- FLOKI needs to reclaim a Fibonacci level as support and consolidate to introduce a bullish bias.

- The technical indicators and liquidity pools hinted at another price drop.

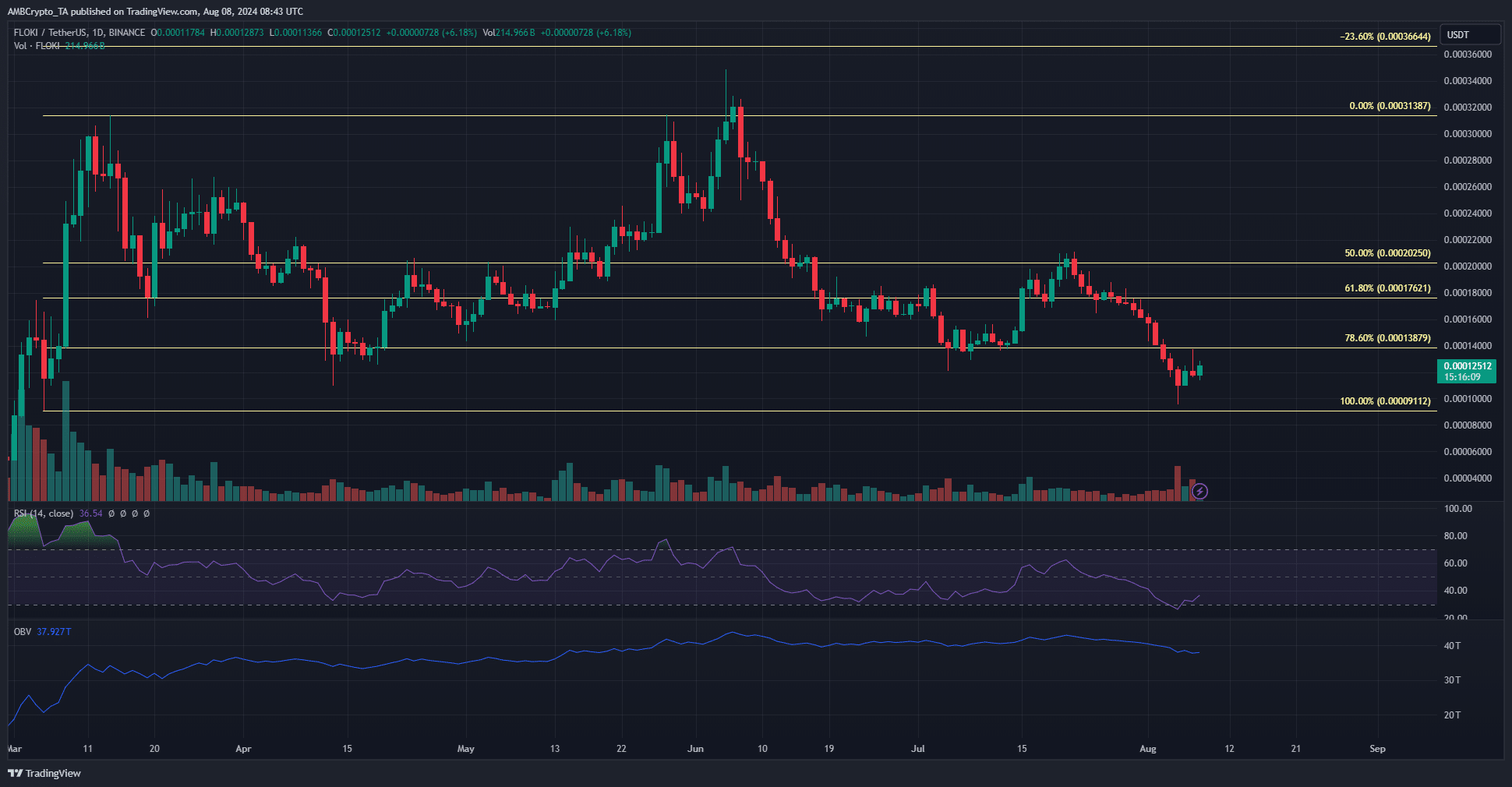

Floki [FLOKI] was trending downward and did not begin to recover from the recent losses, though it is up 30.5% from the recent lows. The $0.00014 resistance level overhead appeared likely to rebuff the bulls.

The most recent lower high is at $0.0002. In the coming weeks, FLOKI investors would be hoping that the nearby resistance level would be flipped to support and prices can consolidate there.

