- BNB’s price held on to a support level at press time.

- Increased accumulation signal combined with magnetic zone hinted at short-term bullishness.

The exchange token Binance Coin [BNB] performed admirably in July. The bulls tenaciously defended the five-month range lows at $500, which is also psychologically important.

They were able to drive a price rebound, but the momentum has stalled.

The Fibonacci levels and the levels within the range have been respected in recent months. The BNB price prediction does not yet signal a bullish breakout, but there is evidence that a move toward $600 is likely.

Prices are finely balanced at the mid-range support

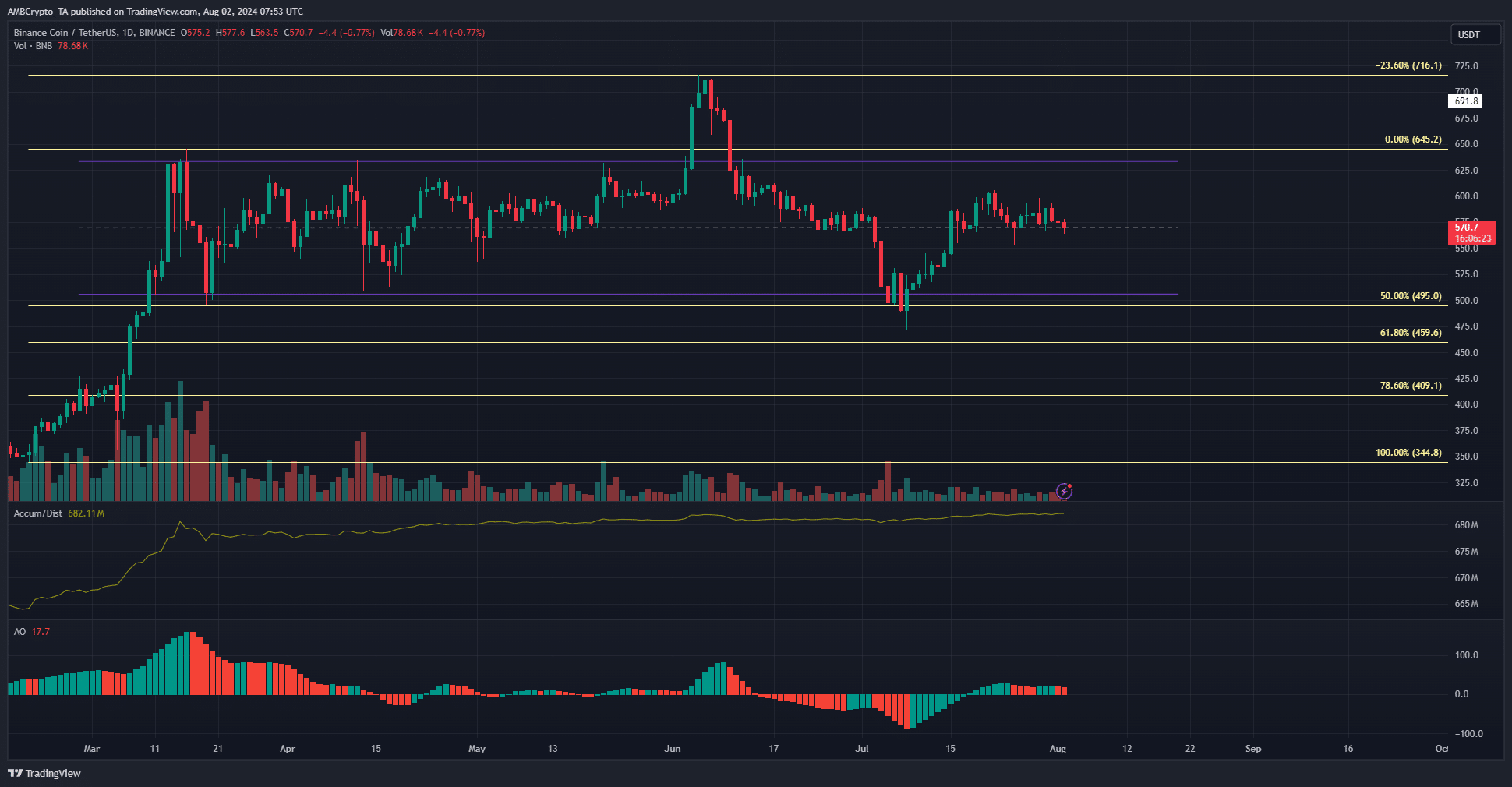

Source: BNB/USDT on TradingView

The range formation (purple) extended from $507 to $633. The Fibonacci retracement and extension levels have been respected in recent weeks.

The bounce from the 61.8% level hinted at another move toward the local highs at $645, and potentially as high as $700.

