- Litecoin gained 9.5% in the past week, defying the broader crypto market downturn.

- Technical analysis indicated a potential breakout to $100, supported by rising Open Interest and SOPR trends.

Litecoin [LTC], one of the top cryptocurrencies by market capitalization, has been bucking the overall bearish trend seen across the crypto market in recent weeks.

While many major assets have been hit hard, dropping at least 5% or more, Litecoin has managed to hold its ground and even post gains.

Over the past two weeks, Litecoin was up 3.5%, and in the last week alone, the asset has surged by 9.5%.

However, in the past 24 hours, there has been a slight retracement, with LTC now down 0.5%, trading at $65.88 at the time of writing.

Litecoin poised for further growth?

This bullish price action from LTC has caught the attention of traders and analysts. One such prominent crypto analyst, ZAYK Charts, shared a technical outlook on Litecoin on X (formerly Twitter).

According to ZAYK Charts, Litecoin was trading within a descending channel formation on its 1-day chart, which could signal a potential breakout on the horizon.

Source: ZAYK Charts/X

For context, a descending channel formation in trading is a technical pattern that occurs when an asset’s price moves within a downward-sloping parallel trendline.

This formation indicates that while the price is trending lower, there could be a potential breakout when the price reaches the lower boundary of the channel.

A breakout happens when the price moves outside the channel’s upper boundary, signaling the end of the downward trend and potentially a reversal to the upside.

According to ZAYK Charts, if Litecoin manages to break out of this descending channel, the next target for the asset could be as high as $100.

This projection is based on previous technical patterns observed in the market.

However, this breakout will largely depend on market momentum and whether Litecoin can gather enough bullish support to break through its resistance levels.

Fundamental outlook on LTC

To support this potential breakout, there has been some interesting movement in Litecoin’s fundamentals.

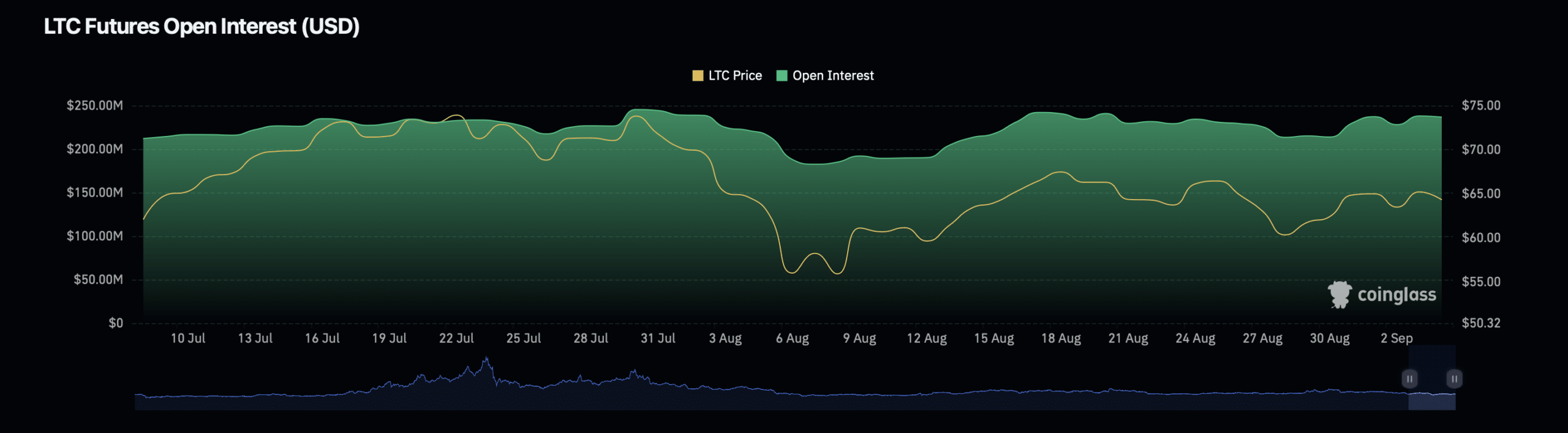

According to data from Coinglass, Litecoin’s Open Interest has been on an upward trend, increasing by 1% to reach a current valuation of $243.96 million.

Source: Coinglass

Open Interest refers to the total number of outstanding derivative contracts (like futures and options) that have not been settled.

The increase in Open Interest suggests more traders are entering positions on Litecoin, which could indicate rising interest and confidence in a potential price surge.

