- A Chainlink whale just triggered LINK selloff concern in the market.

- Uncertainty looms for LINK, but optimism remains high.

The decentralized oracle network Chainlink (LINK) faces selling pressure amid a massive whale dump. This phenomenon has fueled discussions about LINK’s future price movement, but investors are still optimistic about its short-term prospects.

Chainlink Dump 356K LINK Coins

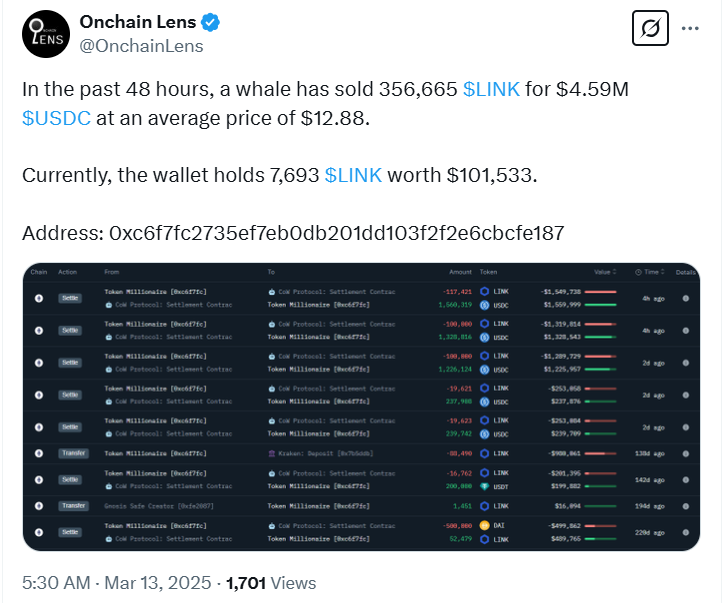

Onchain Lens, a popular crypto tracking platform, detected a massive Chainlink sale from an unknown whale. The platform gave the transaction details in an X post, stating that the holder sold 356,665 LINK for $4.59 million USDC. The whale investor sold the coins at an average price of $12.88.

Onchain data showed ‘0xc6f7f’ as the wallet address making the sales. Despite the huge sell-off, the whale investor still holds 7,693 LINK tokens worth $101,533, according to Onchain Lens. By holding on to these coins, the whale is likely hoping for a best-case scenario wherein the price recovers from the broader volatility.

Typically, such huge sales indicate a loss of confidence in an asset’s potential for gains. Many traders and investors tend to follow the strategies of these whales. Hence, a major selloff can trigger a broader selling trend, shifting sentiment from bullish to bearish.

However, it is important to note that the sales could stem from a panic-selling sentiment prevailing across the market. Traders and investors reflect a cautious approach to risk assets amid severe macro heat.

Surprisingly, the whale investor sold the coins when the current market began experiencing slight relief. Traders and investors speculate whether the LINK price can hit $45 soon, as the coin has increased over 1% despite the sell-off.

As of this writing, the LINK price was trading at $13.25, increasing by 1.58% in the last 24 hours. LINK bottomed at $12.82 on Wednesday and peaked at $13.47.

The surge in LINK’s price aligns with a broader market recovery. Bitcoin (BTC), the leading coin, is back in the green, currently up 1.05% and trading at $83,328.

Analysts Bullish on LINK

Despite the massive selloff, several top crypto analysts have projected a bullish outcome for LINK. In an X post, market analyst ‘Bitcoin Buddha’ said he is optimistic about LINK hitting a new all-time high in the current cycle.

“LINK seems to be recovering after testing support near $12,” says Bitcoin Buddha.

In a recent update we covered, other analysts predict a potential rally toward $22 or higher in the coming months. Meanwhile, Chainlink’s Long/Short ratio indicates that buyers control the market, further supporting the optimistic outlook.

Technical indicators also signal a potential upside. The Relative Strength Index (RSI) shows signs of strength, forming higher lows, while the price follows an ascending support line. In the past, this type of divergence signals a possible trend reversal.

Chainlink’s relevance in the Real-World Asset (RWA) industry could also help increase the adoption of LINK, potentially leading to higher prices. As we reported last week, Chainlink topped the list of RWA assets with the most social mentions.

Credit: Source link