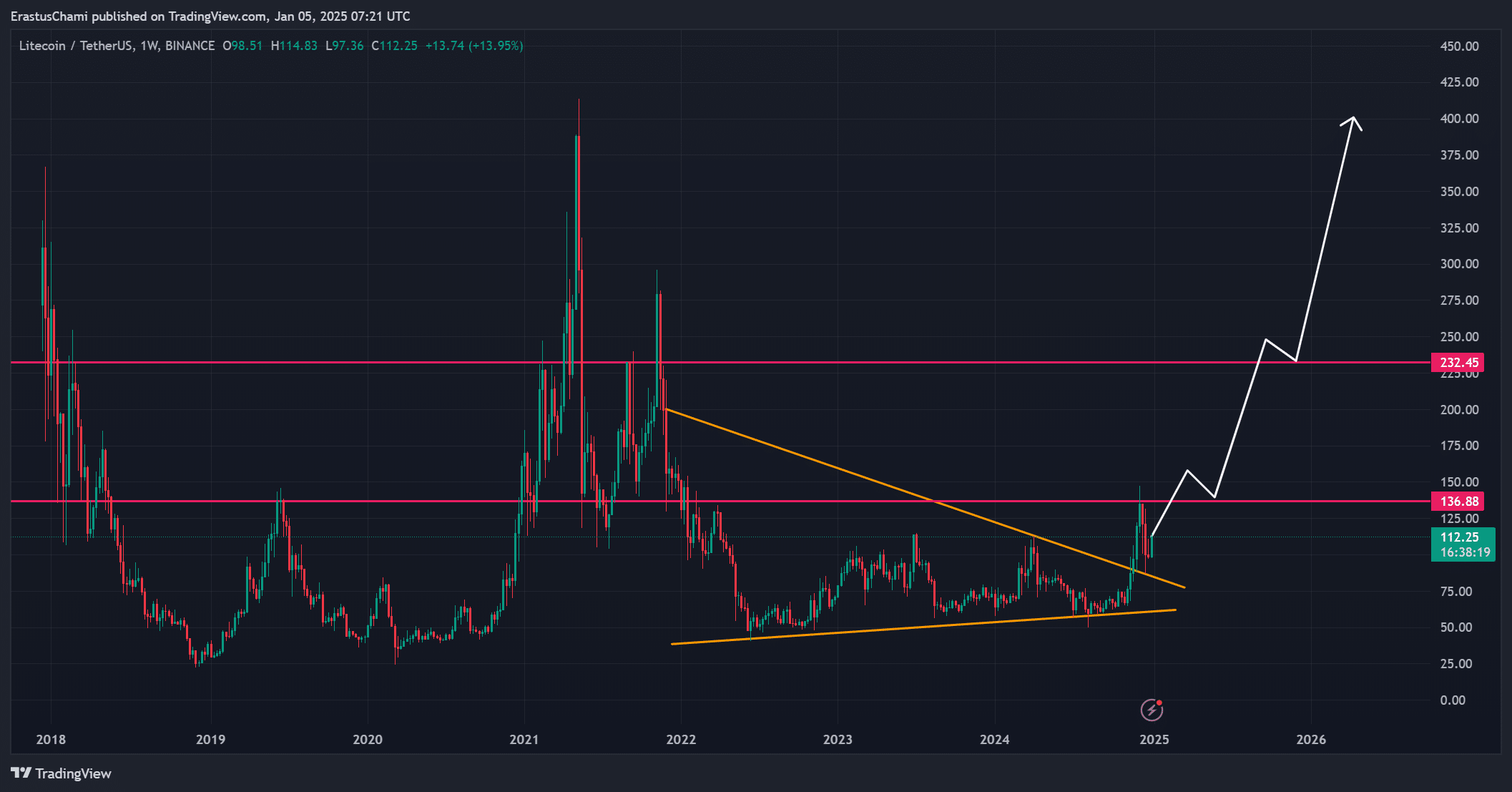

- Litecoin’s breakout from a multiyear triangle highlighted bullish momentum toward the $136 and $232 resistance levels.

- The MVRV ratio and institutional activity suggested cautious optimism for further growth.

Litecoin [LTC] has recently broken out of a multiyear symmetrical triangle pattern, marking the end of a prolonged consolidation phase.

