- LayerAI surged by 81.92%, supported by strong technicals and rising Open Interest

- On-chain activity and short liquidations hinted at growing market confidence in LayerAI’s momentum

The cryptocurrency market has seen its fair share of volatility lately, but LayerAI [LAI] is making a statement. The token surged by an impressive 81.92% in just one day, trading at $0.007600 at press time.

This sudden uptick in price has grabbed the attention of investors and analysts alike. So, what’s driving this upward momentum, and can LayerAI sustain its growth?

Can LAI hold its gains?

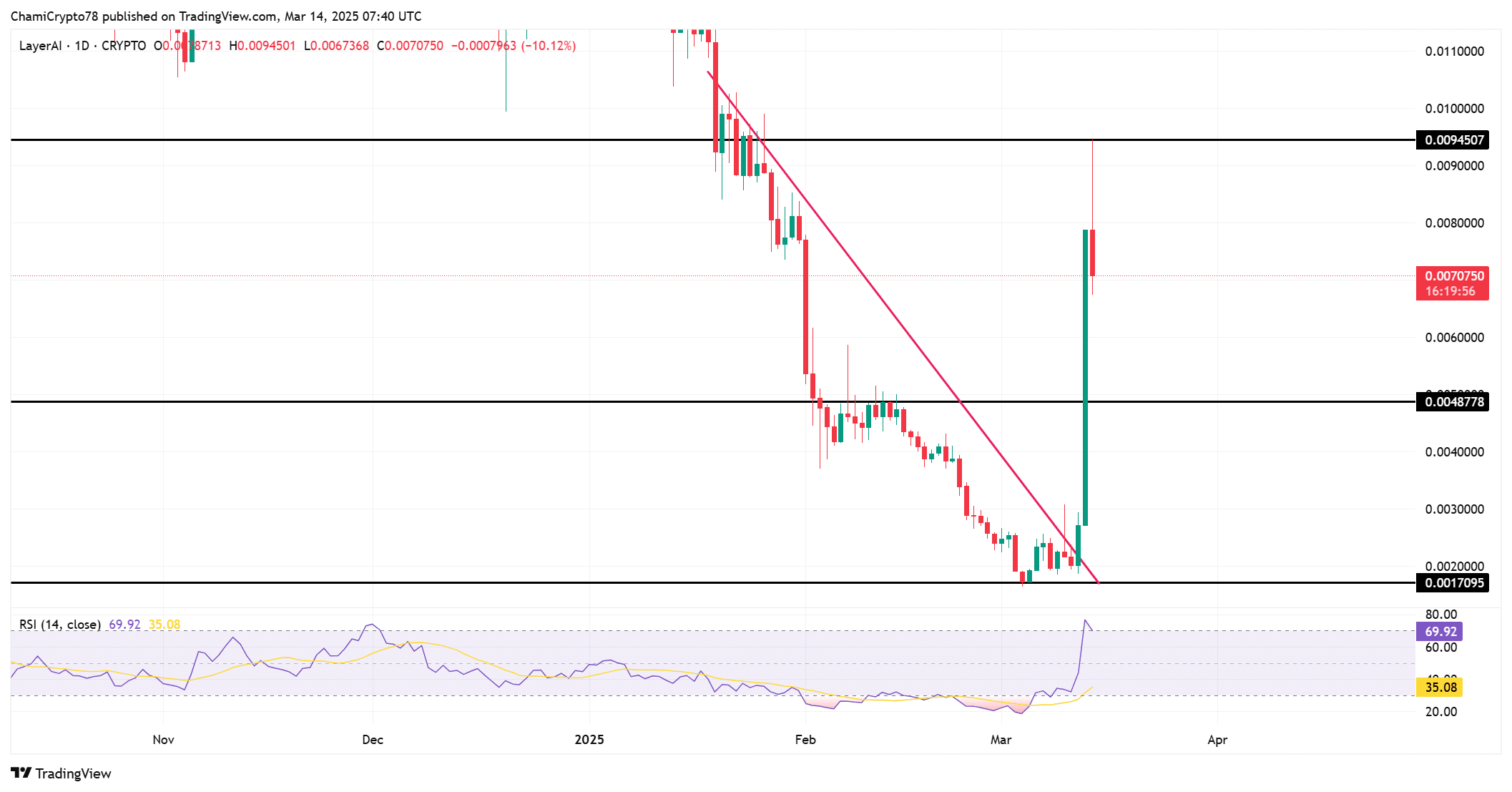

LayerAI’s price chart revealed a dramatic spike in March 2025, where it broke through several resistance levels, pushing the price above the $0.007-mark.

The RSI seemed to be flashing a bullish reading of 69.92 – A sign that the asset was in a strong momentum phase. However, the price correction seen after reaching the peak alluded to potential consolidation before its next big move.

Key support levels to watch include $0.0048778 and $0.006000, while resistance has been forming near the $0.0094507 region. If LayerAI continues to hold above the support, it could target higher price levels in the coming weeks.

Source: TradingView

Open Interest surge – What does it tell us?

LayerAI’s Open interest surged by a staggering 143.39%, hitting $6.42 million. This sharp hike indicated that more capital is being tied up in LAI Futures, signaling growing market confidence. It’s a clear sign that investors are betting on further price action.

However, the significant uptick in Open Interest could also signal higher market risk, especially if the price records a reversal. With this in mind, traders should closely monitor the Open Interest levels to gauge the intensity of market sentiment.

Besides, LayerAI’s on-chain metrics highlighted a significant spike in daily active addresses and transaction volume. The number of daily active addresses jumped dramatically, reaching 54 addresses at press time – Marking an increase in network activity.

Additionally, this surge has been supported by a corresponding hike in transaction counts. Such a spike in on-chain activity typically indicates that more users are engaging with the network. This could signal growing adoption and further demand for LAI.

