The Office of the Comptroller of the Currency confirmed that national banks may engage in riskless principal crypto-asset transactions, eliminating a key barrier between traditional banking and digital assets.

The decision allows banks to act as intermediaries in crypto trades by simultaneously buying from one customer and selling to another without holding inventory.

The policy shift marks the OCC’s most aggressive step yet toward integrating crypto into mainstream banking, building on earlier approvals for custody services and balance sheet holdings.

Banks can now facilitate client crypto trades while assuming only minimal settlement and credit risk.

Banking’s Crypto Gateway Opens Under New Framework

In Interpretive Letter 1188, senior deputy comptroller Adam Cohen said the activity falls squarely within the business of banking because it mirrors existing brokerage functions.

National banks have long acted as financial intermediaries in securities, derivatives, and other asset classes through riskless principal transactions, taking momentary ownership to bridge buyer and seller.

The OCC applied the same logic to crypto-assets, noting that banks eliminate market risk through offsetting trades while retaining limited exposure to counterparty defaults.

Cohen emphasized that the authority extends beyond securities to any crypto-asset, including those not classified under federal securities law, because the transactions align with banks’ traditional intermediary role.

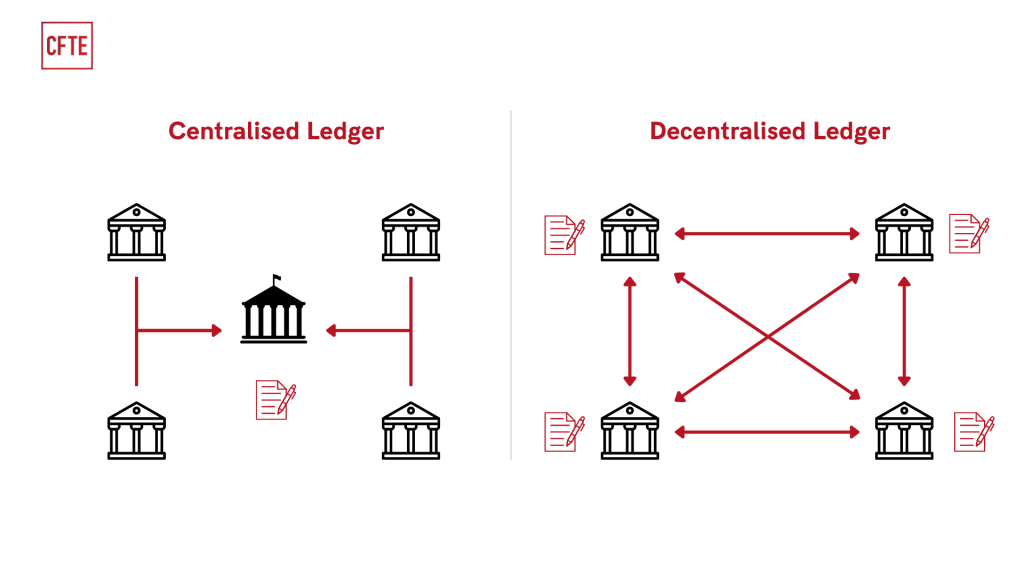

Meanwhile, the regulator dismissed concerns about operational complexity, arguing that banks already manage similar risks when settling securities via electronic ledgers.

Cohen said distributed ledger technology simply represents a modern method of recording transactions, no different in principle from book-entry settlement systems that banks have used for decades.

Why This Changes Bank Crypto Operations

The decision removes a structural obstacle that forced banks to either avoid crypto trading entirely or rely on third-party intermediaries for client transactions.

By allowing direct riskless principal activity, the OCC enables banks to offer seamless crypto services while maintaining regulatory compliance and customer protections.

Banks can now serve clients who want crypto exposure without partnering with unregulated exchanges or pseudonymous counterparties.

The framework requires banks to implement know-your-customer protocols, transaction monitoring, and the ability to freeze or reverse transfers when necessary, features built into certain blockchain platforms, such as Stellar.

The policy also strengthens banks’ competitive position against fintech rivals and crypto-native firms seeking federal bank charters.

Several major institutions have already moved toward crypto integration, with Bank of America authorizing advisers to recommend Bitcoin ETFs and JPMorgan allowing customers to fund Coinbase accounts via Chase cards.

Regulatory Momentum Builds Across Digital Assets

The OCC’s move comes as federal agencies accelerate the development of stablecoin and tokenized deposit frameworks under the GENIUS Act.

The FDIC will publish its first stablecoin rule proposal later this month, establishing capital, liquidity, and reserve requirements for bank-issued dollar-backed tokens.

Federal Reserve Vice Chair Michelle Bowman said the central bank is coordinating with peer agencies on standards to anchor digital assets to traditional finance.

The Treasury Department closed its second public consultation on non-bank stablecoin issuers in recent weeks, creating parallel oversight tracks that will govern the entire US stablecoin market.

Acting FDIC chair Travis Hill revealed that guidance on tokenized deposits is also underway, clarifying how blockchain-based representations of bank deposits will be treated under existing regulations.

The effort responds to growing industry interest in using distributed ledgers for payments and settlement.

Jonathan Gould, who became the OCC’s first permanent comptroller since 2020 after confirmation in July, has pushed back against banking industry complaints about approving crypto firm charters.

Speaking at the Blockchain Association Policy Summit last week, he said digital asset custody and safekeeping have operated electronically for decades, adding there is no justification for treating crypto differently.

The OCC received roughly 14 bank charter applications this year, including from Coinbase, Circle, and Ripple, all seeking federal oversight for stablecoin and custody operations.

Gould dismissed concerns about supervisory capacity, noting the agency already supervises a crypto-native national trust bank and fields daily inquiries from traditional banks launching innovative products.

Credit: Source link