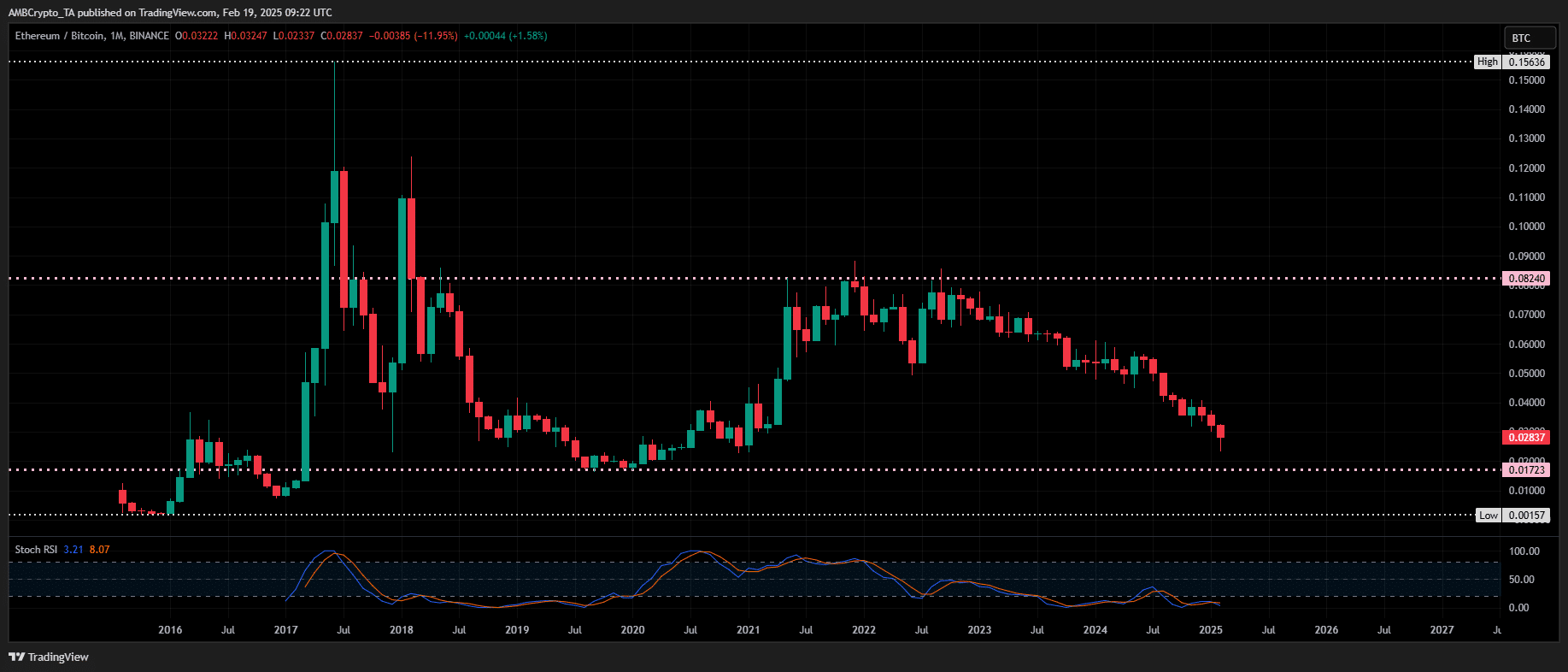

- ETH/BTC pair is closely mirroring the 2017-2019 cycle, with the Stochastic RSI dipping below 20.

- Is history about to repeat itself?

Historical trends indicate that Ethereum [ETH] could outpace Bitcoin [BTC] by mid-Q3, as the Stochastic RSI has remained below 20 for two years – a rare oversold condition.

This setup closely resembles the 2017-2019 cycle, where ETH/BTC hit an all-time low before staging a significant recovery. Currently, the ETH/BTC pair mirrors that pattern, testing the same key support level.

