of investors.

“We’re attracting a new and increasingly global generation of investors through things like our digital assets offerings,” he said.

Digital assets are currently reported under the ETF category, alongside core equity and fixed income. However, with digital assets contributing nearly 31% of alternative product flows in Q2, they are becoming a key pillar of the firm’s alternative investment strategy.

While digital assets remain a small slice of the overall portfolio, BlackRock’s growing involvement in tokenized finance, ETFs, and related infrastructure suggests a long-term commitment to institutional crypto adoption.

“These are just the early days in our next phase of even stronger growth,” Fink added.

BlackRock shares fell more than 6% after a major institutional client based in Asia withdrew $52 billion from its index funds during the second quarter, the Wall Street Journal reported.

The withdrawal illustrates the volatility that even the world’s largest asset manager can face from a small number of large clients, particularly in passive investment vehicles.

Still, BlackRock’s overall performance remained strong, with total assets under management climbing to a record $12.53 trillion.

According to the WSJ, net income rose 6.5% year-over-year to $1.59 billion, indicating operational resilience in the face of short-term outflows.

The firm also reported increased revenue driven by higher base fees and strong flows into active strategies and ETFs, suggesting that BlackRock continues to diversify its growth drivers beyond traditional index products.

Credit: Source link