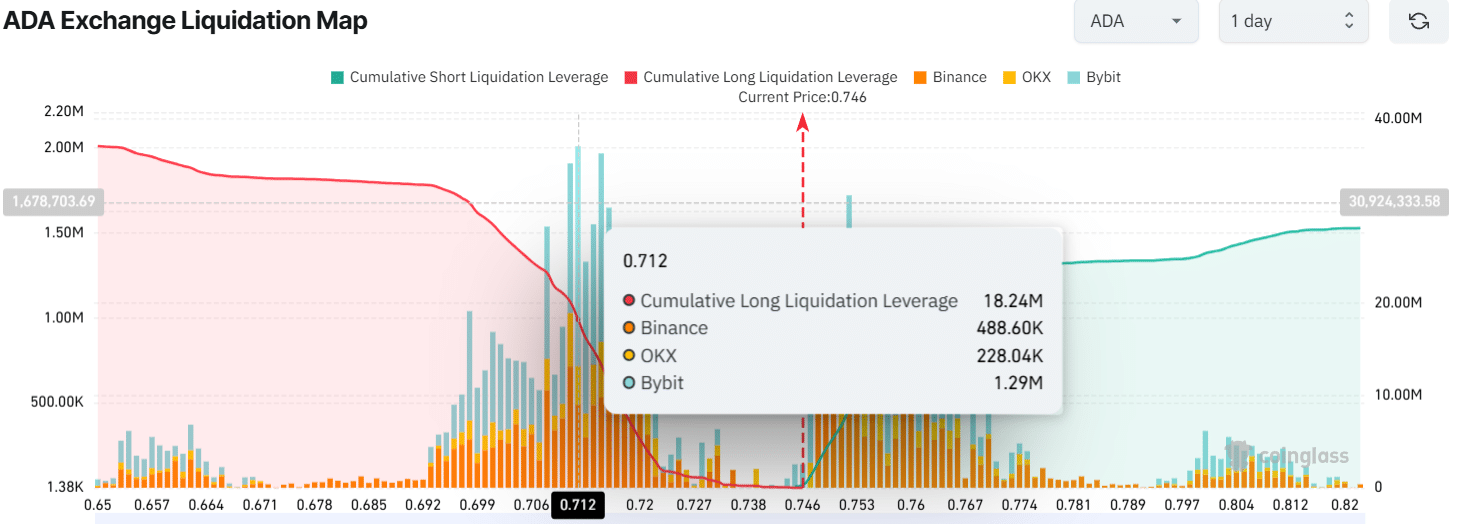

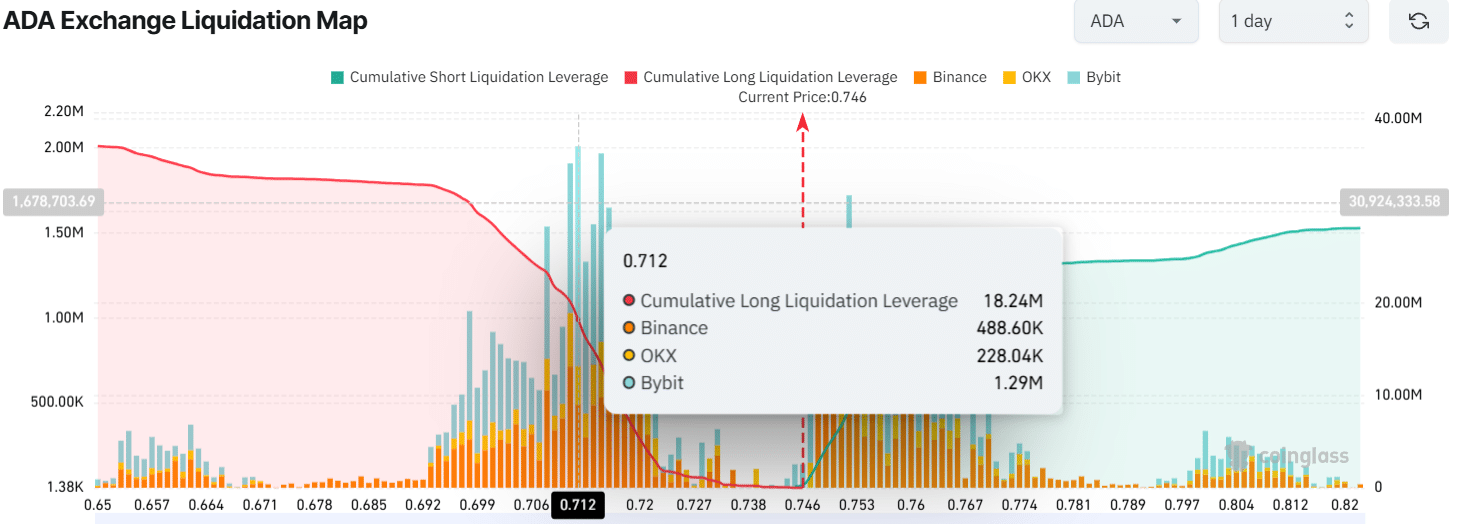

- $8.50 million worth of short positions is at risk of liquidation.

