- The price surge of Destra crypto aligned with robust sentiment, so breaking resistance at $0.5349 is critical.

- Record active addresses confirmed a strong foundation for sustained growth.

Destra Network [DSYNC] has been on an impressive run, climbing 70% over the past week and attracting significant market attention.

At press time, DSYNC was trading at $0.5113, reflecting a notable 9.89% increase in the past 24 hours.

This surge has been fueled by robust market sentiment, increasing network activity, and strong on-chain metrics. Therefore, investors are closely monitoring whether this momentum will continue.

Breaking down Destra crypto: $0.60 on the horizon?

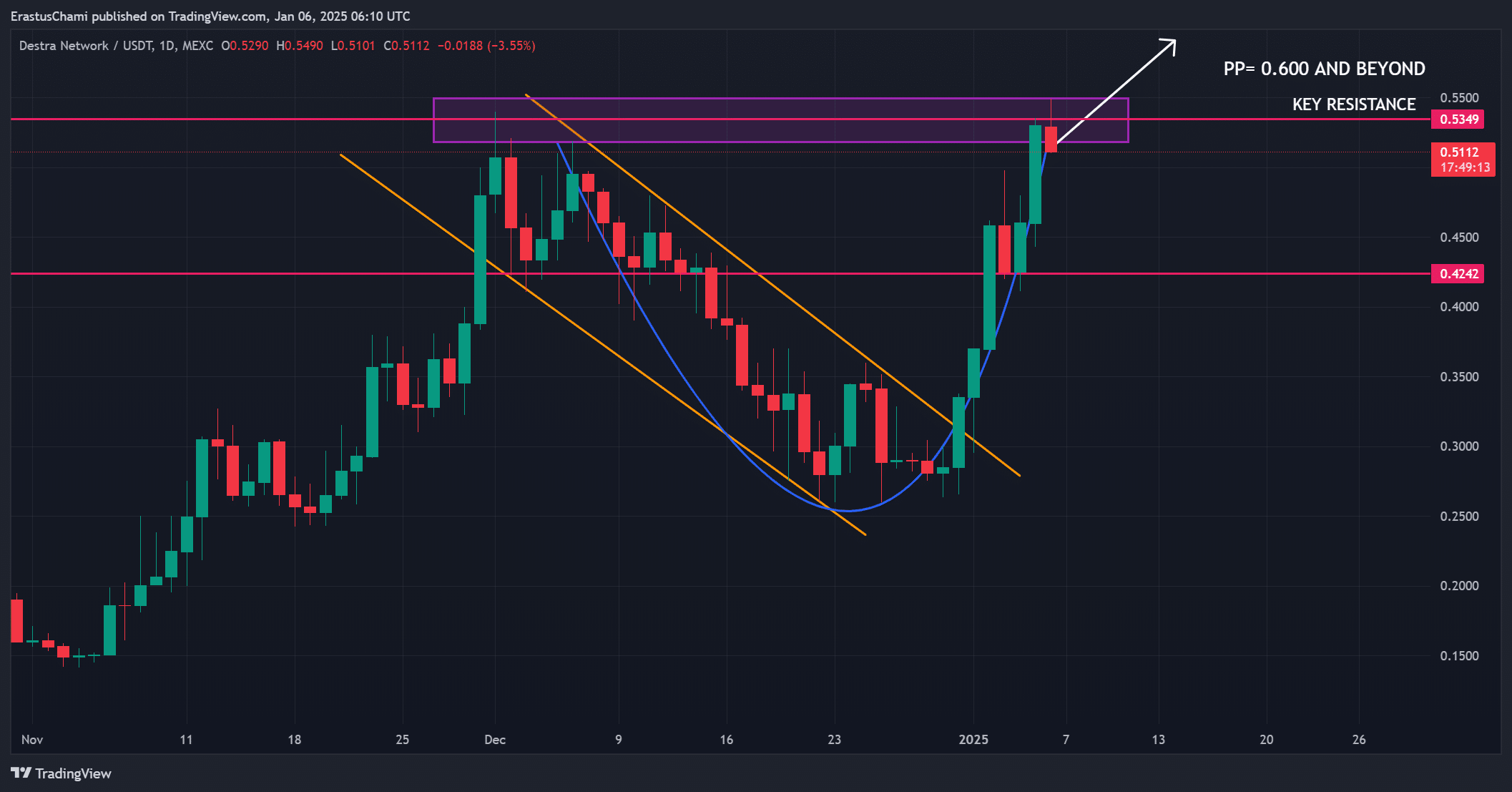

Destra Network’s price movement has been nothing short of remarkable. The price has surged consistently, reaching $0.5113 and pushing toward key resistance at $0.5349.

If this level is decisively breached, DSYNC could target the psychological milestone of $0.60, presenting further upside potential.

Additionally, the recent breakout from a downward channel and the formation of a bullish cup-and-handle pattern suggest strong buyer interest.

Therefore, with sustained volume backing this movement, the price outlook remains optimistic.