Source: Santiment

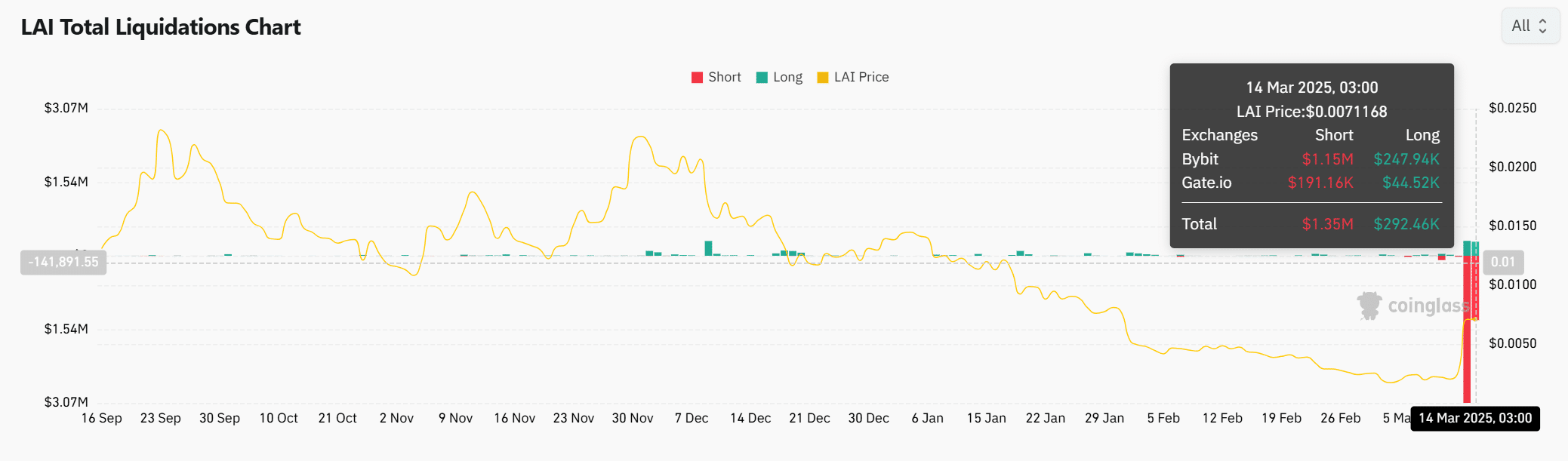

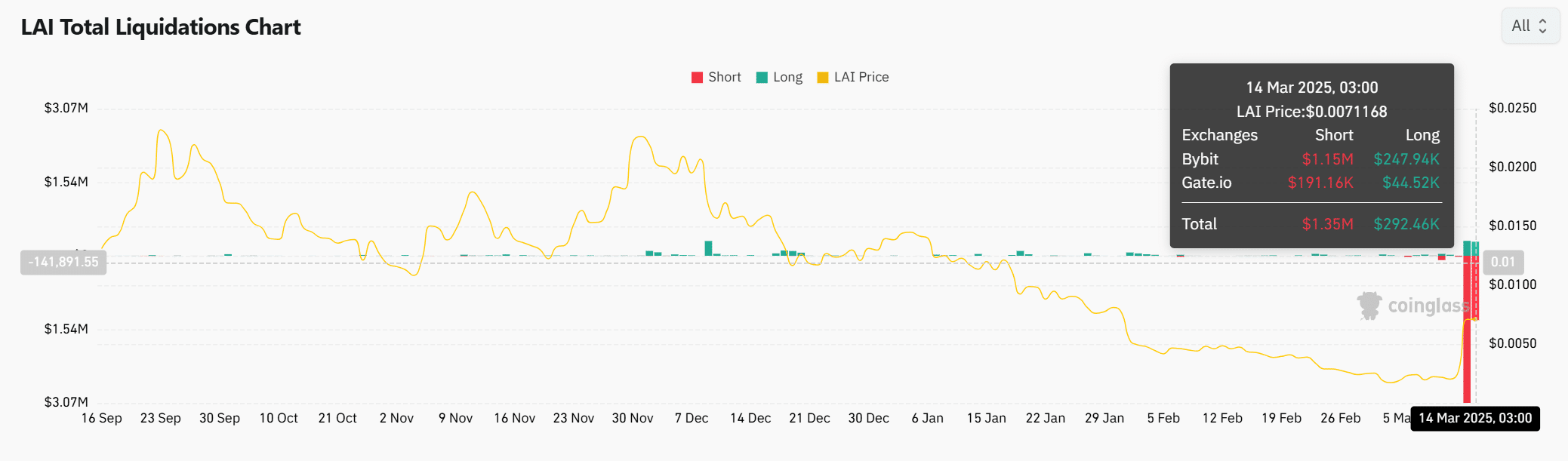

LAI Long vs. Short liquidations – Who’s winning?

LayerAI has seen notable liquidations in the market, with short positions facing significant pressure. As of 14 March, short liquidations amounted to $1.35 million across exchanges like Bybit and Gate.io.

The rapid price surge caused many short sellers to exit their positions, further fueling the rally.

Now, long positions also faced some liquidations. However, the overwhelming short liquidations mean that bearish sentiment has been squeezed out for now.

Source: Coinglass

Will LayerAI continue to surge?

LayerAI’s dramatic price action, bolstered by increased Open Interest, rising on-chain activity, and the dominance of long liquidations, paints a bullish picture. However, the market could see volatility in the short term. Especially as the RSI suggested the token may be nearing overbought conditions.

Therefore, while the surge has been promising, traders should remain cautious and watch for any signs of a correction. If LayerAI manages to hold above key support levels, it could continue its bullish trajectory.

Credit: Source link