- On-chain metrics supported a Litecoin significant increase before the halving.

- Those who bought LTC at lower prices have quit profit-taking.

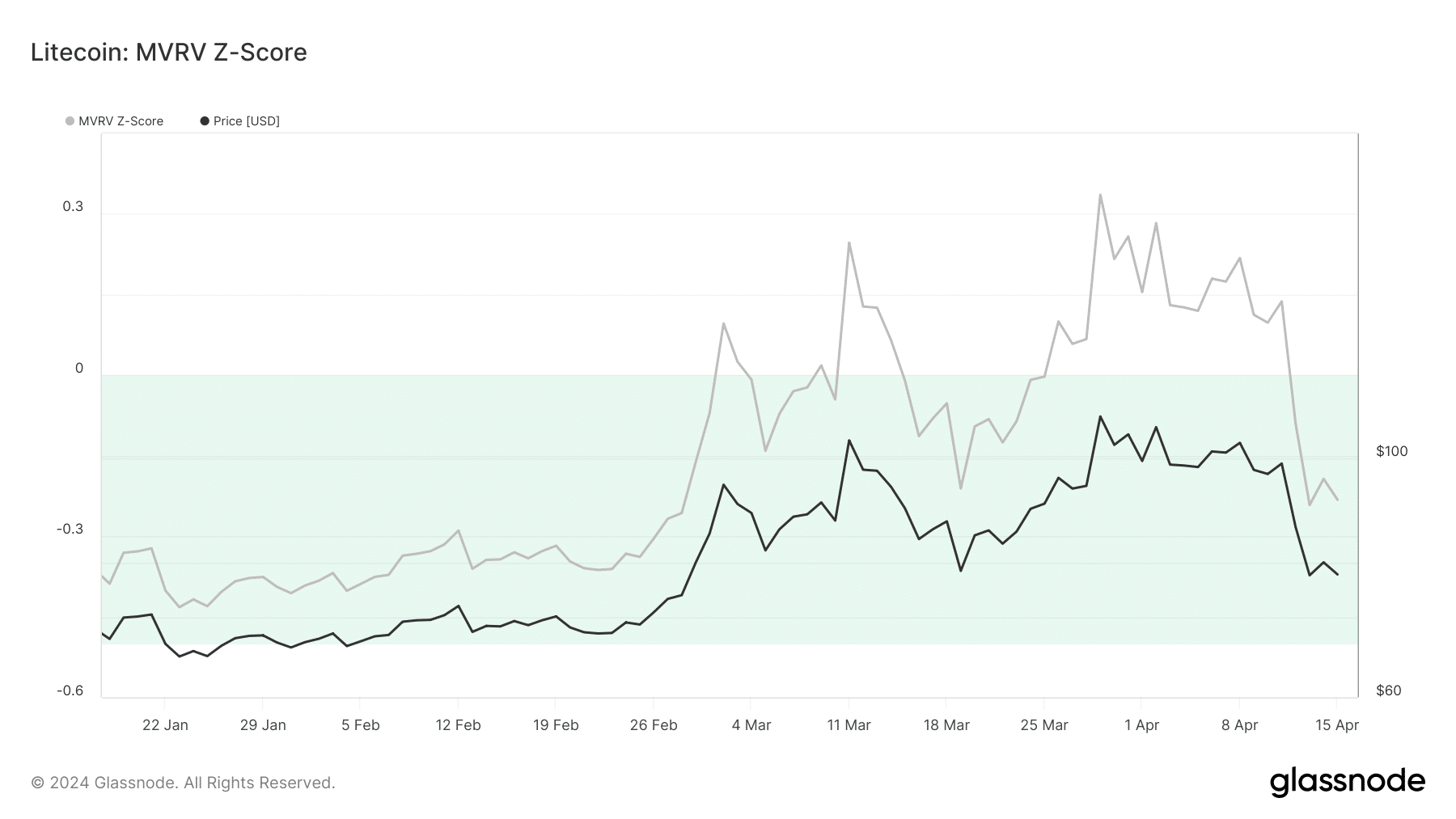

Litecoin [LTC] has reached a critical spot that could trigger a bounce, AMBCrypto noticed. At press time, the Market Value to Realized Value (MVRV) Z-Score, obtained from Glassnode, was -0.23.

