- WLD’s price saw a double-digit hike over the course of the last trading session

- Futures traders are not convinced about its latest price moves though

Worldcoin initiated yet another token unlock earlier in the week, an episode that often prompts significant market reactions. However, the altcoin’s price response was tepid. In fact, despite the token unlock, its price movement was not significant enough to shift overall trader sentiment positively.

This cautious or negative sentiment was particularly evident in the Futures market.

Worldcoin commences unlocks

Tools for Humanity (TFH), the development team behind the Worldcoin project, recently announced a significant alteration to the unlock schedule of its native token, Worldcoin (WLD).

Detailed in a blog post dated 16 July, the original plan was set for an unlock period of three years. However, this timeline has been extended, with 80% of the WLD tokens held by team members and investors now scheduled to become accessible over five years, starting from 24 July 2024.

Under the new arrangement, the unlocking of these tokens will occur gradually across four years, concluding by the end of July 2028. This extended schedule is likely aimed at managing market supply and stabilizing the token’s price by avoiding a sudden influx of a large volume of tokens into the market.

How did Worldcoin react?

Worldcoin has experienced a series of fluctuations in its market performance over the past week.

Initially, the token was on a downtrend for more than seven days. However, on 24 July, coinciding with the start of the token unlock event, Worldcoin saw a modest hike of 1.32%, which nudged its price from approximately $2.1 to $2.2. The following day, the token experienced a setback with a decline of over 4%, bringing it back to $2.1.

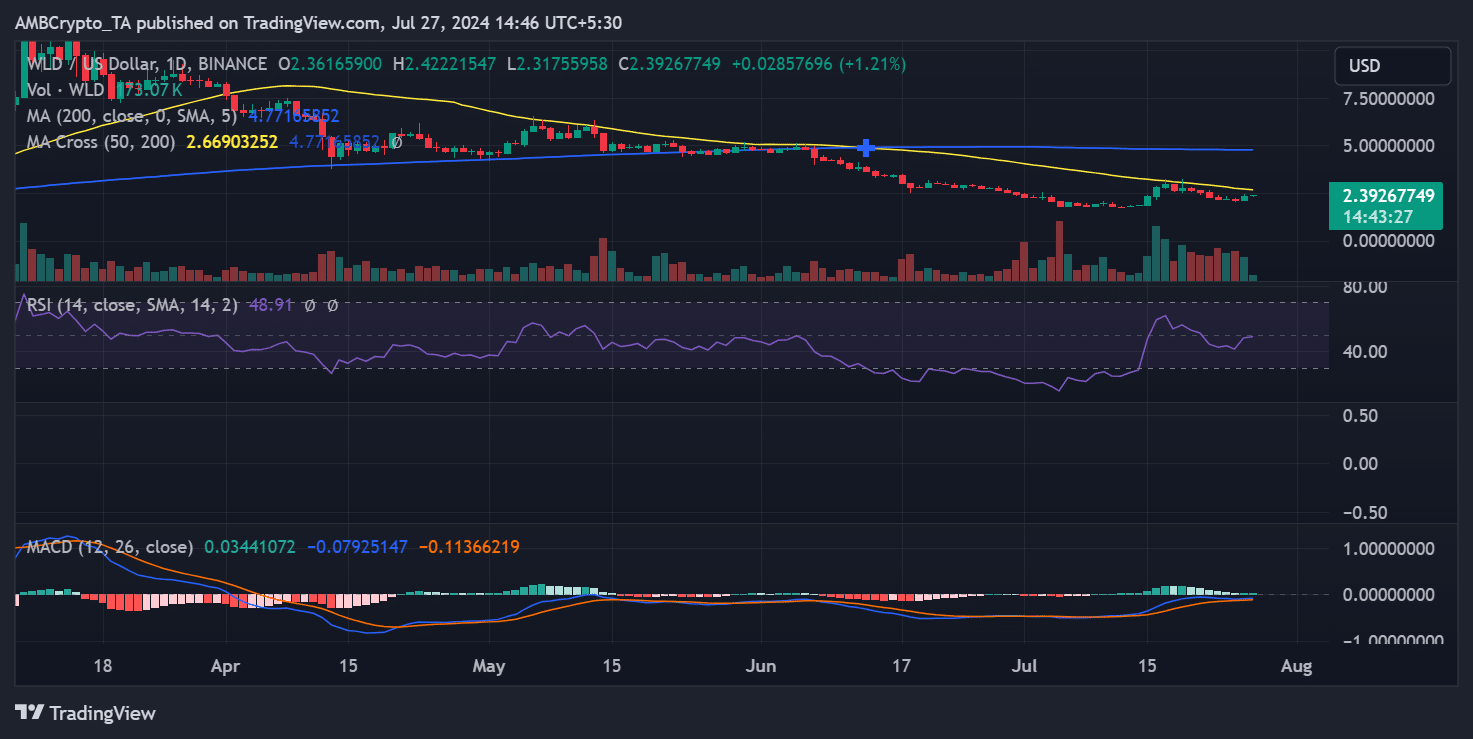

Despite these fluctuations, a significant positive shift occurred on 26 July. According to AMBCrypto’s analysis, WLD’s price jumped by 11.74%, reaching the $2.3 level. This uptrend continued slightly, bringing the price to about $2.4, with an additional increase of over 1%.

Despite these gains, however, the trend has not yet turned bullish.

Technical analysis further highlighted that its short-term moving average (yellow line) still posed as an immediate resistance at approximately $2.7 to $3. Overcoming these levels would be crucial for the token to establish a more robust bullish trend.

