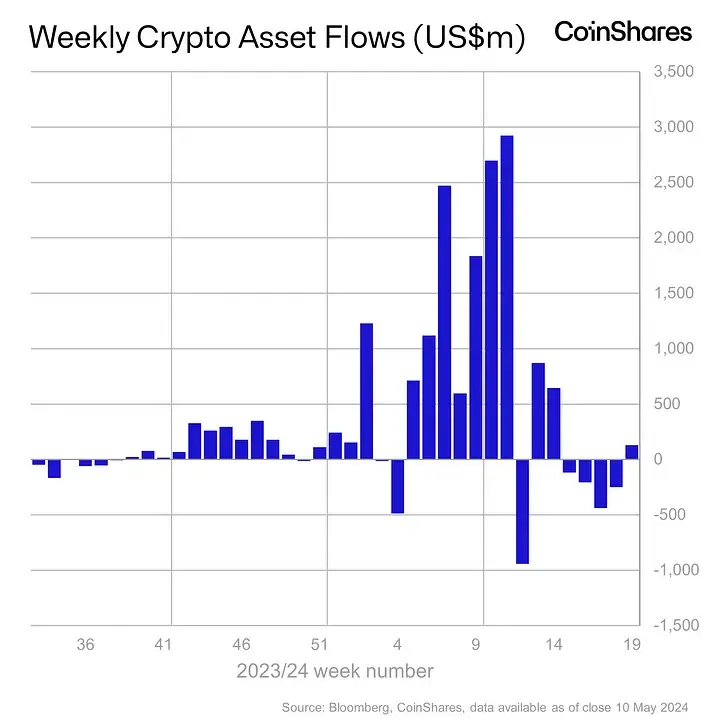

- Digital assets investment products saw $130 million in inflows, the first after four weeks of outflows.

- Bitcoin remains above $62k and saw inflows of $144 million this past week.

As Bitcoin shows fresh resilience above $62,000, latest market data reveals that digital asset investment products recorded inflows for the first time in over a month last week.

On Monday, digital assets manager CoinShares published its weekly report on crypto investment products.

The details showed the industry saw $130 million in inflows for the week ending May 10. It’s the first time the metric reads positive since the first week of April – a run of four weeks of outflows.

Notably, Bitcoin saw inflows of $144 million, while short-Bitcoin ETPs recorded outflows of $5.1 million.

The majority of the inflows were seen in the US, with $135 million. Hong Kong saw $19 million in inflows. Elsewhere, Canada and Germany recorded outflows of $20 million and $15 million respectively.

ETP volumes remain low

While the week saw inflows overall, CoinShares’s head of research James Butterfill wrote in the company blog that ETP volumes have continued to decline.

For instance, the market saw ETP volumes of $8 billion last week, while it averaged $17 billion in April.

“These volumes highlight ETP investors are participating less in the crypto ecosystem at present, representing 22% of total volumes on global trusted exchanges relative to 31% last month,” Butterfill noted.

Credit: Source link