The cryptocurrency market is facing a substantial dip today, July 29, 2025. Dogecoin (DOGE) has fallen 6.3% in the daily charts and 15.4% over the last week. Dogecoin’s (DOGE) correction comes ahead of the Federal Reserve’s interest rate decision due tomorrow. Despite the dip, DOGE is still up by 18.1% in the 14-day charts, 37.2% over the previous month, and 67.7% since July 2024, as per CoinGecko’s Dogecoin data.

Will DOGE Rally After The Fed’s Announcement?

The Federal Reserve has kept interest rates unchanged so far in 2025. The decision comes despite President Trump repeatedly asking Fed Chair Jerome Powell to reduce interest rates. A rate cut could lead to another bullish reversal for Dogecoin (DOGE) and the larger crypto market. Retail investors were more or less absent during the last market rally. High interest rates may have kept retail players at bay. Retail participants may ramp up their crypto investments if borrowing becomes easier.

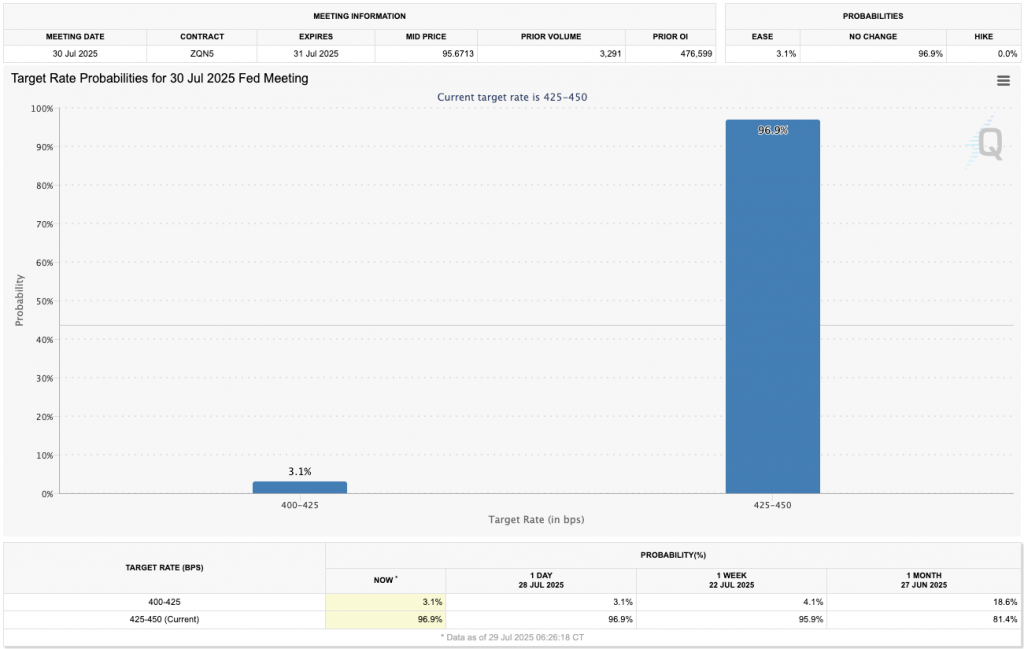

While a rate cut has long been asked for, there is very little chance that the Federal Reserve will cut interest rates after its meeting. According to the CME FedWatch tool, there is a 96.9% chance that the Federal Reserve will keep interest rates unchanged after its July meeting.

Dogecoin (DOGE) and other crypto assets may consolidate if the Federal Reserve keeps interest rates unchanged. If the Fed decides to hike interest rates, we may see another market correction. On the other hand, if the Fed decides to cut interest rates, Dogecoin (DOGE) and the larger market may see another bullish reversal.

Also Read: Dogecoin (DOGE) Enters Bullish Pattern: Traders Forecast $1.5

The crypto market saw one of its most significant rallies in recent times earlier this month. The surge was fuelled by increased ETF inflows by institutional investors. A similar pattern could emerge after the Fed’s interest rate announcement. Continued ETF inflows could inspire more confidence from retail players. Such a development could also help DOGE’s price rally.

Credit: Source link