- BONK is setting the stage for an ETF after plans of ETP launched.

- The price action and funding rates are positive for BONK.

Bonk Inu [BONK] is creating buzz with its plans to launch the first-ever meme token exchange-traded product (ETP) in the U.S.

Announced at the Solana Breakpoint event, BONK is partnering with Osprey Funds to launch the ETP by the end of the year. This move has excited investors, as BONK’s price is projected to rise higher, with a potential 0f more than 200% surge expected in October.

As the first memecoin pursuing an ETP, BONK is setting the stage for further growth and possibly an exchange-traded fund (ETF) in the future. Investors are eagerly watching for updates on BONK’s progress.

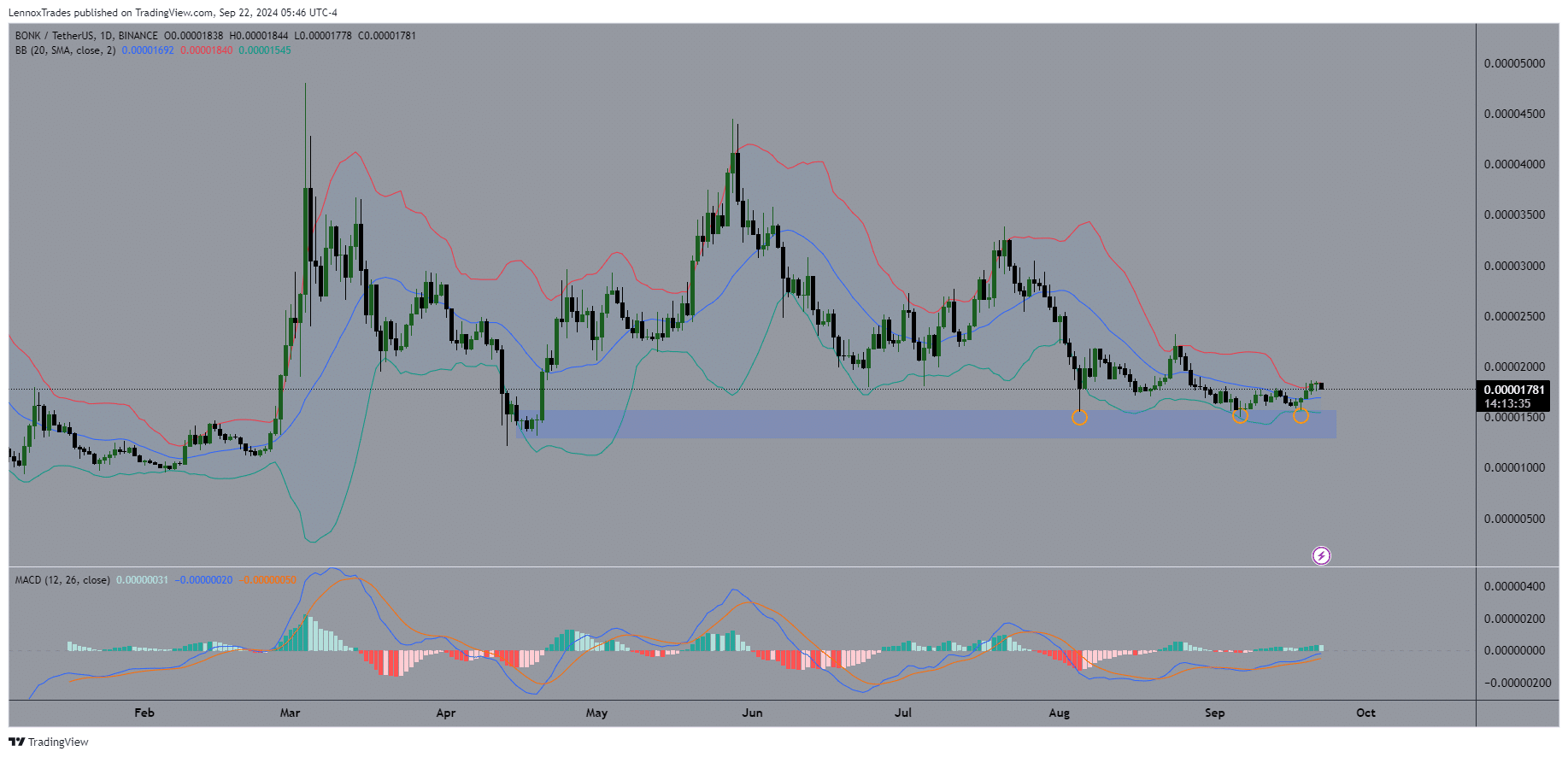

BONK’s recent developments have impacted its price action. The BONK/USDT pair has now cleanly touched this crucial support level three times, a level that resulted in more than 182% price surge from April to May of this year.

However, the pair has since experienced a decline, reaching the support zone again on 5th August when the entire crypto market hit six-month lows.

Source: TradingView

With the announcement of the Bonk ETP, which could lead to the first memecoin ETF, bullish sentiment is building. The Bollinger Bands on the daily timeframe are tightening, signaling a potential breakout.

The moving average convergence divergence (MACD) indicator also shows growing buying momentum, suggesting the price could move higher soon.