- Traders are over-leveraged at $0.712 on the lower side and $0.76 on the upper side.

Cardano’s [ADA] price has remained unchanged over the past few days due to prolonged consolidation. However, as market sentiment shifts, the asset is soaring and reaching a crucial level, hinting at a major rally ahead.

Cardano: Upcoming levels

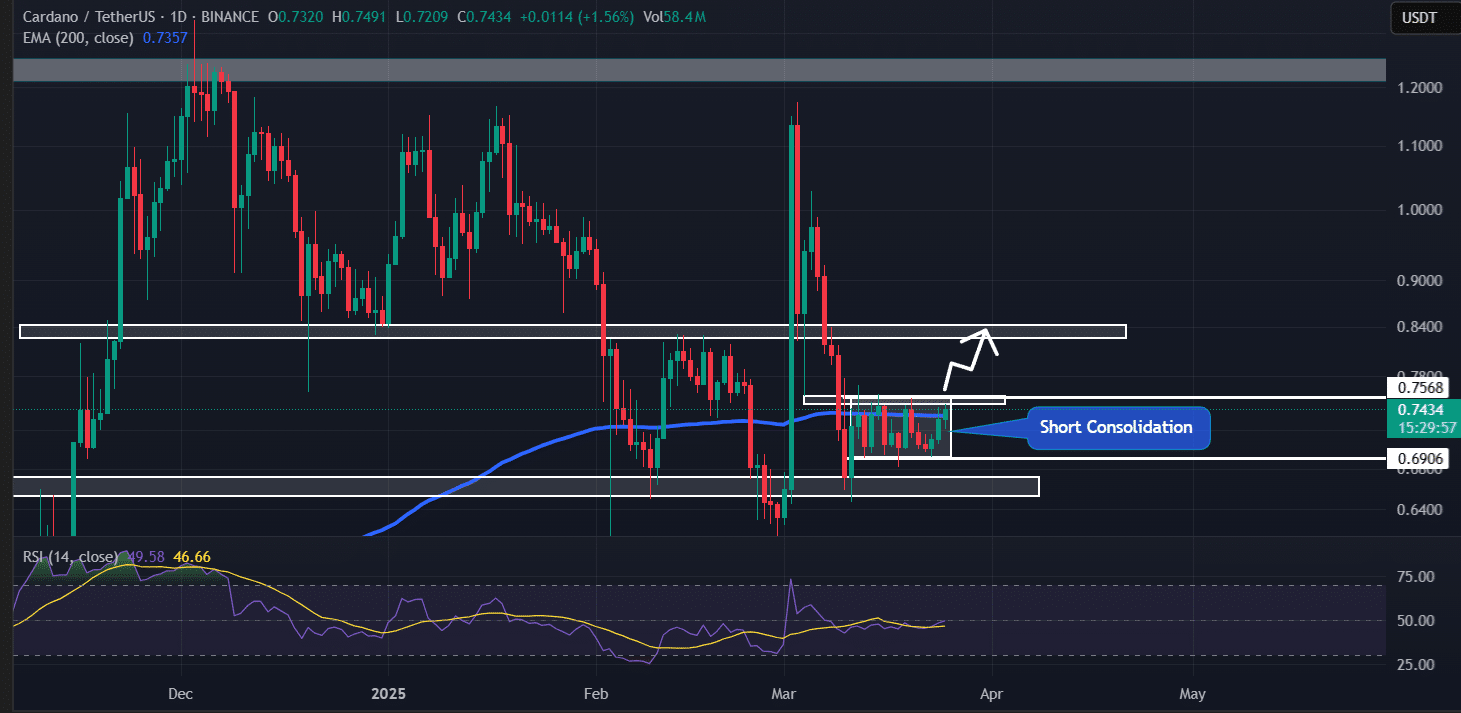

On the daily time frame, ADA appeared to be consolidating within a tight range between $0.699 and $0.75.

However, with a recent price surge, the asset reached the upper boundary of this range and was on the verge of a breakout.

According to AMBCrypto’s analysis, if ADA breaches the upper boundary and closes a daily or four-hour candle above the $0.76 mark, there is a strong possibility it could soar by 13% to reach $0.85 in the coming days.

Source: TradingView

The asset’s four-hour chart also revealed that the 200 Exponential Moving Average (EMA) was near the $0.75 mark, providing additional resistance.

Meanwhile, ADA’s Relative Strength Index (RSI) was near 60, indicating that the asset has enough room to rise and overcome these minor hurdles hindering its upward momentum.

Bullish on-chain metrics

Besides this price action, intraday traders are bullish on the asset, strongly betting on the long side, as reported by the on-chain analytics firm Coinglass.

Notably, traders were over-leveraged at $0.712 on the lower side and $0.76 on the upper side, with $18.25 million worth of long positions and $8.50 million worth of short positions built, respectively.