At press time, LTC was trading at $112.32, reflecting a 0.86% increase in the last 24 hours.

The breakout has captured significant attention from traders, raising expectations for a sustained bullish rally.

The question now is whether Litecoin can maintain its upward trajectory and reach the anticipated $400 mark.

Litecoin: Strong rally ahead

This breakout, driven by strong momentum, has set the stage for a bullish rally, with critical resistance levels at $136 and $232 in focus.

Litecoin’s price action indicates a solid opportunity to test these levels, which will serve as key indicators of its trajectory.

Additionally, the symmetrical triangle breakout underscores renewed buying interest, further strengthening the case for continued upward movement.

Overcoming these resistance points will be crucial for Litecoin’s path toward $400.

Source: TradingView

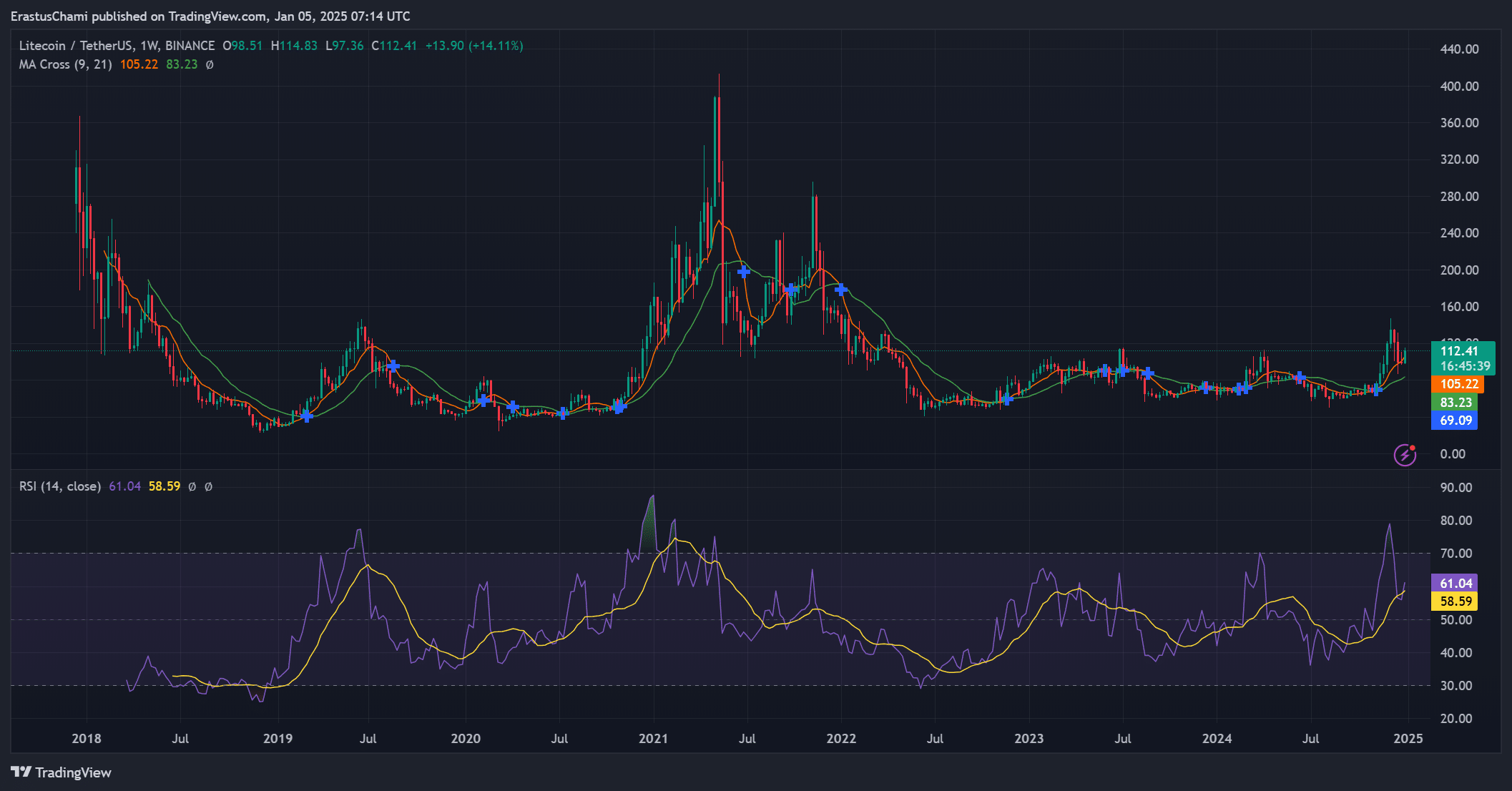

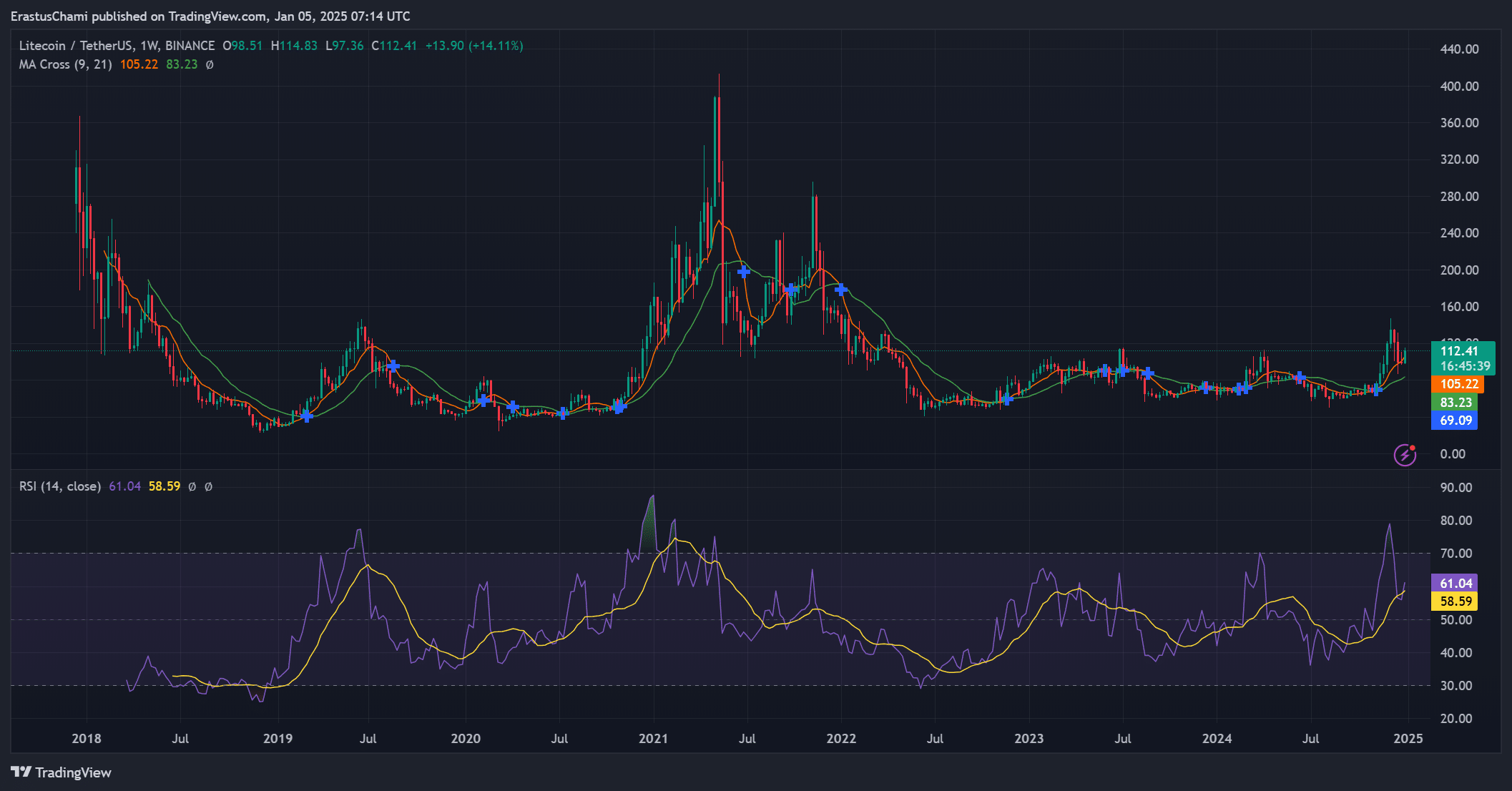

Technical indicators are painting a promising picture for Litecoin’s potential price rally. The Relative Strength Index (RSI) was at 61 at press time, signaling bullish momentum while staying below overbought conditions.