The Awesome Oscillator noted bullish momentum, but only barely. The red bars on the histogram signaled that the momentum had stalled. The trading volume has been low as well.

Despite the lack of momentum in the past two weeks, the A/D indicator continued to trend higher. This was bullish and supported the idea of price gains in the coming days.

The mid-range level at $570 served as support. A daily session close below it would be an early bearish warning.

The liquidation heatmap could see prices pulled higher

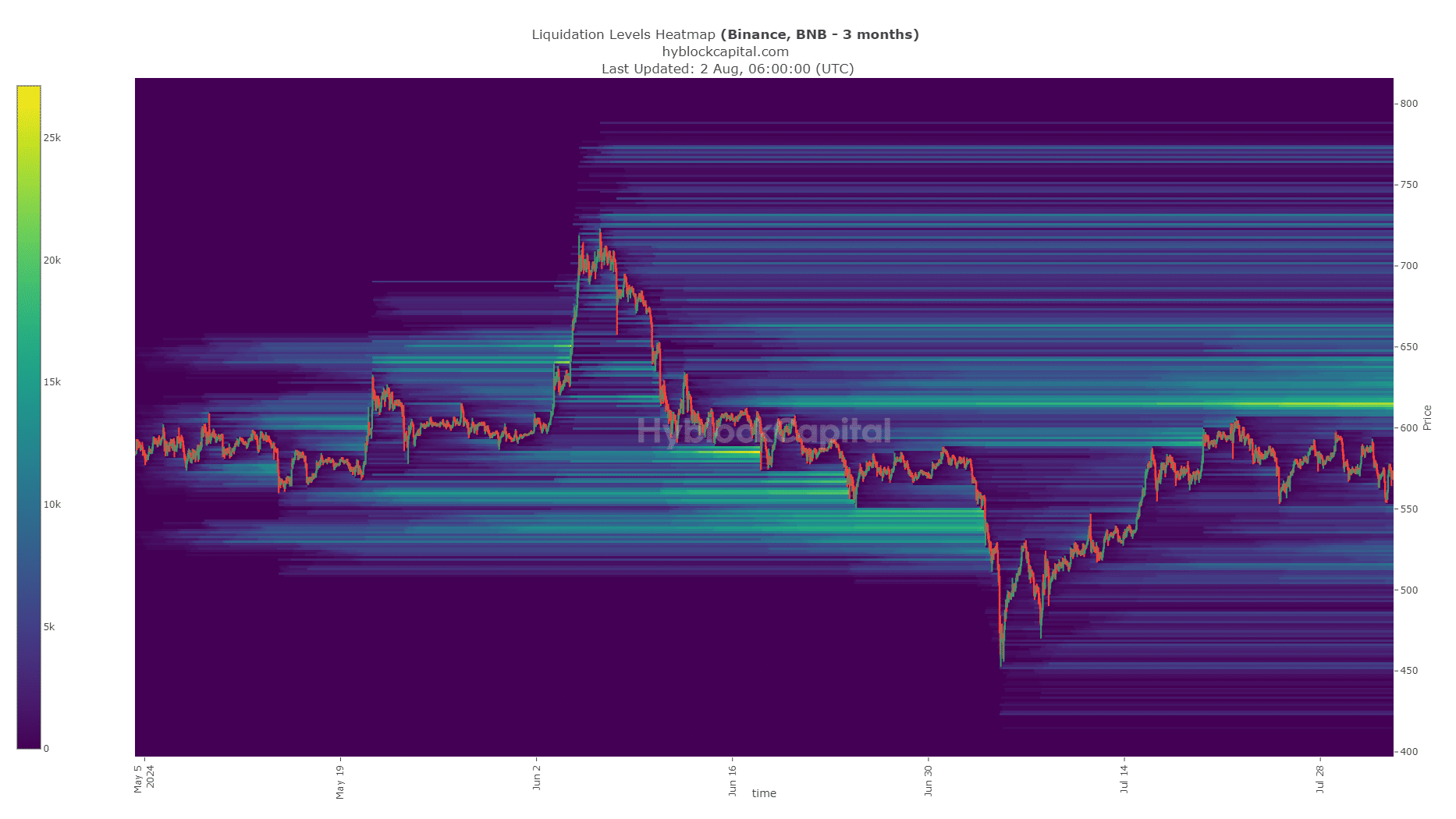

Source: Hyblock

The price action of the past three weeks saw a cluster of short liquidations build up around the $615 zone. This magnetic zone could attract BNB to it before a price reversal.

Read Binance Coin’s [BNB] Price Prediction 2024-25

The A/D indicator and the mid-range level’s defense also hint at the same.

Overall, the BNB price prediction was bullish in the short term due to the liquidation levels. However, the token is likely not yet ready to break out past the range highs.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Credit: Source link