FLOKI bulls have a long battle ahead

Source: FLOKI/USDT on TradingView

The closest significant high at $0.0002 is 67% higher than the meme coin’s market price. A slow series of higher lows and higher highs in August would be what the doctors recommend for FLOKI bulls’ health.

In this climate of uncertainty, it is unclear if the performance can match the bulls’ expectations. The daily RSI was still well below neutral 50 to signal bearish momentum, and the OBV was in decline to reflect heightened selling volume in recent days.

The Fibonacci levels are expected to serve as resistance on the way higher.

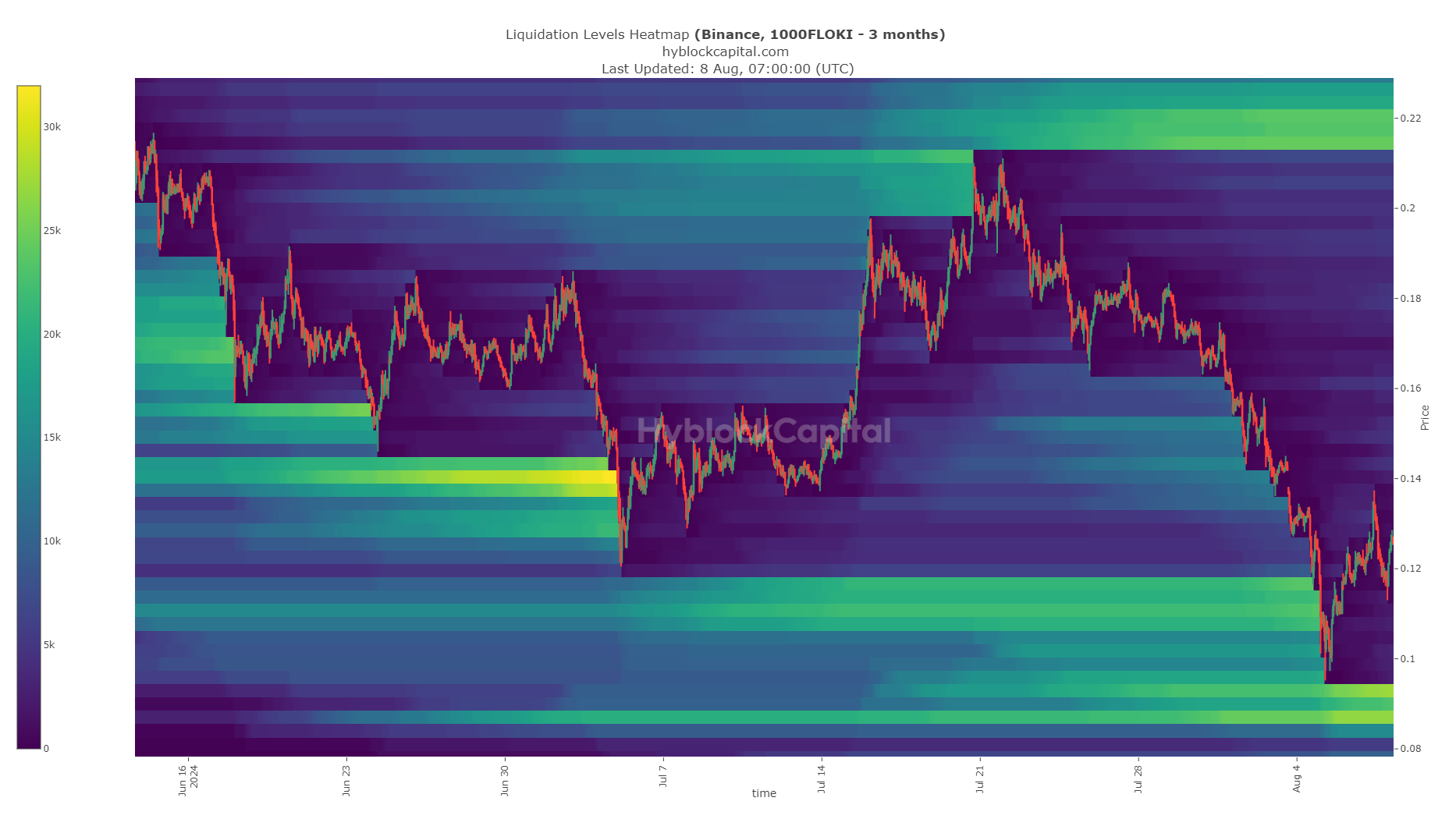

