The Internal Revenue Service’s (IRS) criminal division has come under scrutiny for failing to properly document and track billions of dollars in seized cryptocurrency assets, according to a recent report by the Treasury Inspector General for Tax Administration (TIGTA).

The watchdog’s investigation, released this week, shows major lapses in how IRS Criminal Investigation (IRS-CI) handles digital assets seized in criminal cases.

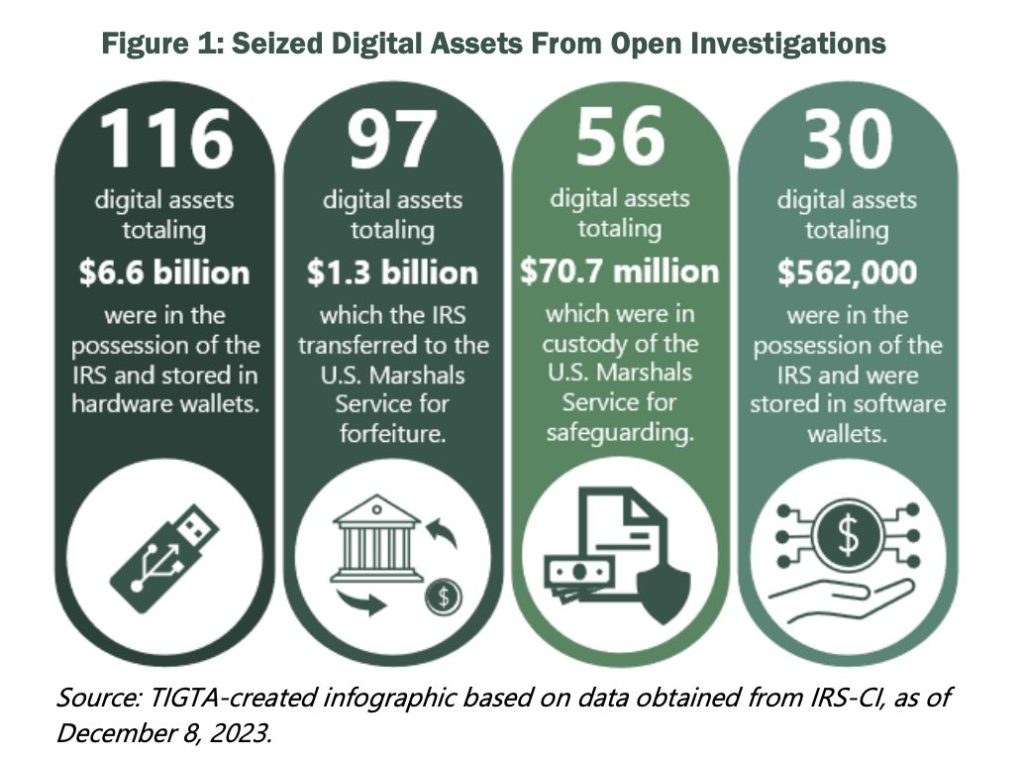

As of late 2023, the agency had taken custody of around $8b in digital assets tied to open investigations. Yet TIGTA found that IRS-CI did not consistently follow its own procedures for documenting those seizures, leaving key data either missing or incorrect.

Watchdog Finds IRS Lacked Basic Documentation in Key Crypto Cases

One core issue involved the required seizure memoranda. These documents are meant to formally log the transfer of digital assets into government-controlled wallets.

TIGTA found that not all seizures had such memos, and among those that did, many lacked crucial details, such as wallet addresses, transaction amounts, or even the date of the seizure. In one case, wallet addresses were swapped by mistake.

Beyond paperwork gaps, the report flagged more serious concerns. Investigators discovered three hardware wallets had gone missing after being handed over by the FBI.

In another case, IRS staff shredded the recovery seed phrase for a government wallet, risking permanent loss of access. While the funds were ultimately recovered, the report noted that such errors could have led to irretrievable losses.

Litecoin-to-Bitcoin Swap and Decimal Blunder Expose IRS Crypto Flaws

IRS-CI was also criticized for converting a Litecoin asset into Bitcoin during a seizure. It failed to preserve the asset in its original form. Later, the agency updated its guidelines to maintain seized crypto in its native format. However, that change came only after TIGTA raised concerns in May 2024.

Recordkeeping failures extended to the IRS’s own inventory system, known as AFTRAK.

Around 43% of seized crypto assets were listed in the wrong location. In addition, several entries had quantity mismatches that could impact asset valuation. For example, one seized bitcoin holding was undervalued by more than $9,000 due to a simple decimal error.

TIGTA issued six recommendations, urging IRS-CI to improve inventory systems, clarify internal guidelines, and enforce timelines for documentation. The IRS agreed to five of them and partially accepted a sixth, citing real-world complications in preserving asset types during seizures.

With crypto seizures likely to grow, the pressure is now on the agency to improve its controls and prevent costly missteps.

Credit: Source link