- Binance Coin was unable to defend the gains it made earlier this month.

- It is likely that prices would move toward $500 next before recovery can begin.

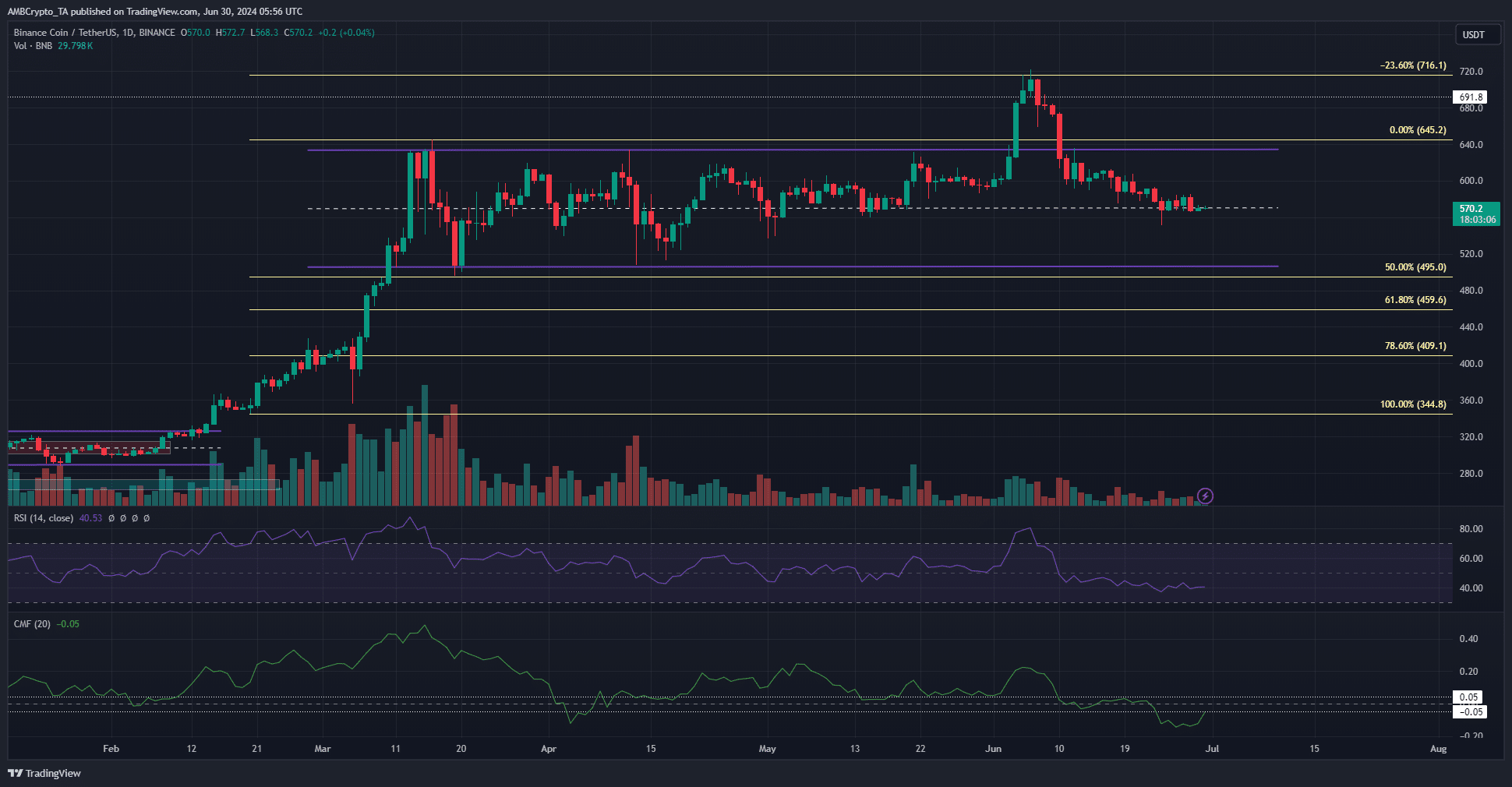

Binance Coin [BNB] bulls could not defend the breakout past the $635 resistance. The prices were back at the $570 support zone at press time. The technical indicators highlighted bearish expectations.