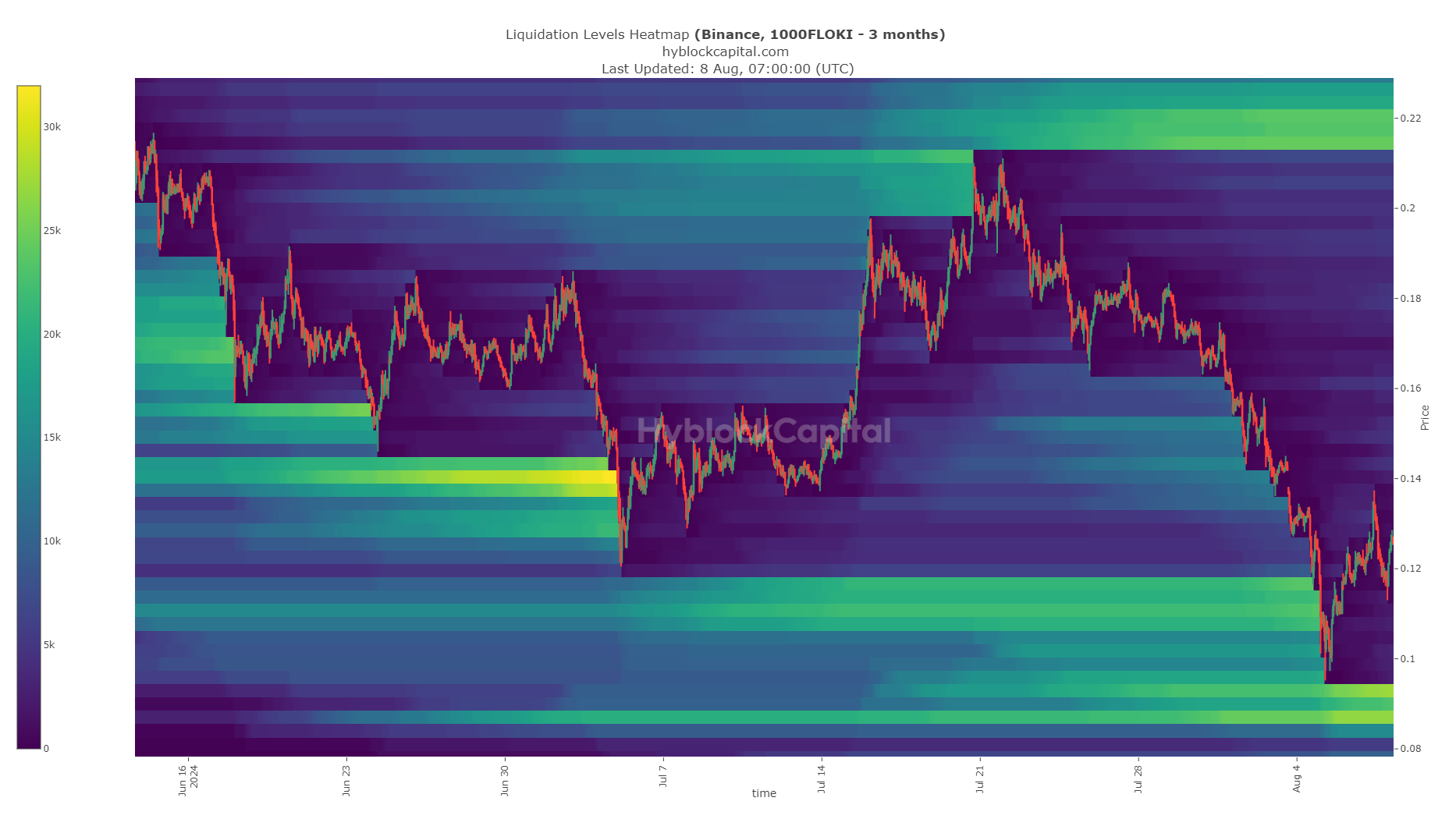

The liquidation heatmap shows the price has another 25% drop left

Source: Hyblock

The liquidity pool at the $0.0001 zone has been collected and prices rebounded higher after Bitcoin [BTC] formed a local bottom at $49k. However, there was a significant amount of liquidation levels remaining at the $0.000093 zone.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

To the north, the $0.00022 was the bullish target, based on the 3-month lookback period. The $0.000142 and $0.00016 levels are also potential spots where a bearish reversal could occur in the short term.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Credit: Source link