The Dubai Virtual Assets Regulatory Authority (VARA) has sanctioned 19 crypto firms for operating unlicensed Virtual Asset operations and violating VARA’s Marketing Regulations.

The penalties included cease-and-desist orders alongside fines between AED 100,000 ($27,300) and AED 600,000 ($163,000), adjusted according to the severity and extent of each violation.

A Tuesday official statement confirmed the sanctions serve as a public warning to consumers, investors, and institutions that involvement with unlicensed operators presents substantial financial, legal, and reputational risks.

“Enforcement is a critical component of maintaining trust and stability in Dubai’s Virtual Asset ecosystem.”

VARA Tightened Marketing Rules And Licensing Requirements

These measures support VARA’s mandate to ensure only firms meeting the highest compliance and governance standards can operate.

All penalized companies have been ordered to stop operations immediately and halt any promotion of unlicensed Virtual Asset services in or from Dubai.

This action follows similar enforcement in October 2024, when the regulator fined seven unlicensed crypto companies.

In that earlier round, fines ranged from AED 50,000 ($13,612) to AED 100,000 ($27,225), based on the nature and severity of violations.

In 2024, VARA strengthened its crypto marketing requirements, mandating disclaimers on promotional materials.

The regulator also required prior authorization before marketing products and services to citizens and residents.

Updated regulations aim to prevent the dissemination of misleading information and prioritize consumer protection.

The regulations address various aspects of marketing communications, including the proper use of language and the importance of providing full and clear disclosures.

The objective is to ensure consumers understand the risks and opportunities associated with virtual assets.

Marketing regulation violations can result in fines up to AED 10,000,000 ($2.7 million).

Beyond marketing, entities providing virtual asset services in or from Dubai must secure a VARA license.

This applies to activities like Virtual Asset Issuance, Trading Platforms, and Custody Services. The process begins with applying for Initial Approval to establish operations, then progressing to a full VASP (Virtual Asset Service Provider) license.

Cryptocurrency platforms, including Crypto.com, Bybit, Deribit, and HashKey Group, have complied with these requirements by obtaining provisional approval from VARA, enabling them to offer virtual asset exchange services to retail, institutional, and qualified investors in Dubai.

Why Dubai Became the World’s Most-Obsessed Crypto Nation

These developments occur as the UAE continues to establish itself as a regional center for blockchain innovation and crypto finance, with regulatory clarity attracting major global players.

Recall that White House AI & Crypto Czar David Sacks met with top UAE officials in March to discuss deeper collaboration in emerging technologies and investment opportunities between the two nations.

Following the meeting, a state-backed investment firm, MGX in Abu Dhabi, invested $2 billion into Binance using USD1, a stablecoin developed by World Liberty Financial, a crypto venture closely connected to the Trump family.

A recent study reveals the UAE ranked first among the world’s “most crypto-obsessed countries” in 2025, recording exceptional crypto adoption growth of 210%.

The UAE also scored 98.4%, with the highest crypto ownership rate at 25.3%.

Dubai is now becoming a key destination for crypto and stablecoin ventures seeking alternatives to the EU’s newly implemented Markets in Crypto-Assets (MiCA) regulation.

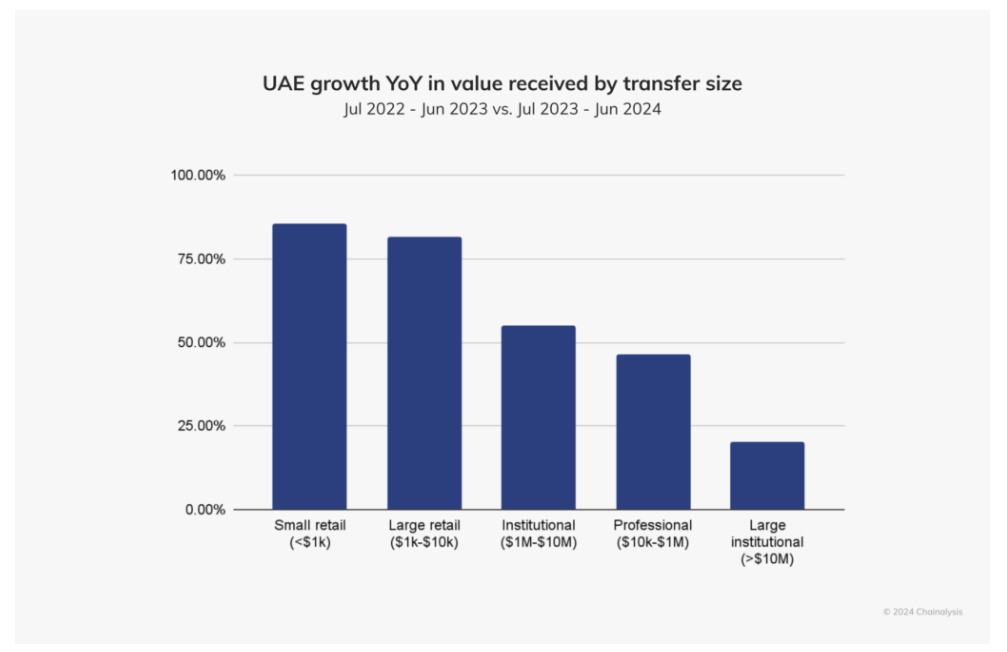

Across the Middle East & North Africa (MENA), a Chainalysis report affirmed that the UAE is now the third-largest crypto economy in the region.

Between July 2023 and June 2024 alone, the UAE received over $30 billion in crypto, ranking among the top 40 globally.

Crypto investments are also expanding rapidly as numerous VC funds and blockchain businesses establish operations in the UAE, including Chainalysis, which opened its regional headquarters in Dubai last year.

Tether, the issuer of the world’s most traded stablecoin (USDT), also recently announced plans to launch a stablecoin pegged to the Dirham.

Credit: Source link