These on-chain metrics further revealed that bulls were currently dominating, and if ADA hits the $0.76 level, $8.50 million worth of short positions will be liquidated.

Source: Coinglass

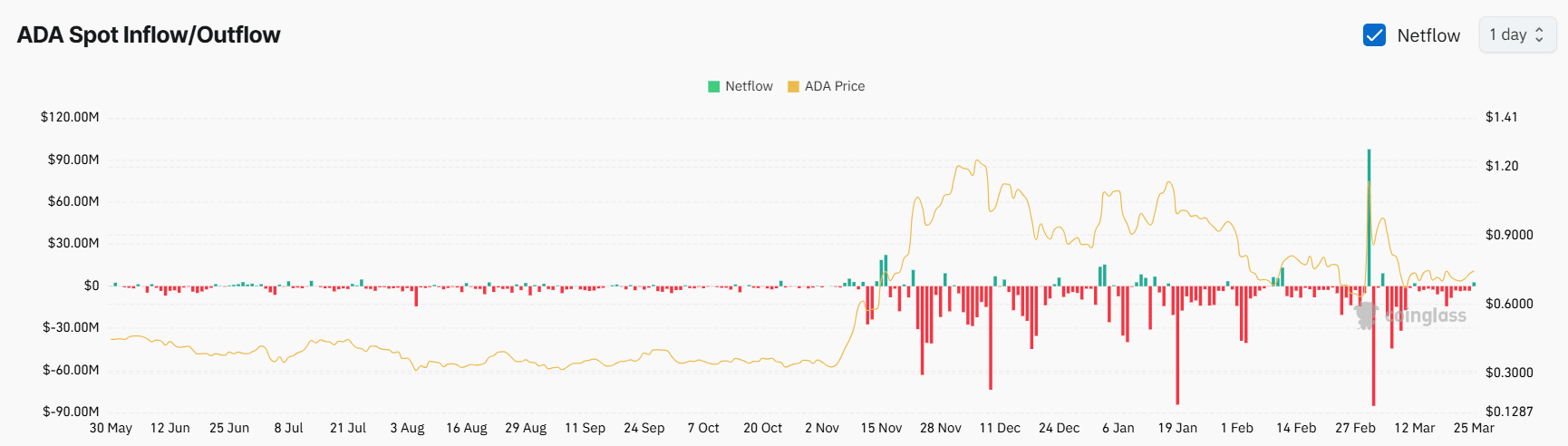

ADA’s continuous outflow

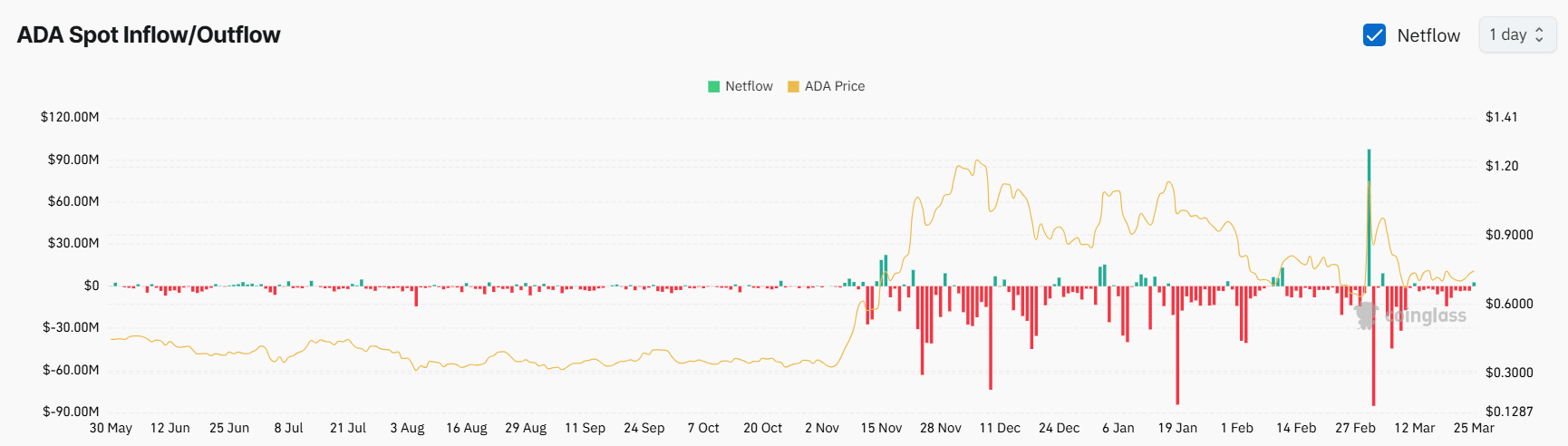

In addition to trader participation, whales and long-term holders have shown notable accumulation during the ongoing consolidation.

Source: Coinglass

Data from spot inflow/outflow revealed that since the 13th of March, exchanges have witnessed a continuous outflow of ADA tokens, suggesting potential accumulation and indicating an ideal buying opportunity.

Credit: Source link