Source: TradingView (ETH/BTC)

If history repeats, a momentum shift could be underway. After the 2017-2019 cycle, ETH closed 2020 with a staggering 487% YTD gain, outperforming BTC’s 302%.

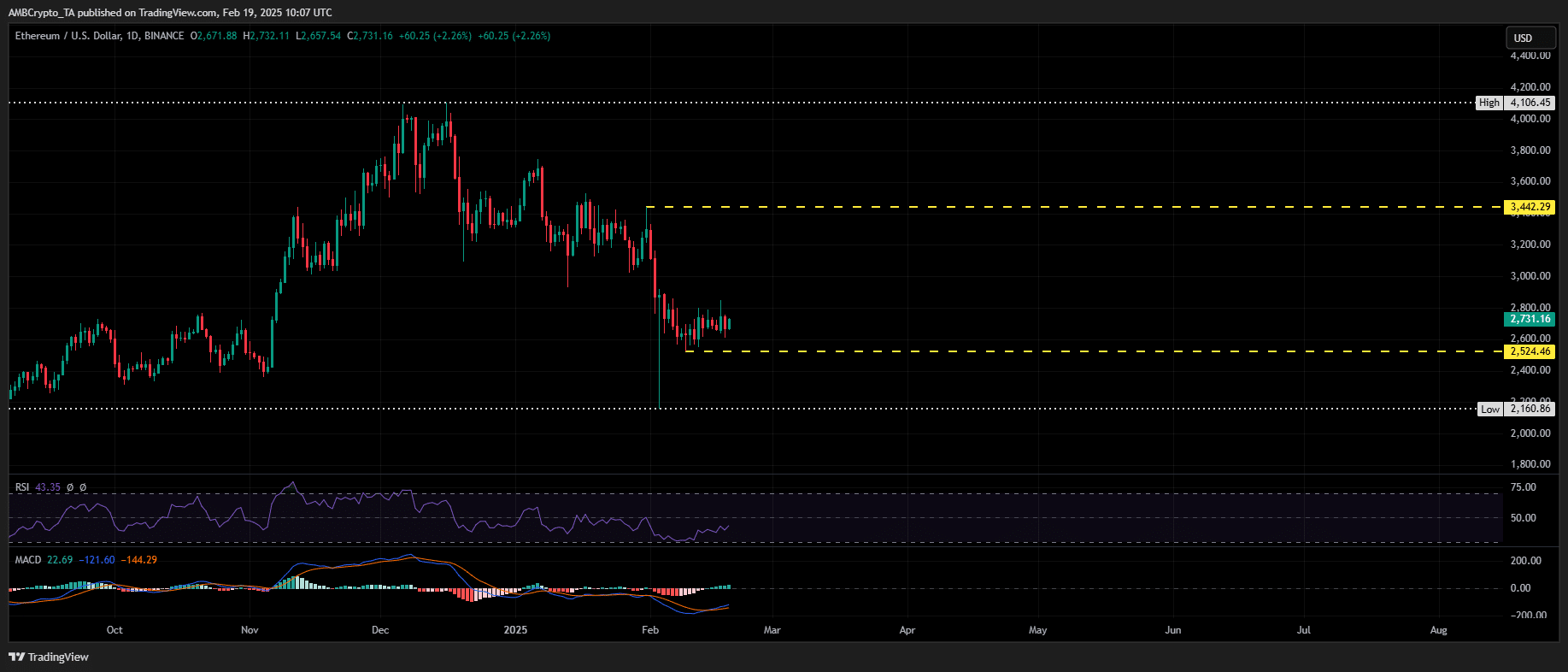

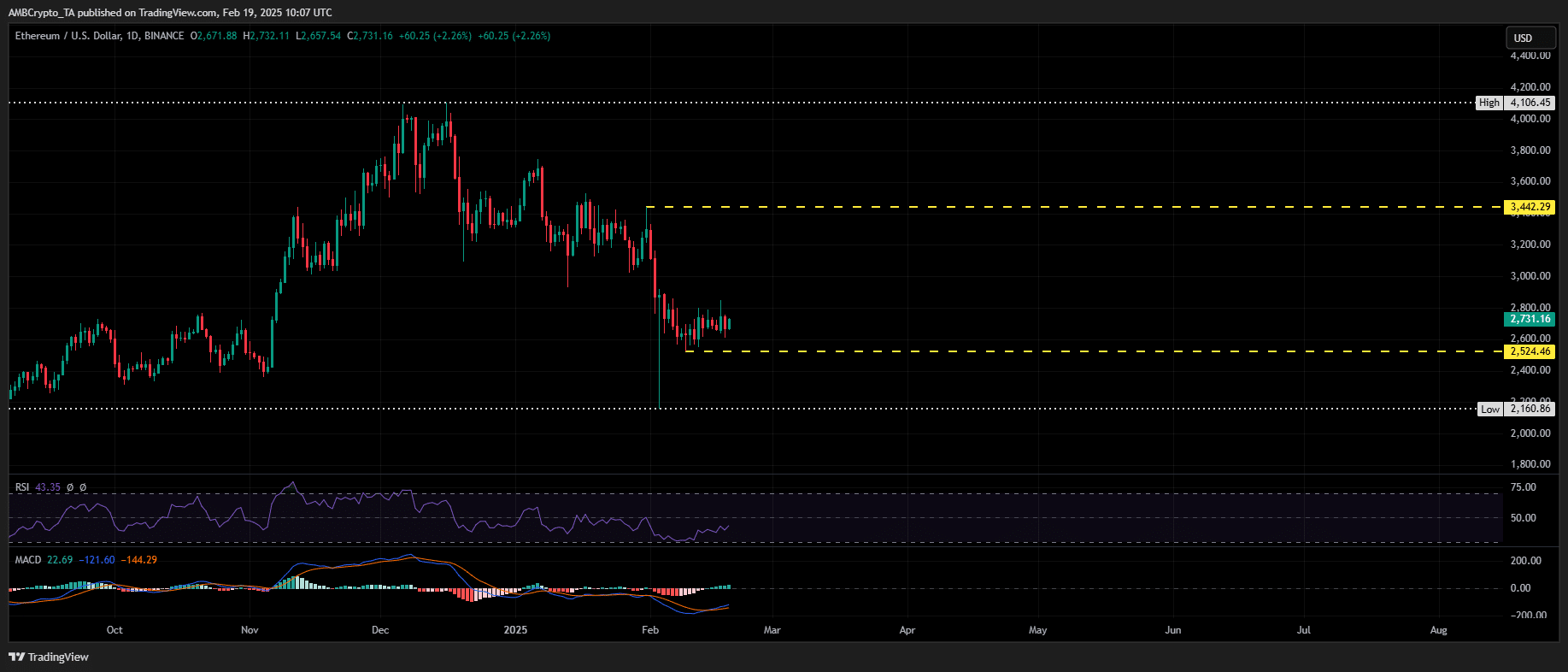

Currently, a supply crunch is unfolding, indicating potential accumulation as ETH consolidates within the $2.7K-$2.8K range. The MACD is also showing early signs of a bullish crossover, hinting at a possible trend reversal.

With these technical signals aligning, could Ethereum be on the verge of a breakout against Bitcoin?

ETH/BTC — Where is investor sentiment shifting?

Ethereum has lost over $80 billion in market value this month, underperforming Bitcoin amid broader market uncertainty.

The ETH/BTC pair remains in a downtrend, with the RSI signaling a potential bottom. However, a 20% decline in trading volume indicates weak accumulation, making an immediate trend reversal unlikely.

Source: TradingView (ETH/USDT)

Despite this, early bullish signals are emerging. For ETH to regain bullish momentum, it must reclaim $3.5K as support before attempting a breakout toward its post-election peak of $4K.

Given historical trends and technical indicators, ETH’s current consolidation phase could be a setup for a potential rebound.

Traders should closely watch volume inflows and bullish divergences in the ETH/BTC pair to validate the repeat of the 2017-19 cycle.

Credit: Source link