Decentralized perpetual futures exchange Hyperliquid is preparing to roll out its first native stablecoin while slashing spot trading fees by 80%, in a move designed to boost liquidity and deepen its hold over the decentralized finance (DeFi) derivatives market.

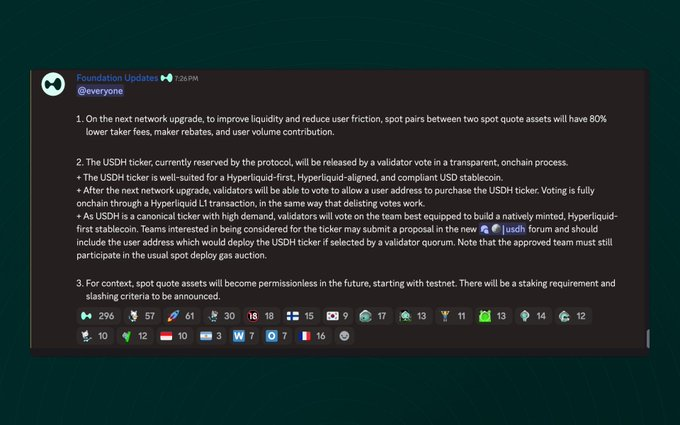

The exchange announced on Discord that the next network upgrade will cut taker fees, maker rebates, and user volume contribution for spot pairs between two quote assets by four-fifths.

Alongside the fee changes, Hyperliquid has reserved the USDH ticker for a new dollar-backed stablecoin, which will be allocated through a validator vote.

Teams seeking to issue USDH must submit proposals including their deployment address, with the winning bid to be selected by validator quorum in a fully on-chain process.

USDH Stablecoin Aims to Anchor Hyperliquid’s Expanding DeFi Suite

USDH is intended as a “Hyperliquid-first” compliant stablecoin that will integrate across the platform’s ecosystem, including perpetuals, spot markets, staking, and protocols such as Kinetiq, Hypurrfi, and Hyperlend.

The exchange described stablecoins as the “backbone of any L1,” with USDH expected to serve as a settlement layer that can expand total value locked (TVL) across DeFi applications.

Revenue is expected to accrue internally through mint and burn fees, collateralized lending flows, and native on- and off-ramps, creating a self-reinforcing “stablecoin flywheel.”

The launch comes as regulators in the United States, including the Treasury Department, seek feedback on the GENIUS Act, a legislative framework for stablecoin oversight.

Hyperliquid’s decision to put the stablecoin under validator control highlights its bid to align with regulatory expectations while reinforcing its decentralized governance model.

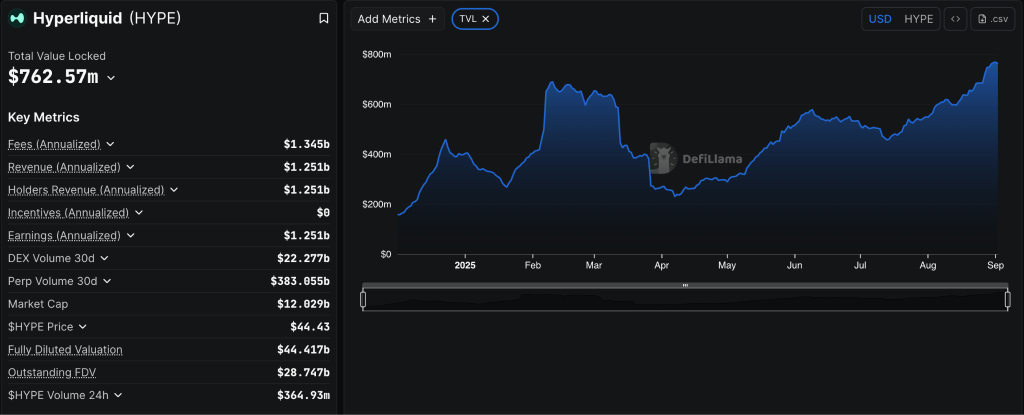

Hyperliquid’s expansion into stablecoins follows a record-breaking summer. The platform reported $106 million in revenue from perpetual futures trading in August, a 23% increase from July’s $86.6 million, according to DefiLlama.

Monthly trading volume surged to $383 billion, lifting its annualized revenue to $1.25 billion and cementing a 70% market share among DeFi perpetual platforms. Cumulative trading volume has now exceeded $2.57 trillion.

Despite its scale, Hyperliquid operates with just 11 employees, relying on automation and smart contracts to handle functions such as settlement, reconciliation, compliance, and customer operations.

