Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin returned to its familiar price range over the week after a dip last weekend brought its price to just under $99,000. This was followed by a bounce to the $106,000 price level, which has given bulls a reason to remain hopeful.

However, on-chain data shows some deeper cracks are forming beneath the surface. The latest on-chain data from analytics firm Glassnode shows growing signs of fatigue in both spot and futures markets. These are conditions that may again cause Bitcoin price to retest $99,000.

Price Support Holds, But Momentum is Clearly Fading

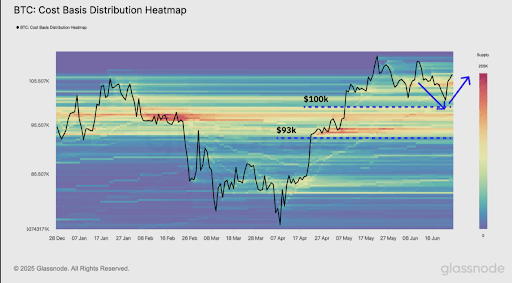

Bitcoin has gone through multiple price swings in recent days, but it has found its way back to the narrow $100,000 to $110,000 band that has defined market structure since early May. On-chain data from Glassnode shows that strong accumulation between $93,000 and $100,000, which is visible on the Cumulative Volume Delta (CBD) Heatmap, has so far served as a buffer zone that helped Bitcoin’s prices bounce during the most recent geopolitical volatility. However, market volume indicates that this structural support may soon face additional pressure.

Related Reading

According to the latest weekly report by Glassnode, investor profitability and engagement surrounding Bitcoin are cooling rapidly. Specifically, a third major wave of profit-taking is causing the 30-day realized profit average to taper, and on-chain activity has decreased significantly. The 7-day moving average of on-chain transfer volume has dropped by about 32%, from a peak of $76 billion in late May to $52 billion over the recent weekend. Current spot volume trading, which is now at just $7.7 billion, is far below the volumes seen during previous rallies.

The lack of strong buying enthusiasm on the spot market shows that bullish sentiment has been replaced by caution. As such, the risk of a breakdown below $99,000 grows unless another wave of demand re-enters.

Futures Market Also Cooling Off

The slowdown in sentiment is not limited to the spot market. Although Bitcoin is attracting interest on derivatives exchanges, there are clear signs that futures sentiment is waning. Open interest dropped by 7% over the weekend, from 360,000 BTC to 334,000 BTC, and funding rates have been declining steadily since Bitcoin hit its Q1 2025 all-time high.

Related Reading

Futures market participants had been very active through Bitcoin’s climb to $111,800 in May, but their conviction appears to be fading now. A further indication of a growing reluctance to hold long positions is the sharp decline in both the annualized funding rate and the 3-month rolling basis.

Without stronger directional conviction, the futures markets may not provide the upside needed to push Bitcoin to new highs. This situation may instead contribute to additional downward pressure.

So far, Bitcoin has respected the $93,000 to $100,000 support zone, which was heavily accumulated during the Q1 2025 top formation. However, with low spot volumes, on-chain activity slowing, and fading futures sentiment, this support could become tested again. If market participants with a cost basis in this zone begin to sell, the resulting pressure could drag Bitcoin below $99,000 again next week.

At the time of writing, Bitcoin is trading at $107,100.

Featured image from Pixabay, chart from Tradingview.com

Credit: Source link