This indicator measures the valuation of a cryptocurrency. Around the 29th of February, the MVRV Z-Score had a similar reading.

At that time, LTC changed hands at $74.62. Two days later, the price of the coin jumped to $94.47.

But that was not the only instance in which Litecoin displayed such. In March, the metric was negative, and its price had dropped. But 10 days later, the value rose to $109.29.

Source: Glassnode

Does LTC care about 2020?

At press time, LTC’s price was $78.62, with the Bitcoin [BTC] halving happening in less than five days. If history repeats itself, the price of Litecoin might jump before the Bitcoin event.

But before we conclude that a price increase was inevitable, it is important to check the coin’s performance during the last two halvings.

In 2016, Litecoin’s price was $3.19 a few days before the halving. And on the day of the event, the value was $4.12. But during the 2020 halving, LTC moved sideways as the price traded between $43 and 46.

However, times have changed, as the market condition then was not what it is now. As a result, AMBCrypto considered it necessary to evaluate other metrics that could affect LTC.

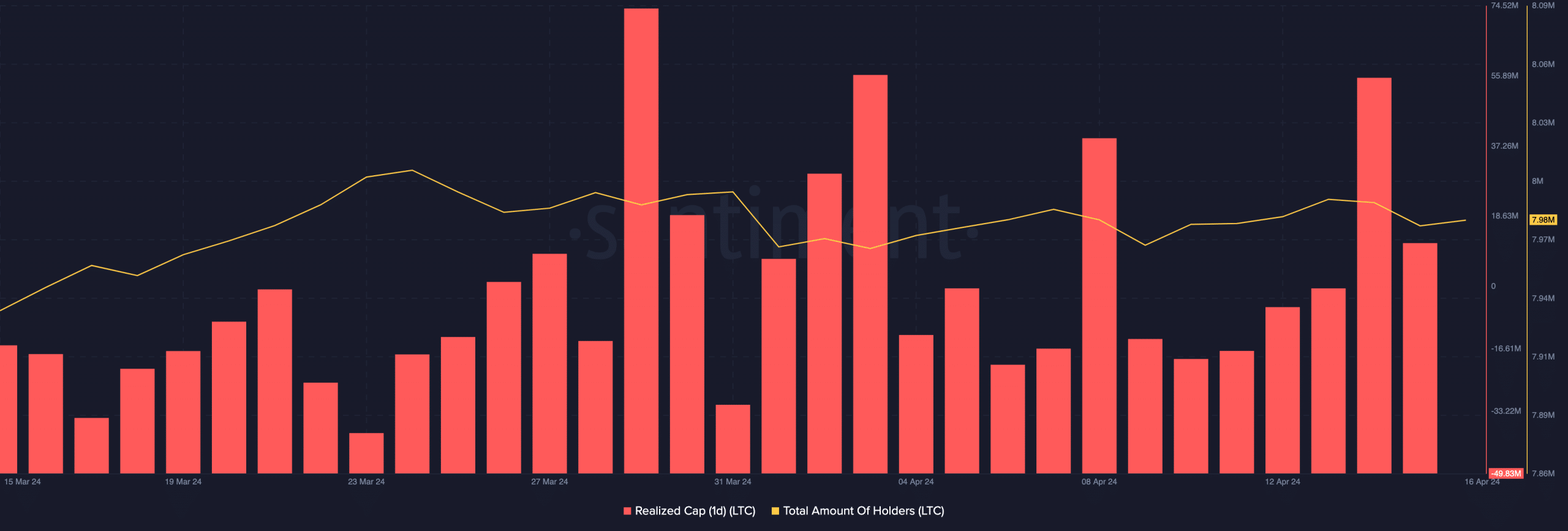

One of the metrics we analyzed was the Realized Cap. This metric tells a bit about the sentiment in the market.

If the Realized Cap spikes, it means that coins bought at lower prices are being spent, and participants are realizing profits.

This trend might lead to further correction, However, a falling Realized Cap shows perceived undervaluation. At press time, Litecoin’s one-day Realized Cap was -49.83 million, suggesting a bounce could be close.

Source: Santiment

After the event comes the parabola

Should the metric drop lower, the chance of LTC’s rise before Bitcoin’s halving might increase. But if the metric rises, that prediction could be annulled.