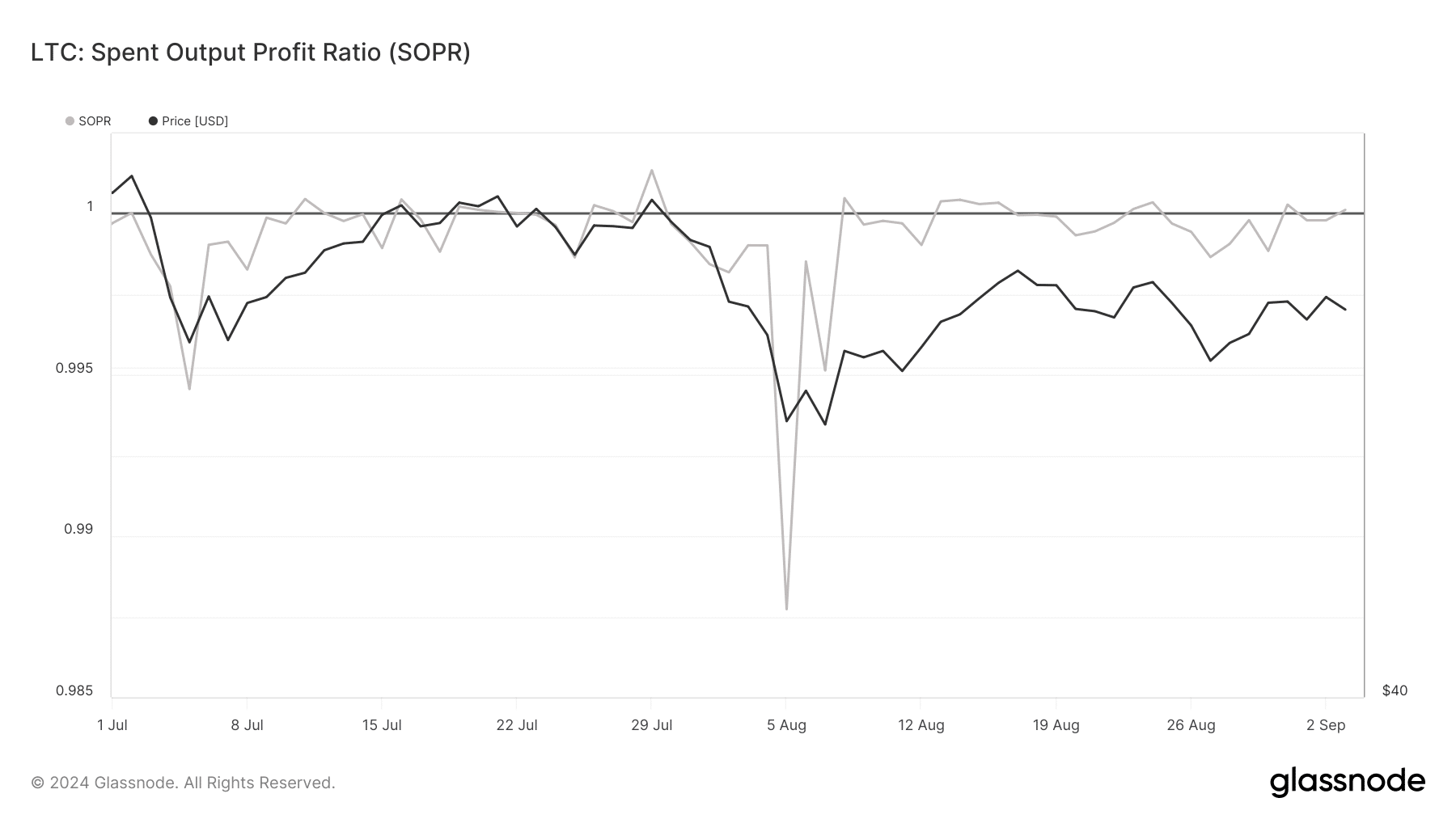

Another key metric to monitor for Litecoin is the spent output profit ratio (SOPR), which measures whether holders are selling their assets at a profit or a loss.

A SOPR value of 1.0 indicates that coins are being sold at their original purchase price, while a value above 1.0 means holders are selling at a profit, and a value below 1.0 indicates they are selling at a loss.

According to data from Glassnode, Litecoin’s SOPR has recently shown a slight rebound. After dipping below 1.0 early last month, the metric has now returned to 1.0.

Source: Glassnode

Read Litecoin’s [LTC] Price Prediction 2024–2025

This indicates that on average, LTC holders are now breaking even on their sales, which could suggest a stabilizing market.

A rising SOPR could be a positive sign for LTC’s price, as it may signal that selling pressure is easing and buyers are becoming more confident.

Credit: Source link