Furthermore, the 9-day and 21-day moving averages recently formed a bullish crossover, confirming the trend reversal.

These indicators suggest that Litecoin has the momentum to sustain its rally, provided market conditions remain favorable. However, traders should watch for any signs of overextension as the price approaches resistance levels.

Source: TradingView

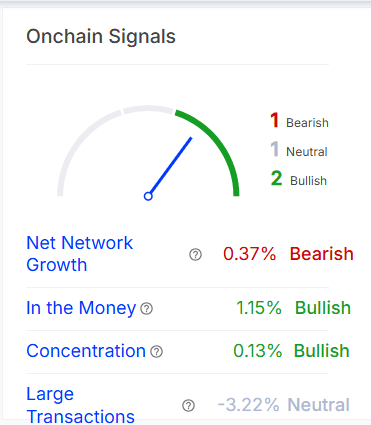

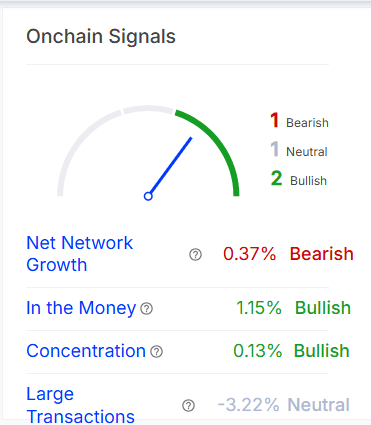

On-chain metrics show strong network activity

On-chain metrics provide a mixed outlook for Litecoin’s rally. The “in the money” metric shows a 1.15% increase, indicating profitability for a slightly larger proportion of holders and boosting investor confidence.

Concentration metrics reveal a 0.13% uptick, reflecting growing interest from large holders.

However, net network growth is lagging at just 0.37%, categorized as bearish, while large transactions have decreased by 3.22%, indicating potential hesitation among institutional players.

Therefore, sustained network activity and large transactions will be critical in driving further price action.

