Market participants are increasingly interested in the digital asset space, says Hong Kong Special Administrative Region (SAR) Financial Secretary Paul Chan Mo-po. The digital asset market and stablecoins will only gain further traction. Therefore, the region will continue shaping itself into a significant hub, attracting both the crypto and TradFi players.

According to GovHK, Chan has been the Financial Secretary since 2017. He is a former President of the Hong Kong Institute of Certified Public Accountants, a member of the Legislative Council, Chairman of Legal Aid Services Council, and Secretary for Development.

Chan published a blog post on Sunday, discussing a variety of monetary topics, including digital assets. Hong Kong has “made great progress in digital finance,” he writes.

Moreover, the digital asset development has advanced the businesses of financial institutions as well. Local banks saw the total digital asset transaction volume hit HK$17.2 billion (US$2.19 billion) in 2024. By the end of the year, banks custodied HK$5.1 billion (US$ 649.7 million).

Meanwhile, in late 2022, Hong Kong issued its first policy statement on the development of the digital asset market. Since then, the market has seen significant and fast development. It has attracted “many related companies to settle and expand in Hong Kong.”

Chan noted that ten digital asset trading platforms have secured their licenses so far. However, the Securities and Futures Commission is processing applications of eight more.

Notably, the government is now set to issue the second policy statement, with Chan saying that this comes “in response to the latest developments and changes in the situation.”

Moreover, the government is advancing the regulatory arrangements for custody and over-the-counter (OTC) transactions, Chan says.

Notably, product innovation is crucial, he argues, as it’s “an effective way to create market demand, increase market flow, and accelerate the evolution of the industry.”

Hong Kong: ‘Many Market Participants Are Very Interested’ in Stablecoins

Hong Kong’s Legislative Council has already passed the Stablecoin Ordinance, which takes effect on 1 August. Its aim is to establish a licensing system for stablecoin issuers. Therefore, Hong Kong has “steadily and prudently promoted the development of stablecoins, providing a new paradigm for the global stablecoin market,” Chan says.

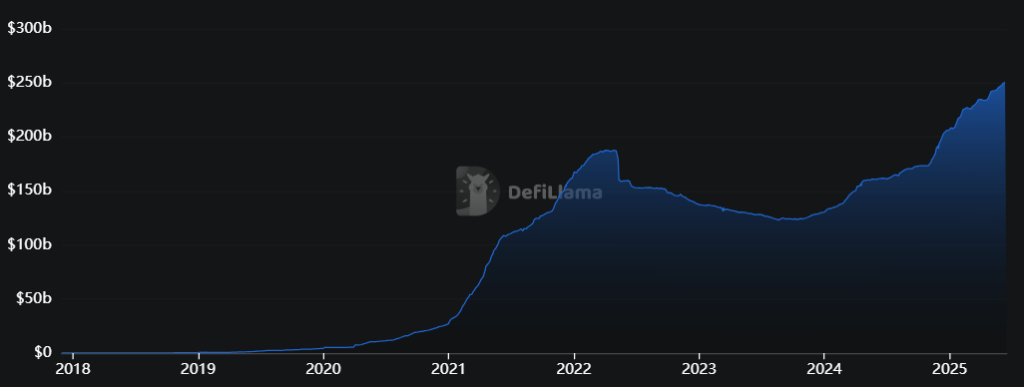

The focus on the stablecoin sector will grow further, as will the market demand, Chan says. Currently, the total stablecoin market cap is $251.738 billion, while the stablecoin trading volume stood at $27.6 trillion in 2024.

Per Chan, stablecoins pegged to fiat currencies have the security and efficiency of blockchain and the stability of legal tender. As such, they will become “a potential tool to combine the financial system and the real economy to reduce costs and improve efficiency.”

Moreover, stablecoins can help develop innovative solutions and be used as a medium of exchange, unrestricted by traditional payment time and location. He writes that,

“We have noticed that many market participants are very interested in this. After the Ordinance comes into effect, the HKMA [Hong Kong Monetary Authority] will process the license applications received as soon as possible so that qualified applicants can carry out their business and bring new opportunities to Hong Kong’s real economy and financial services.”

Furthermore, Hong Kong has adopted a more open model, Chan says. This allows licensed issuers to choose different fiat currencies to peg their stablecoins to. The approach attracts more institutions globally to issue stablecoins in Hong Kong. In turn, it “will greatly improve the liquidity of related activities and the competitiveness” of the Hong Kong market.

“In this era of challenges and opportunities, we must seize opportunities, continuously enhance Hong Kong’s competitiveness in all aspects, and improve Hong Kong’s business environment,” Chan concludes.

Credit: Source link