Source: TradingView

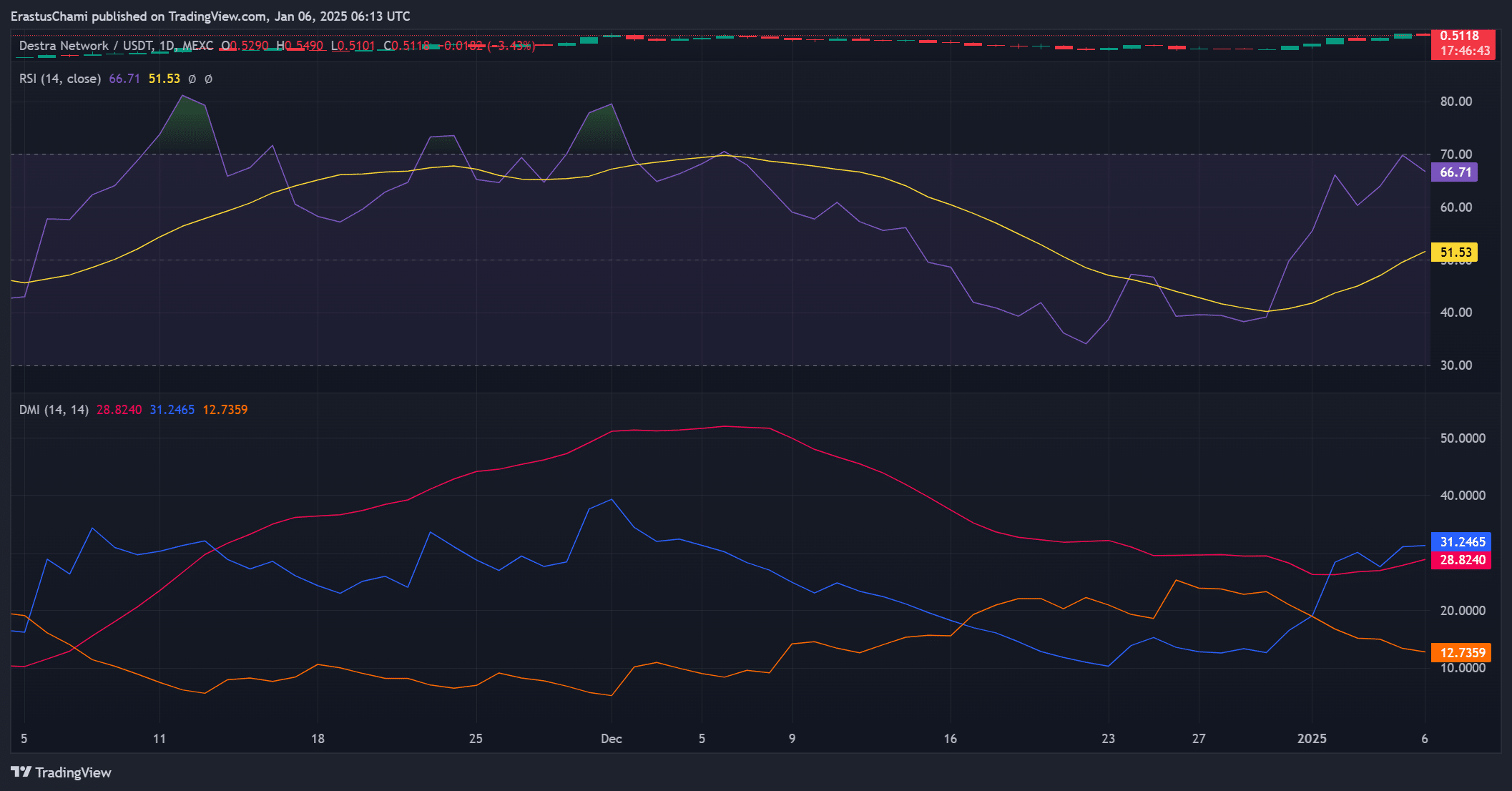

Technical signals point to bullish momentum

Technical indicators also aligned with Destra’s bullish trajectory. The Relative Strength Index (RSI) was 66.71 at press time, indicating significant buying pressure while leaving some room before hitting overbought territory.

Furthermore, the Directional Movement Index (DMI) highlighted strong bullish sentiment, with the positive directional index (+D) at 31, the negative directional index (-D) at 12, and the Average Directional Index (ADX) at 28.

These figures confirmed that buyers were in control, and upward momentum remained dominant.