Source: IntoTheBlock

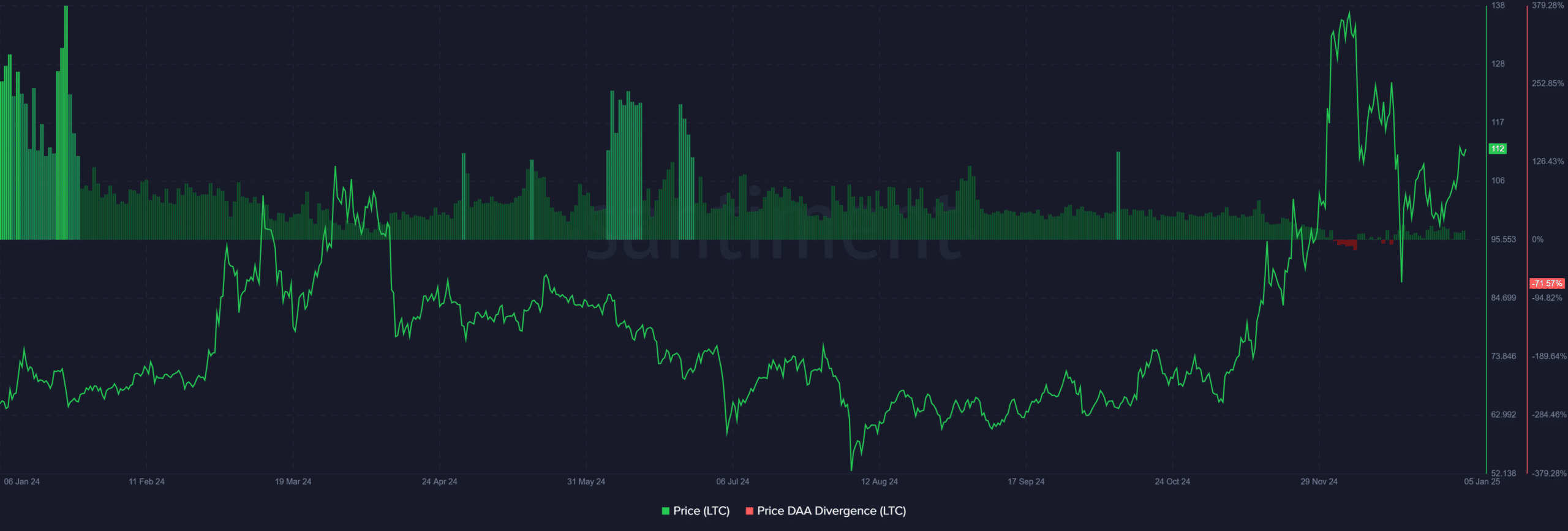

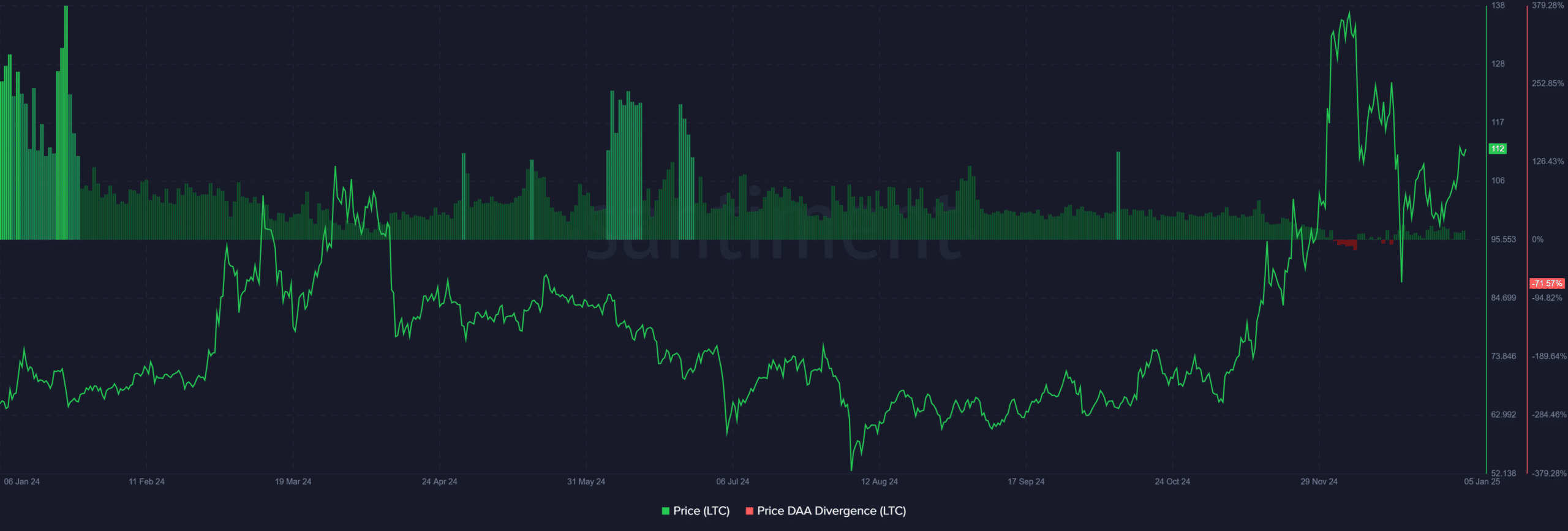

LTC MVRV ratio and price-DAA divergence raise caution

Litecoin’s MVRV ratio of 25.41% suggests that it is moderately valued, leaving room for further gains without immediate risk of overbought conditions.

However, the price-DAA (daily active addresses) divergence at -71.57% raises some concerns, as it reflects a lag in address activity relative to the price increase.

This divergence could signal potential volatility if the network activity fails to catch up with the recent price surge. Therefore, investors should remain cautious while evaluating short-term risks.

Source: Santiment

Is your portfolio green? Check the Litecoin Profit Calculator

Conclusion: Can Litecoin reach $400?

Litecoin shows strong technical signals, suggesting potential for continued growth. However, the mixed on-chain metrics and resistance levels at $136 and $232 may challenge its rally.

With sustained momentum and increased network activity, Litecoin could realistically achieve its $400 target. Therefore, its success will depend on how it navigates these key hurdles in the coming weeks.

Credit: Source link