Three of Japan’s largest banks, Mitsubishi UFJ Bank, Sumitomo Mitsui, and Mizuho, are joining forces to launch stablecoins pegged to the Japanese yen and US dollar, a move to challenge the dominance of dollar-backed USDT and USDC stablecoins.

According to an October 17 report from Japanese outlet Nikkei, the yen-backed stablecoin will first be used for settlement by Mitsubishi Corporation.

The three megabanks, which collectively serve over 300,000 major business partners, have united specifically to drive stablecoin adoption across Japan.

“The banks will build a structure for corporate clients to allow for stablecoins to be transferred between them along uniform standards, initially issuing a yen-pegged coin and potentially a dollar-pegged coin in the future,” Nikkei reported.

Progmat Is Building Japan’s Stablecoin To Challenge USDT And USDC Dominance

CryptoNews covered this initiative back in April when Mitsubishi UFJ Trust and Banking first announced plans to issue the nation’s first fiat-pegged stablecoin.

At the core of this development is Progmat, the blockchain infrastructure company established by MUFG.

Progmat specializes in building digital financial products that meet regulatory requirements.

The platform will handle the issuance and governance of the new stablecoin, maintaining consistent legal and operational compliance throughout.

Beyond Progmat, the banks have partnered with several crypto sector players, including domestic exchange Bitbank, blockchain company Avalabs, and crypto infrastructure provider Fireblocks.

This follows Nikkei’s earlier report that Japan was preparing to approve its first yen-denominated stablecoin this autumn.

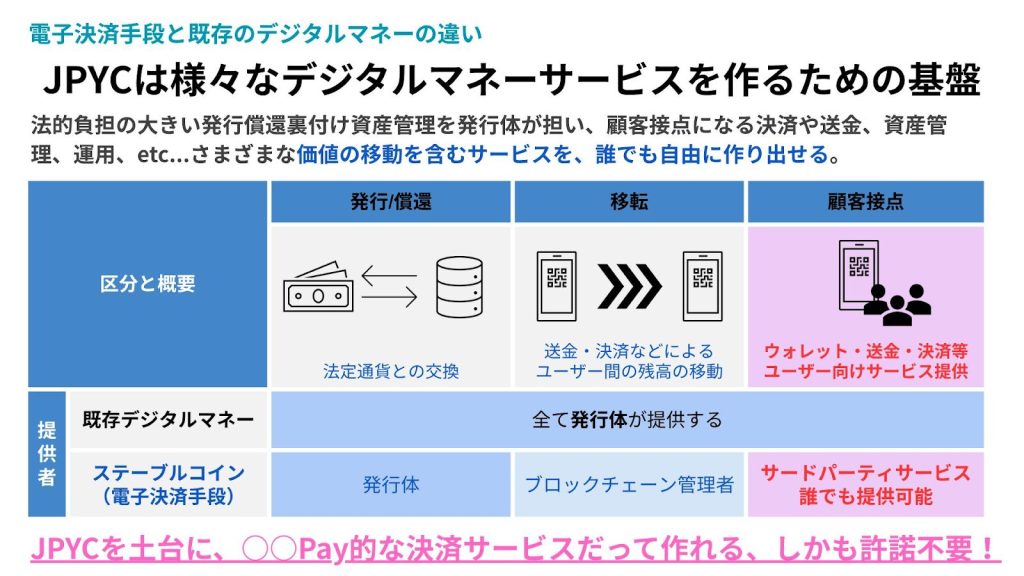

CryptoNews confirmed then that Tokyo-based fintech company JPYC would lead the launch.

The stablecoin, also named JPYC, will maintain its peg to the yen through reserves of highly liquid assets, including deposits and government bonds.

Potential applications for the yen-backed stablecoin include sending money to students abroad, facilitating cross-border corporate payments, and enabling participation in decentralized finance.

Over the next three years, the banks plan to issue 1 trillion yen worth of JPYC, equivalent to approximately $6.64 billion at the current exchange rate of 150.42 yen to the dollar.

The timing coincides with growing global interest in stablecoins, whose total market capitalization recently crossed $307 billion, with dollar-backed tokens USDC and USDT holding the lion’s share.

Currently, only Circle’s USDC has received approval as a global dollar stablecoin for use in Japan.

USDC entered the Japanese market after Circle partnered with financial conglomerate SBI Group in March to list the token on the SBI VC Trade crypto exchange.

Jeremy Allaire, CEO of Circle, acknowledged Japan’s welcoming arms to crypto in an X post, stating: “We have spent 2+ years engaging with Japan’s regulators, major industry players, strategic partners, banking partners and others to enable USDC for the Japanese market.”

Japan Doubles Down on Crypto Adoption

Japan’s revised legal framework, effective since June 2023, indicates the country’s intent to challenge the dominance of dollar-backed stablecoins.

Under the new rules, stablecoins are classified as “currency-denominated assets” and can only be issued by banks, trust companies, and registered money transfer businesses.

These policy changes have helped the country more than double its crypto adoption over the past year, according to crypto analytics firm Chainalysis.

Among the top five markets in the Asia Pacific region, Japan recorded the strongest growth, with its on-chain value received growing 120% year-over-year in the 12 months to June, according to an excerpt from Chainalysis’ 2025 Report released in September.

Over the 12 months to June 2025, the report showed that cryptocurrency purchases using JPY stablecoins have been directed primarily toward XRP, which accounted for $21.7 billion in fiat trading activity, followed by BTC ($9.6 billion) and ETH ($4.0 billion).

The dominance of XRP trading is particularly notable and suggests that investors may be betting on the real-world utility of XRP following Ripple’s strategic partnership with SBI Holdings.

Credit: Source link