Source: TradingView

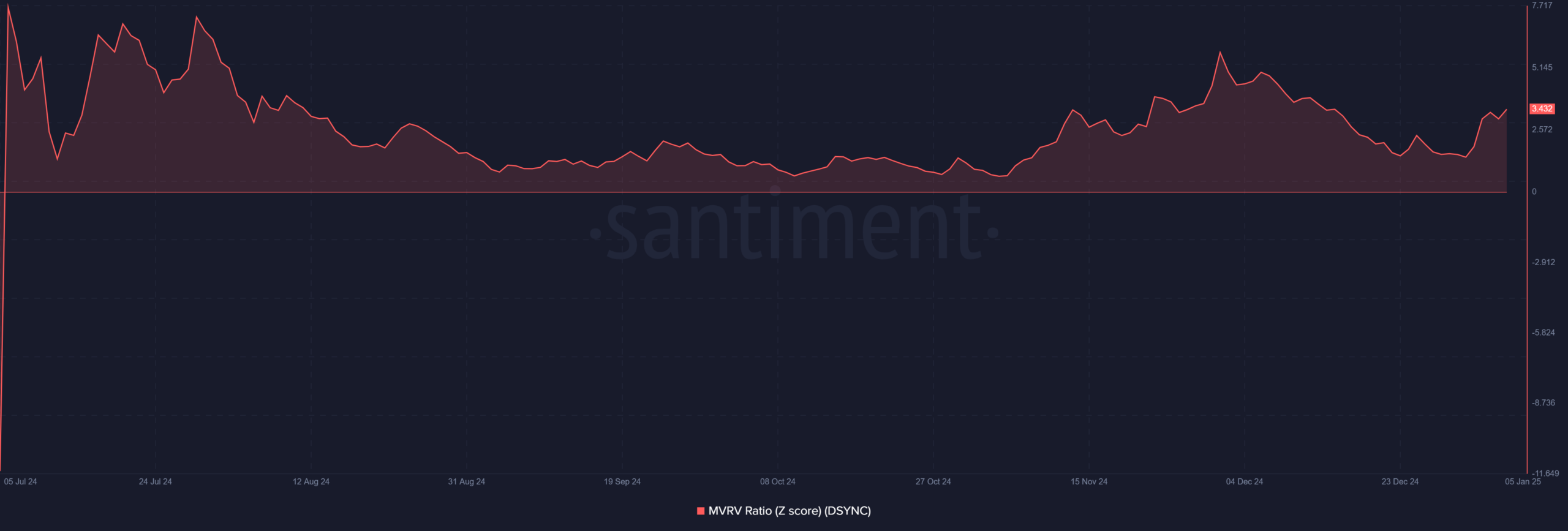

Profitability insights: What the MVRV ratio says

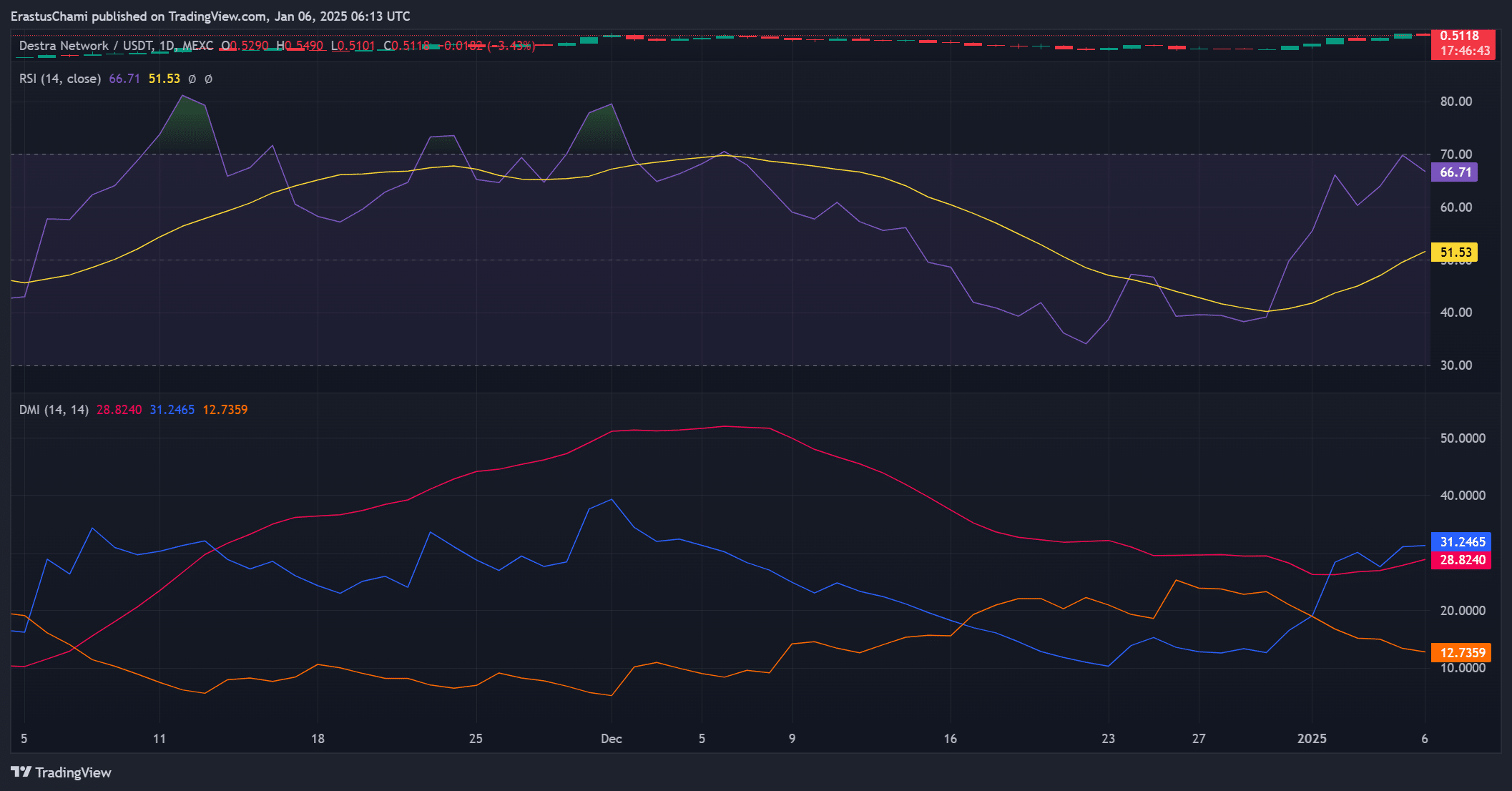

The MVRV (Market Value to Realized Value) ratio provided further clarity into market dynamics.

Notably, Destra crypto’s MVRV ratio was at 3.43, suggesting that while many holders were in profit, the market was not overly saturated with sell pressure.

This balance reduces the risk of significant sell-offs and supports the sustainability of the rally. These factors highlight a healthy growth trajectory for DSYNC.

