As Bitcoin hits new record highs and corporate demand reaches new peaks, Ethereum’s price is also rising, with signals of a strengthening ETH treasury trend.

ETH Surges Past $3,000 as Bitcoin Breaks Records

With Bitcoin hitting new all-time highs, Ethereum’s price reached $3,075 on Monday, increasing 3.4% in the past 24 hours.

The world’s second-largest cryptocurrency is up 19.69% over the last week, breaking and holding above the $3,000 psychological level for the first time since early February.

Record Inflows Into Ethereum ETFs Fuel Momentum

Ethereum’s rally isn’t just about short-term momentum or macro tailwinds. Institutional demand is picking up sharply.

Ethereum exchange-traded funds (ETFs) saw record weekly inflows of $907.99 million, their best week since launching in July 2024.

This is the largest weekly inflow since Ethereum ETFs began trading on July 23, 2024, per SoSoValue.

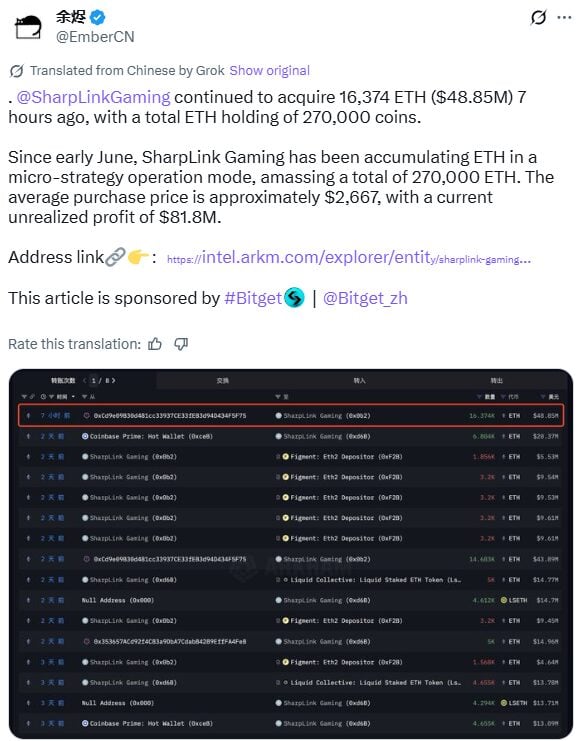

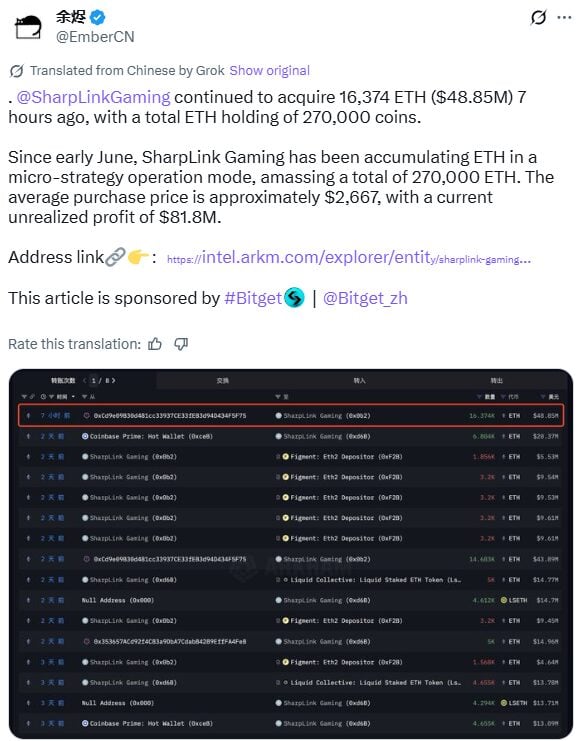

SharpLink Becomes Largest ETH Holder

Inspired by MicroStrategy’s Bitcoin-first strategy, public companies are now adopting Ethereum as a core treasury asset.

Nasdaq-listed SharpLink Gaming has accumulated over 60,582 ETH in just five days, now holding 270,000 ETH or more than the Ethereum Foundation itself. With unrealized profits surpassing $81 million, the company is now the largest known ETH holder in the public market.

Last week, SharpLink bought 10,000 ETH directly from the Ethereum Foundation in a $25.7 million over-the-counter (OTC) deal, which was a first-of-its-kind move by a public company.

SharpLink Gaming stock (SBET) has surged over 60% in the past month and 275% year-to-date as SharpLink moves to build its Ethereum treasury. And the company isn’t the only one investing in ETH.

Corporate ETH Accumulation Intensifies

BitMine closed a $250 million private placement to fund its Ethereum treasury strategy, aiming to adopt ETH as its primary treasury reserve asset. The company plans to use ETH for staking and DeFi activities, expecting this move to enhance shareholder returns while supporting Ethereum’s ecosystem growth. Since announcing its pivot to Ethereum, BitMine Immersion Technologies’ stock climbed 25%.

Bit Digital, a publicly traded digital asset platform focused on Ethereum-native treasury and staking strategies, shifted a significant portion of its treasury from Bitcoin to Ethereum, holding over 100,600 ETH, following a $172 M equity raise and pivot from BTC to ETH.

Blockchain technology company BTCS Inc. (BTCS) has raised $62.4 million in capital year-to-date while increasing its Ethereum holdings to 29,122 ETH, representing a 221% increase from year-end 2024. The company’s stock has reflected this aggressive growth strategy, delivering an impressive 204% return over the past year.

Why This Matters

Ethereum isn’t just for developers and DeFi anymore. As public companies start treating Ethereum (ETH) like a long-term treasury asset, it’s moving from tech experiment to financial backbone, with growing influence across both Wall Street and Web3.

Discover DailyCoin’s popular crypto news:

Bitcoin Hits $123K Ahead of Make-or-Break Week for Crypto

Ethereum On Sprint To $4K Despite Foundation’s $3.5M Sale

People Also Ask:

Ethereum offers programmable features like staking and DeFi integration, which companies can use to generate additional yield on treasury holdings, beyond just price appreciation.

Record ETF inflows indicate growing institutional acceptance and provide liquidity, making it easier for companies and investors to buy and hold Ethereum.

Besides general market momentum and Bitcoin’s rally, record inflows into Ethereum ETFs and increasing corporate treasury purchases are key factors boosting ETH’s price.

Credit: Source link