US-based crypto ETFs have witnessed a change in dynamics in August, which has seen inflows tipping towards Ethereum ETFs. However, last week’s trend of strong inflows ended with substantial outflows on Friday, with Ethereum ETFs leading the retreat with $164.64 million and Bitcoin ETFs following with $126.64 million. This sudden reversal coincides with an interesting timing of stubborn inflation data that seems to have rattled institutional investors.

Related Reading

A Sudden Reversal At Week’s End

According to data from Farside Investors, US-based Spot Ethereum ETFs ended the week with $164.64 million in outflows. The outflows came from Fidelity’s FETH with $51 million, Bitwise’s ETHW with $23.7 million, Grayscale’s ETHE with $28.6 million, and Grayscale’s ETH with $61.3 million. BlackRock, on the other hand, witnessed neither inflows nor outflows into its Spot ETH ETFs, alongside 21Shares, VanEck, Invesco, and Franklin Templeton Ethereum ETFs.

Friday’s outflows were a jarring departure from the steady gain that had defined Ethereum’s Spot ETFs since August 21. Ethereum’s six-day inflow streak, which had added about $1.876 billion, was brought to an abrupt end with the outflows on Friday. As a result, total assets under management for Spot Ethereum ETFs dipped to $28.58 billion.

Ethereum ETF Flow: Farside Investors

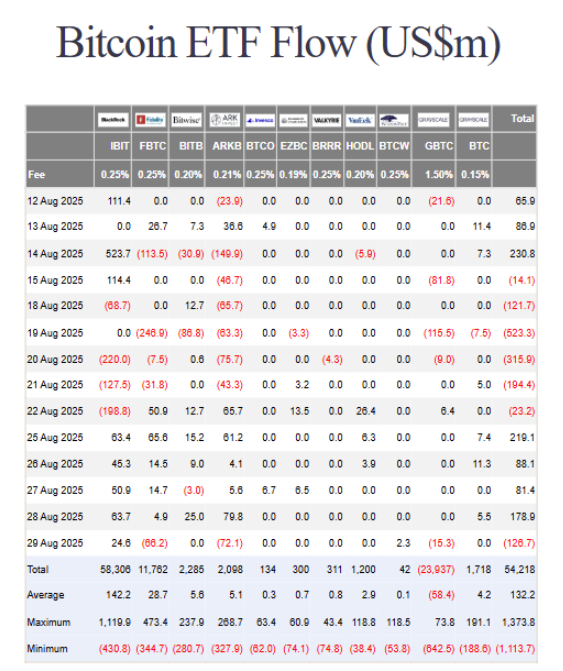

Meanwhile, Spot Bitcoin ETFs also recorded their first daily decline since August 22 with $126.64 million in outflows on Friday. As a result, their total assets under management dropped to $139.95 billion.

However, not every issuer felt the pressure with Bitcoin. Fidelity’s FBTC led the exodus with $66.2 million, followed by ARKB’s $72.07 million and GBTC’s $15.3 million in outflows. On the other hand, BlackRock’s IBIT still managed $24.63 million in inflows and WisdomTree’s BTCW drew in $2.3 million amid the wider outflows.

Bitcoin ETF Flow: Farside Investors

The underlying cause of the outflows can be attributed to investors digesting the latest data on inflation released on Friday. Notably, the US core Personal Consumption Expenditures (PCE) index climbed 2.9% year-over-year in July, the fastest pace since February, creating fears that the Federal Reserve may hold off on rate cuts.

What May Lie Ahead This Week

As a new trading week begins, Spot ETF flow in both Ethereum and Bitcoin is likely to depend on how investors continue to interpret the data. If inflation pressures persist, institutional investors may retreat further at the beginning of the week. However, any signs of cooling could see inflows resume mid-week, particularly into Ethereum, where fundamentals are currently favorable.

On the price side of things, Bitcoin’s hold above the $108,000 price may offer some relief. However, it needs to stay above $110,000 in order for any upside move to gain momentum. At the time of writing, Bitcoin is trading at $109,910.

Related Reading

For Ethereum, a daily close above $4,500 could confirm the return of bullish confidence, whereas a slide below $4,400 might signal further weakness. At the time of writing, Ethereum is trading at $4,470, up by 1.7% in the past 24 hours.

Featured image from Unsplash, chart from TradingView

Credit: Source link