BONK is now trading above the Bollinger Band’s mean, indicating that positive sentiment is on the rise.

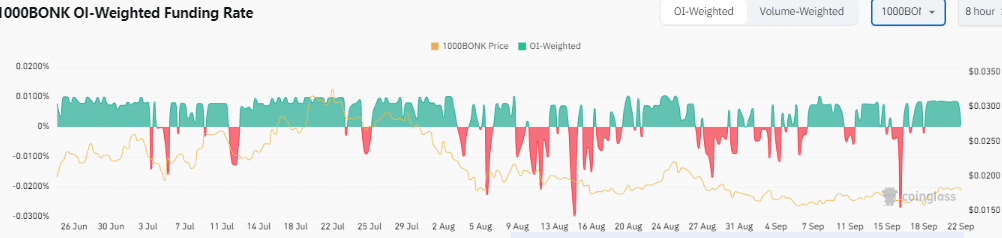

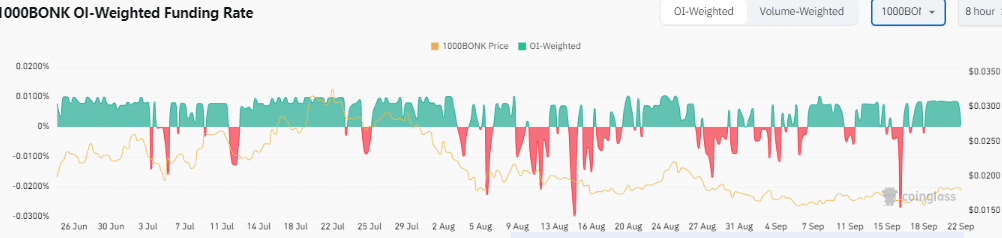

BONK OI-weighted funding rates

Another bullish signal comes from the OI-weighted funding rates, which have turned positive. This indicates that long traders are becoming more optimistic about BONK’s price potential.

As of now, the OI-weighted funding rate stands at 0.0006% with BONK priced at $0.000018. This growing confidence among traders could help push it to new heights, potentially reaching its July highs and generating over 110% gains.

Source: Coinglass

Sell volume and net shorts decline

Sell volume and net shorts are also declining, further supporting the bullish outlook. The decrease in the transfer of contracts suggests a reduction in selling pressure and a period of market consolidation.

This sets up a favorable environment for a price surge, especially if demand remains strong and supply continues to diminish.

With declining selling pressure and increasing long positions, BONK appears well-positioned to rally and possibly surpass its previous highs.

Realistic or not, here’s BONK’s market cap in BTC’s terms

BONK’s upcoming ETP launch, combined with declining sell pressure and rising bullish sentiment, could drive its price higher.

Investors are anticipating a potential breakout that may send BONK back to July’s high, representing a 110% gain, and positioning it for further growth in the last quarter of 2024.

Credit: Source link