Source: Santiment

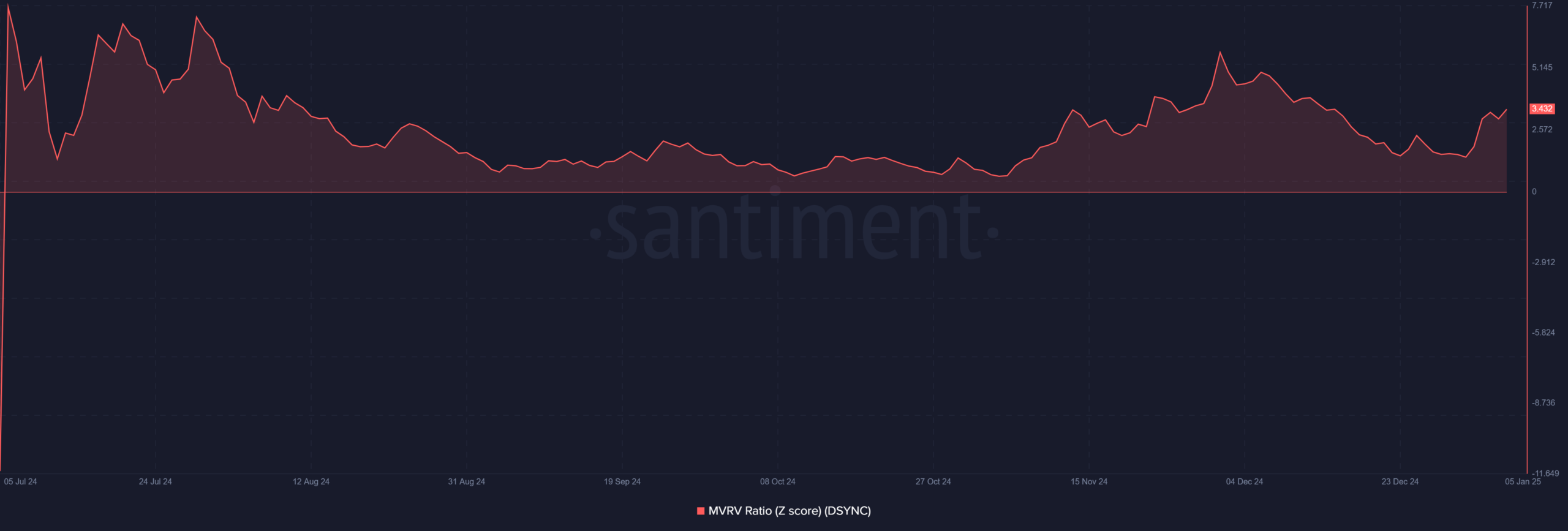

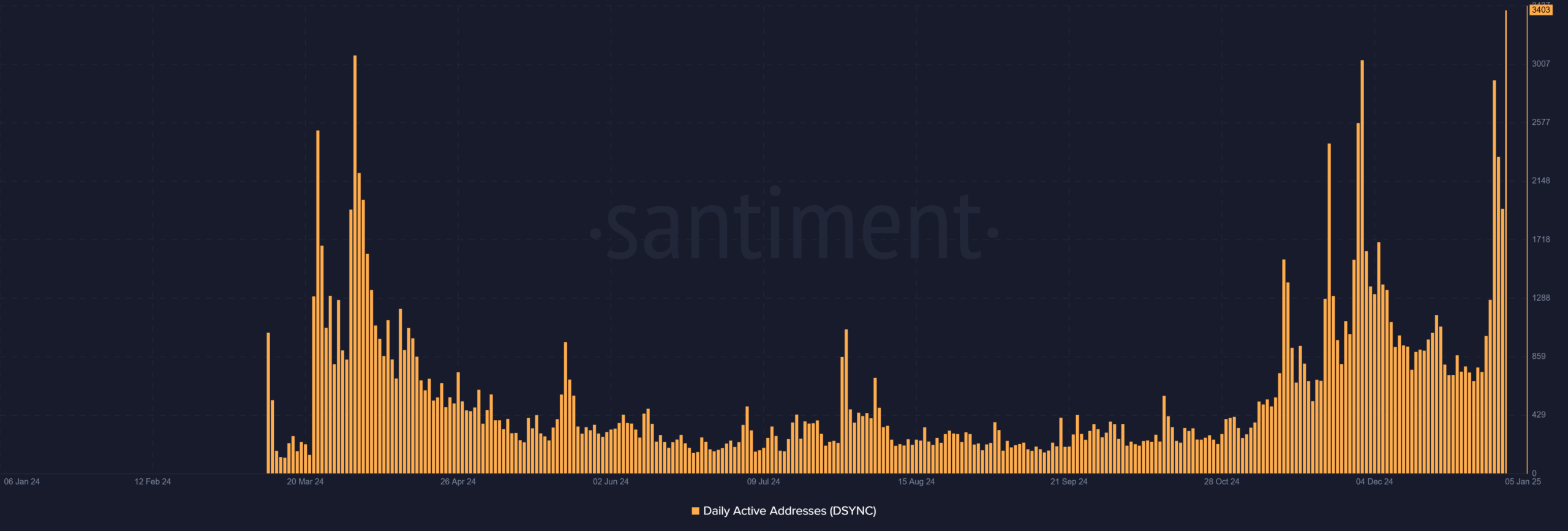

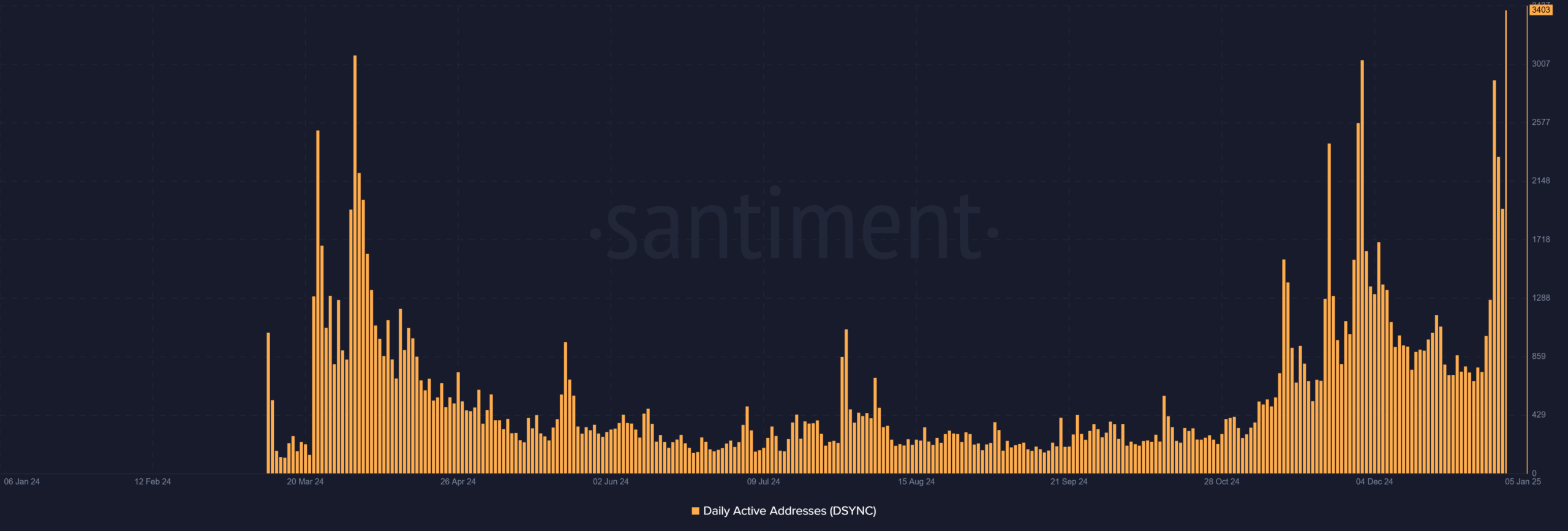

Active addresses hit record highs

Destra Network’s surge in daily active addresses has reached an all-time high of 3,403, signaling increasing user engagement and adoption.

Historically, such spikes in active addresses have correlated with price rallies, reinforcing the bullish case.

This surge suggests that more participants are utilizing the network, boosting its overall utility. Consequently, the strong growth in active addresses strengthens the case for sustained price performance.