Source: TradingView

Additionally, the Relative Strength Index (RSI), hovering around the neutral line, suggested that the asset was on the cusp of entering bullish territory – Contingent on the sustainability of recent positive trends.

WLD traders show negative sentiment

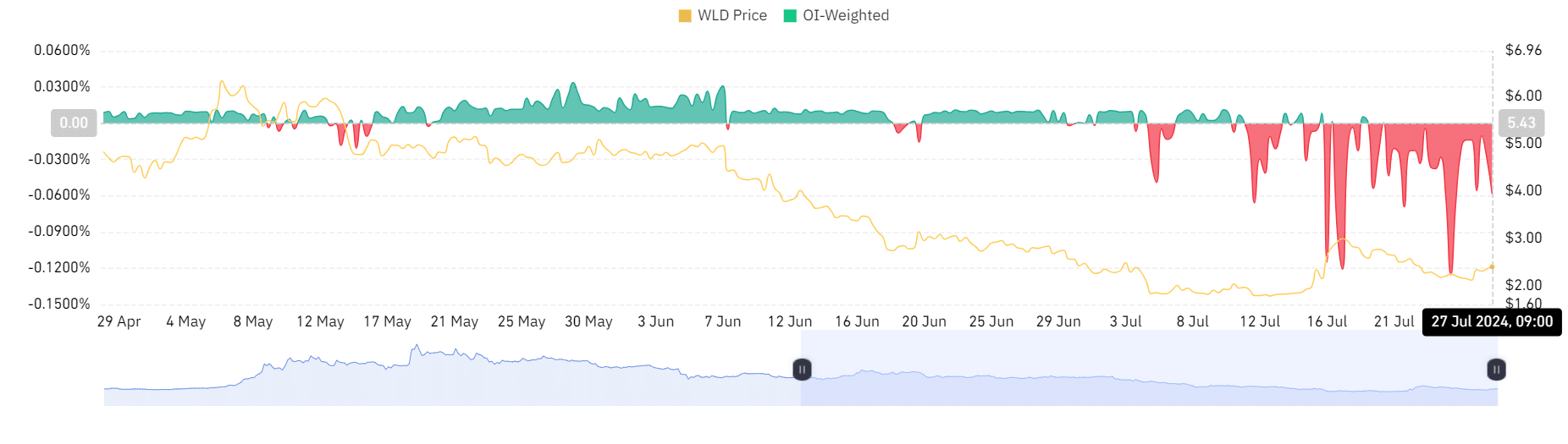

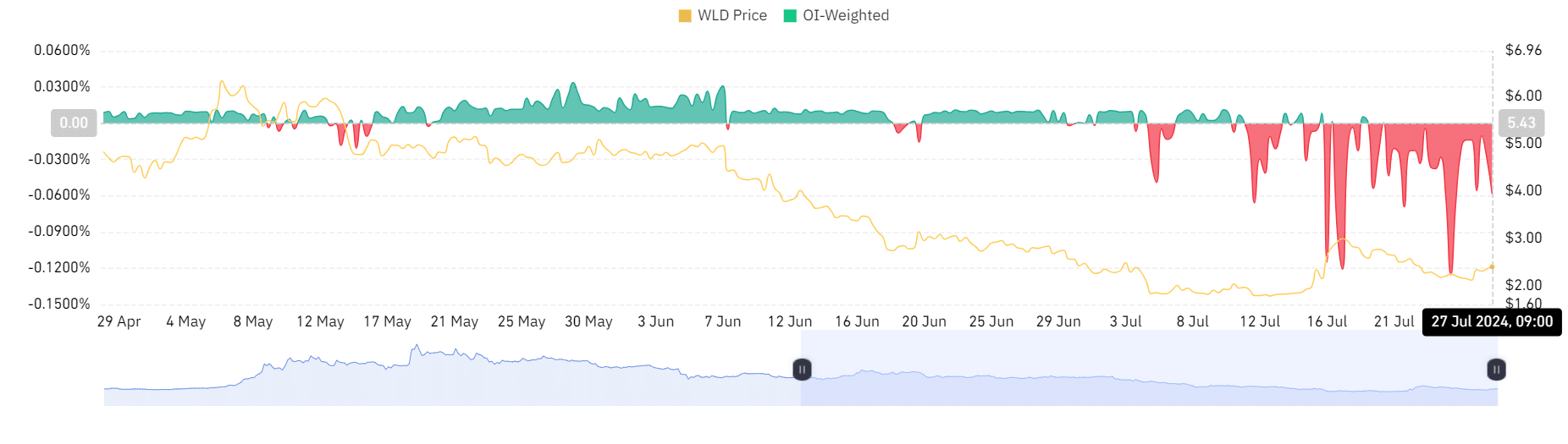

An analysis of Worldcoin (WLD) trading metrics on Coinglass revealed bearish sentiment among traders, as indicated by the prevailing long/short ratio and funding rate trends.

Specifically, the long/short ratio suggested that there have been more short positions than long positions on Worldcoin. Simply put, traders are betting on a decline in the token’s price rather than a hike.

Source: Coinglass

– Is your portfolio green? Check out the Worldcoin Profit Calculator

Finally, the funding rate for WLD has been trending below zero, with the press time rate at approximately -0.058%.

A negative funding rate typically means that shorts are paying longs to keep their positions open, which is common in markets where there is a consensus that prices will drop. This condition seemed to indicate that sellers are dominating the market, exerting downward pressure on the token’s price.

Credit: Source link