The lean model has produced efficiency ratios far ahead of traditional payment firms. PayPal, which employs 29,000 staff, processes $1.6 trillion annually, while Visa requires 28,000 workers for $13 trillion. By comparison, Hyperliquid manages over $330 billion in yearly volume with a fraction of the headcount.

Much of the platform’s dominance is attributed to HyperEVM, its custom Layer 1 blockchain, which eliminates gas fees for trades while maintaining fully on-chain order books.

The model delivers centralized-exchange performance with decentralized transparency, a combination that has helped the exchange outpace competitors such as Robinhood and Bitstamp in recent months.

Trading activity has peaked at $29 billion in 24-hour volume, generating as much as $7.7 million in daily fees.

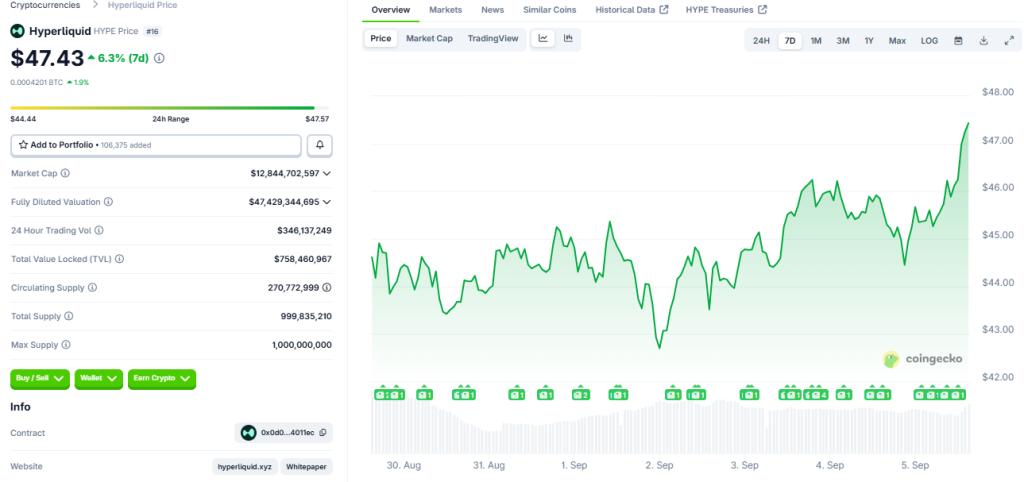

Hyperliquid’s governance token, HYPE, has rallied sharply alongside its financial performance. The token traded at $47.43 at the time of writing, up 4% over the past day and 7% in the past week, according to CoinGecko.

HYPE has gained 21% in the past month, 209% in six months, and nearly 95% year-to-date. The surge coincides with the exchange’s revenue growth, reinforcing the link between governance demand and ecosystem expansion.

$HYPE Gains 4.5% in August Despite Hyperliquid’s Mid-Summer Outage

Hyperliquid suffered more than 30 minutes of downtime in July after its API servers became overloaded. Trading halted at 14:10 UTC as users reported delays in order execution, with complaints quickly surfacing in the platform’s Discord channel.

Although Hyperliquid’s status page did not immediately show issues, the team later confirmed the outage and described it as a “major” event.

Trading resumed at 14:47 UTC after engineers stabilized the servers. In a statement, the exchange said the disruption stemmed from a sharp traffic spike rather than a hack or exploit.

The halt created brief price divergences as traders were unable to close positions. Hyperliquid has since pledged to add monitoring tools and safeguards to prevent a repeat.

Later in August, the exchange reimbursed nearly $2 million to users affected by the brief outage.

Despite the setback, Hyperliquid’s $HYPE climb in August rose by 4.5% to $45.62, edging toward its all-time high on strong liquidity and protocol upgrades.

The token powers Hyperliquid’s on-chain perpetuals DEX, which operates a Central Limit Order Book (CLOB) and supports smart contracts via HyperEVM. It is used for gas, staking, and governance.

The project’s tokenomics tie protocol fees to both an Assistance Fund and the HLP pool, which buy back $HYPE. Current revenue distribution stands at 54% and 46%, respectively.

Speculation around HYPE intensified after former BitMEX CEO Arthur Hayes predicted the token could deliver 126x returns by 2028. Hayes’ thesis assumes Treasury-backed stablecoins will reshape global banking, driving trillions in deposits into compliant DeFi venues like Hyperliquid.

Institutional interest is growing. Hayes himself acquired 58,631 HYPE tokens worth $2.6 million, while 21Shares listed exchange-traded products on Switzerland’s SIX Exchange.

Analysts say expansion into tokenized assets and fintech integrations could further strengthen Hyperliquid’s position in the coming years.

Credit: Source link