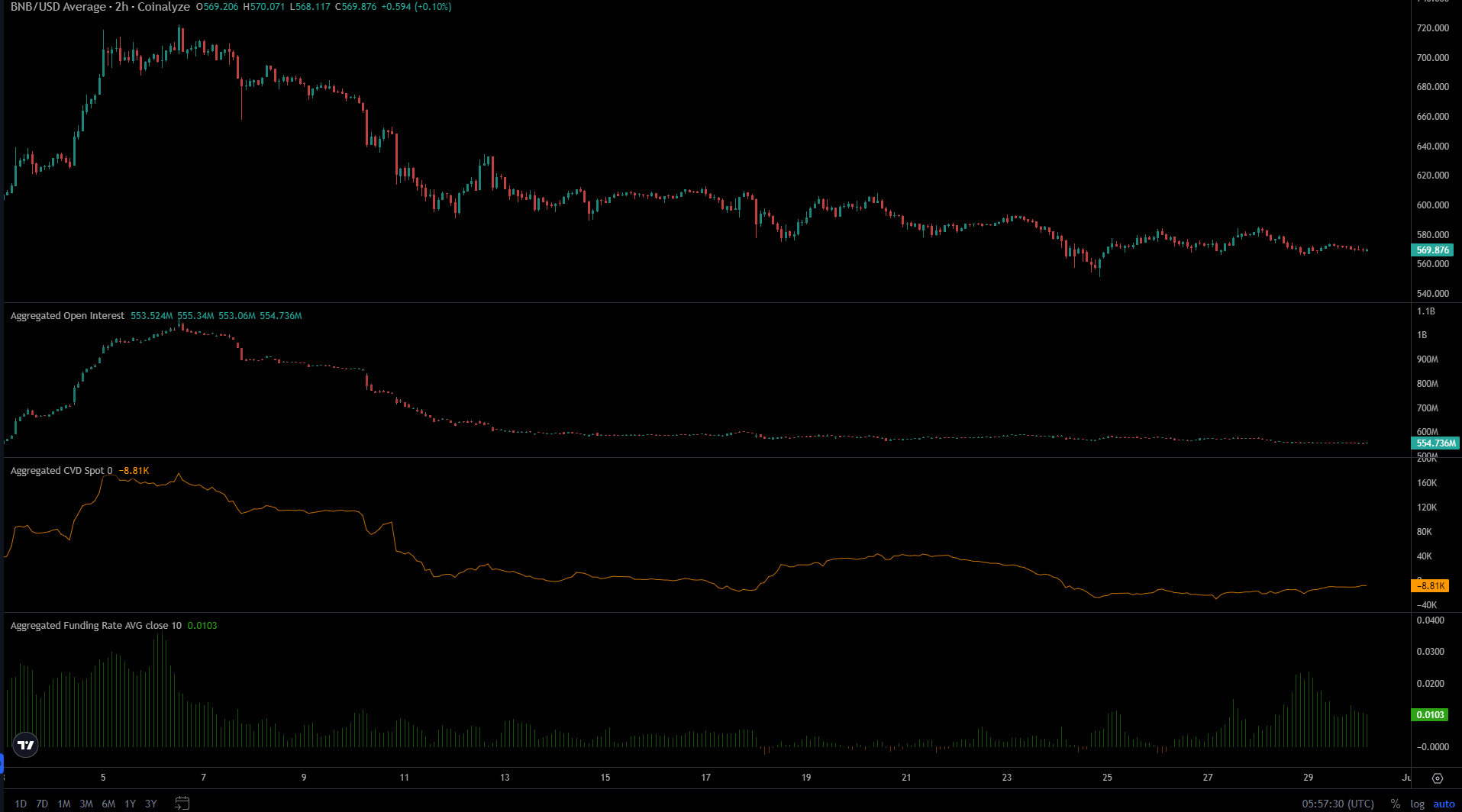

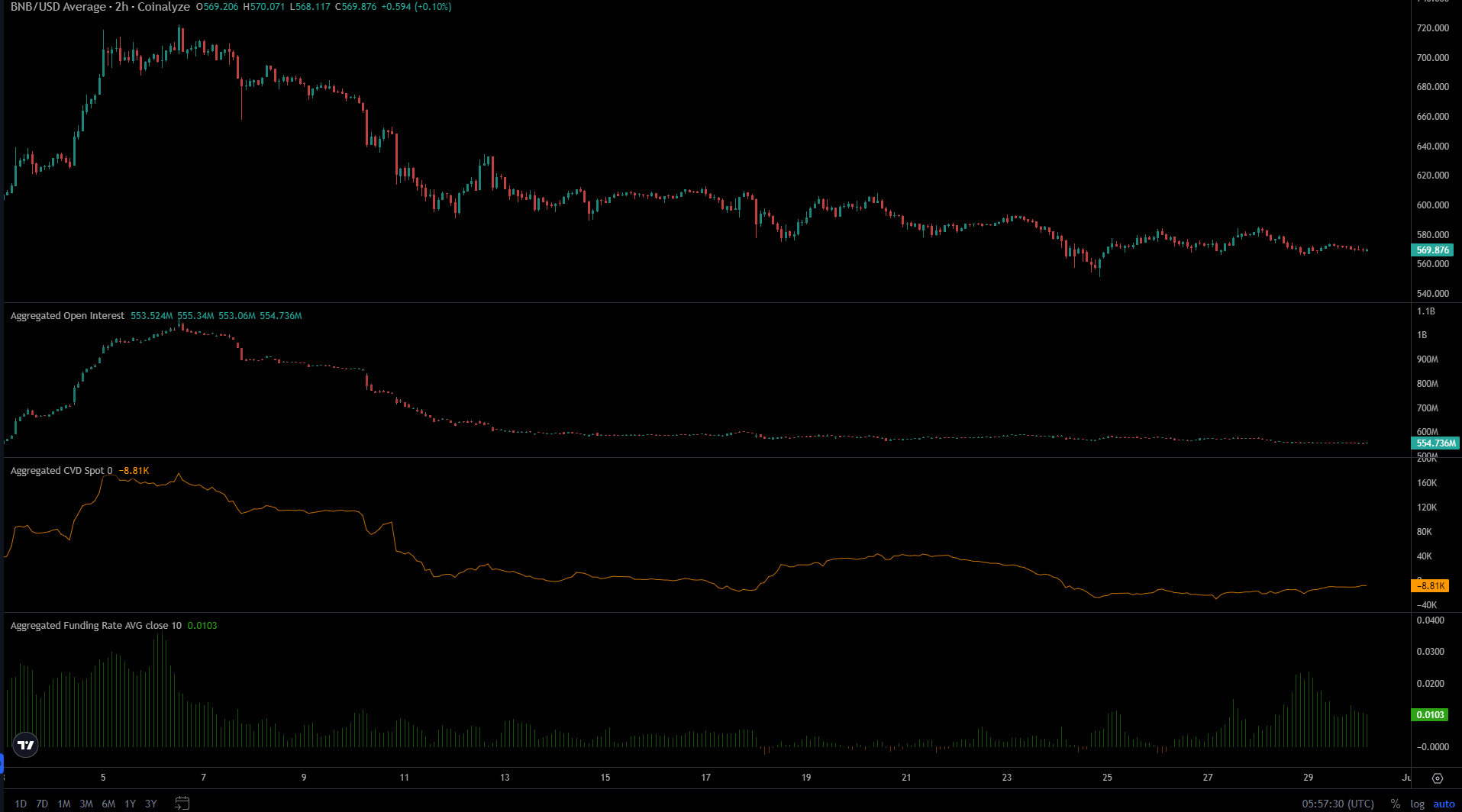

The data from the futures market was also bleak. The sentiment appeared to shift bullishly on the 29th but was not accompanied by an uptick in the Open Interest.

With speculators waiting for the next trend to be established, what should traders expect this week?

The retracement to the mid-range mark was uninspiring

Source: BNB/USDT on TradingView

The first week of June saw Binance Coin post large gains, reaching the $717 mark and set its all-time high. From the Fibonacci levels, it was the 23.6% extension and a technical resistance zone. This saw prices decline.

It was expected that the former range highs at $635 would halt the bearish advance, but this was not to be. The mid-range level at $570 was tested as support and has held over the past week.

The daily RSI was at 40, signaling bearish momentum. The CMF was at -0.05 and showed strong capital outflow from the BNB markets in recent days. Together, they indicated further losses were likely.

The liquidity at the $550 and $520 regions is likely to attract prices before a bullish recovery.

The slow rise in spot demand was a hopeful sign

Source: Coinalyze

Since the 6th of June, the Open Interest has been in a downtrend. It dropped drastically from $1.068 billion on that day to $618.2 billion on the 12th of June. This downtrend persisted, with OI at $554 billion at press time.

Read Binance Coin’s [BNB] Price Prediction 2024-25

The spot CVD saw a similar trend unfold. It attempted to recover from the 19th to the 22nd of June but faltered due to the lack of consistent demand.

Over the past two days, the spot CVD has begun to rise slowly. The funding rate also picked up, which suggested speculators might be turning bullish again.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Credit: Source link