Source: Santiment

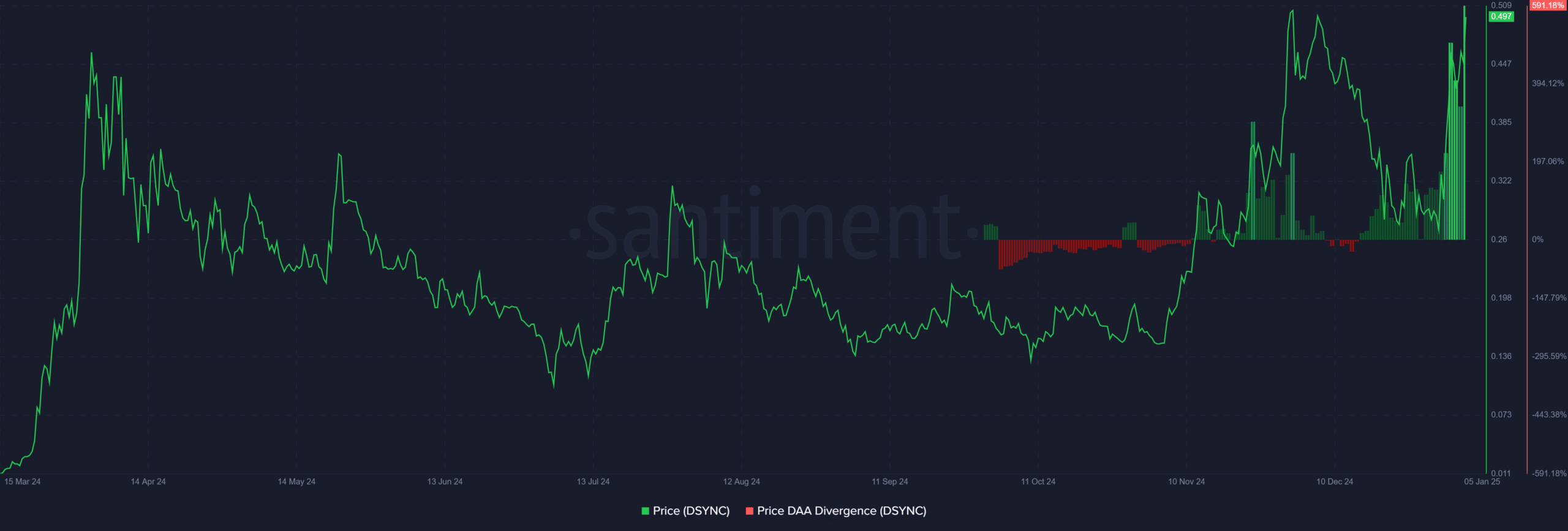

Strong fundamentals, confirmed

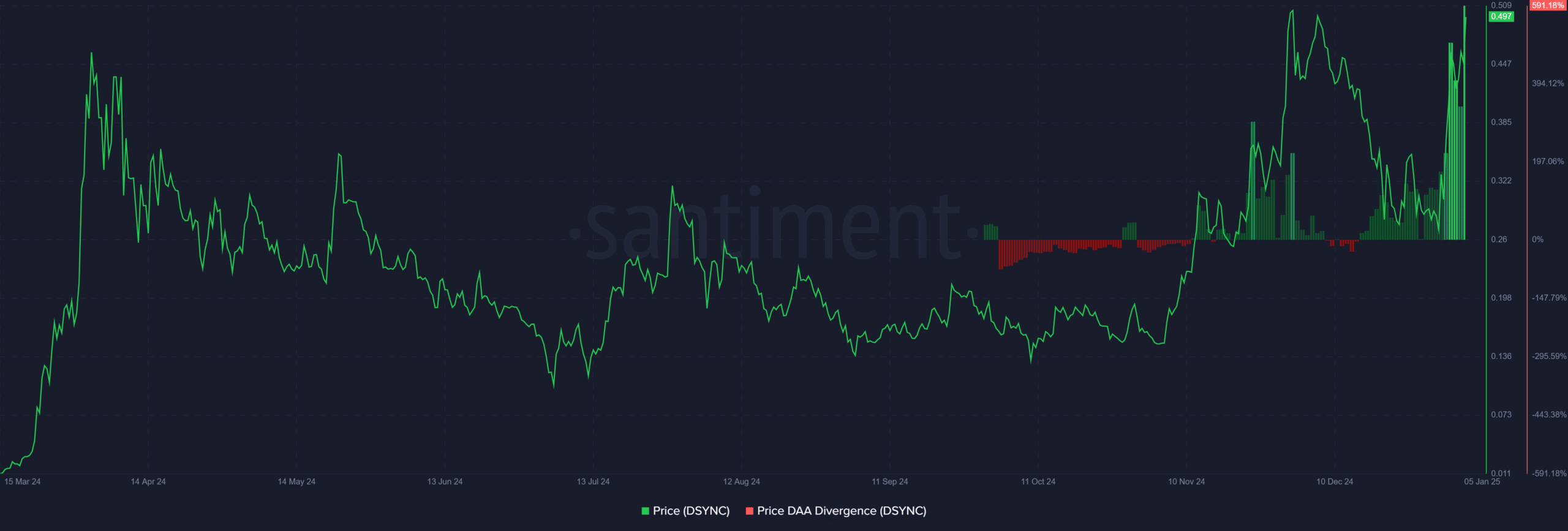

The price-DAA (Daily Active Addresses) divergence metric further bolsters investor confidence.

Destra’s press time divergence of 591.18% indicated that the price gains were fundamentally supported by heightened on-chain activity rather than speculative trading.

Realistic or not, here’s DSYNC’s market cap in BTC’s terms

This alignment between price and network activity demonstrates that the rally is grounded in real adoption, reducing the risk of volatility.

Source: Santiment

Breaking the key resistance at $0.5349 could pave the way to the $0.60 target and beyond for DSYNC.

Credit: Source link