Despite the bullish potential, not every market participant was convinced about the coin’s short-term potential. This was evident in the amount of holders.

According to Santiment, Litecoin’s total number of holders had decreased from 8 million to 7.98 million.

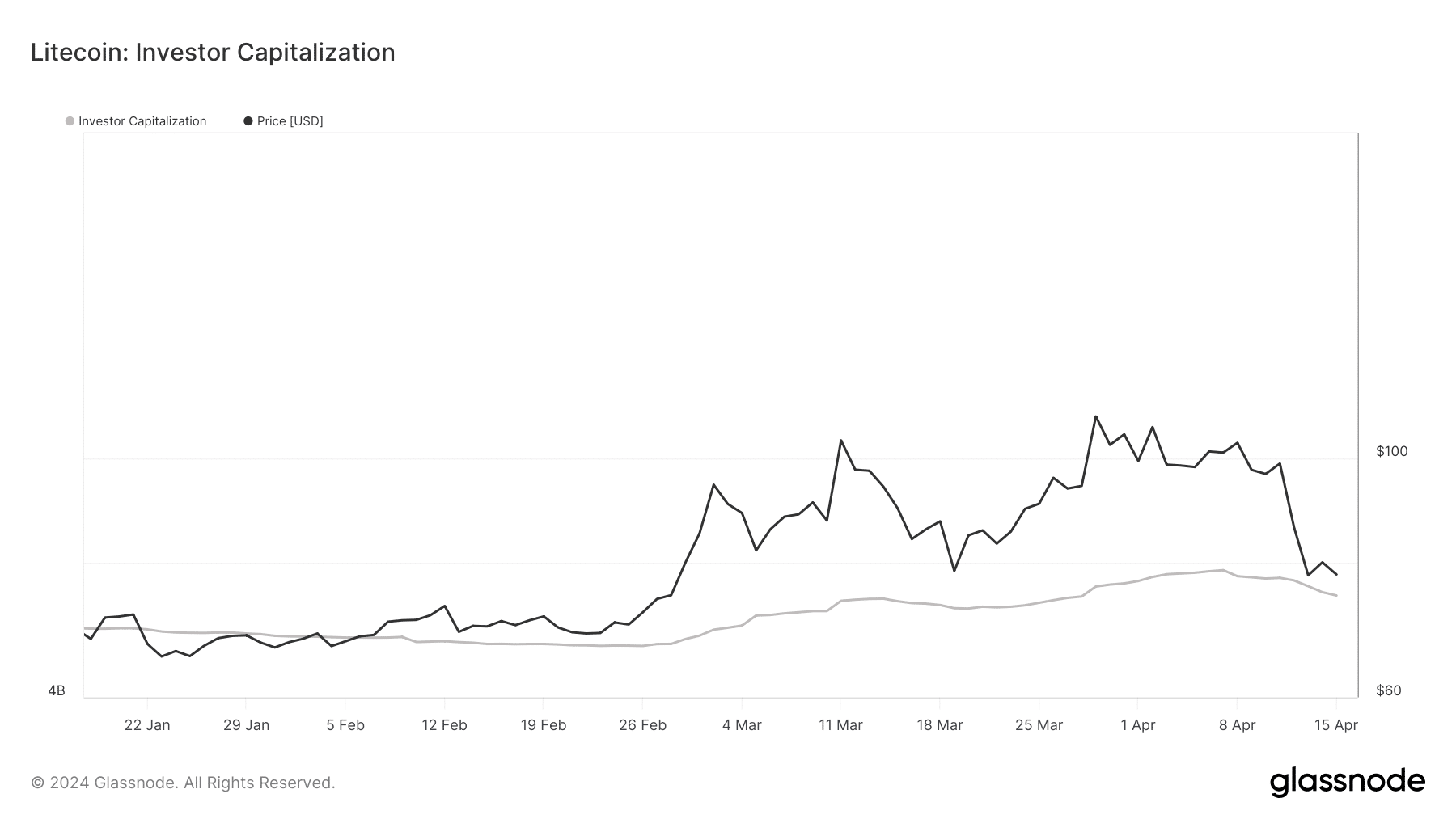

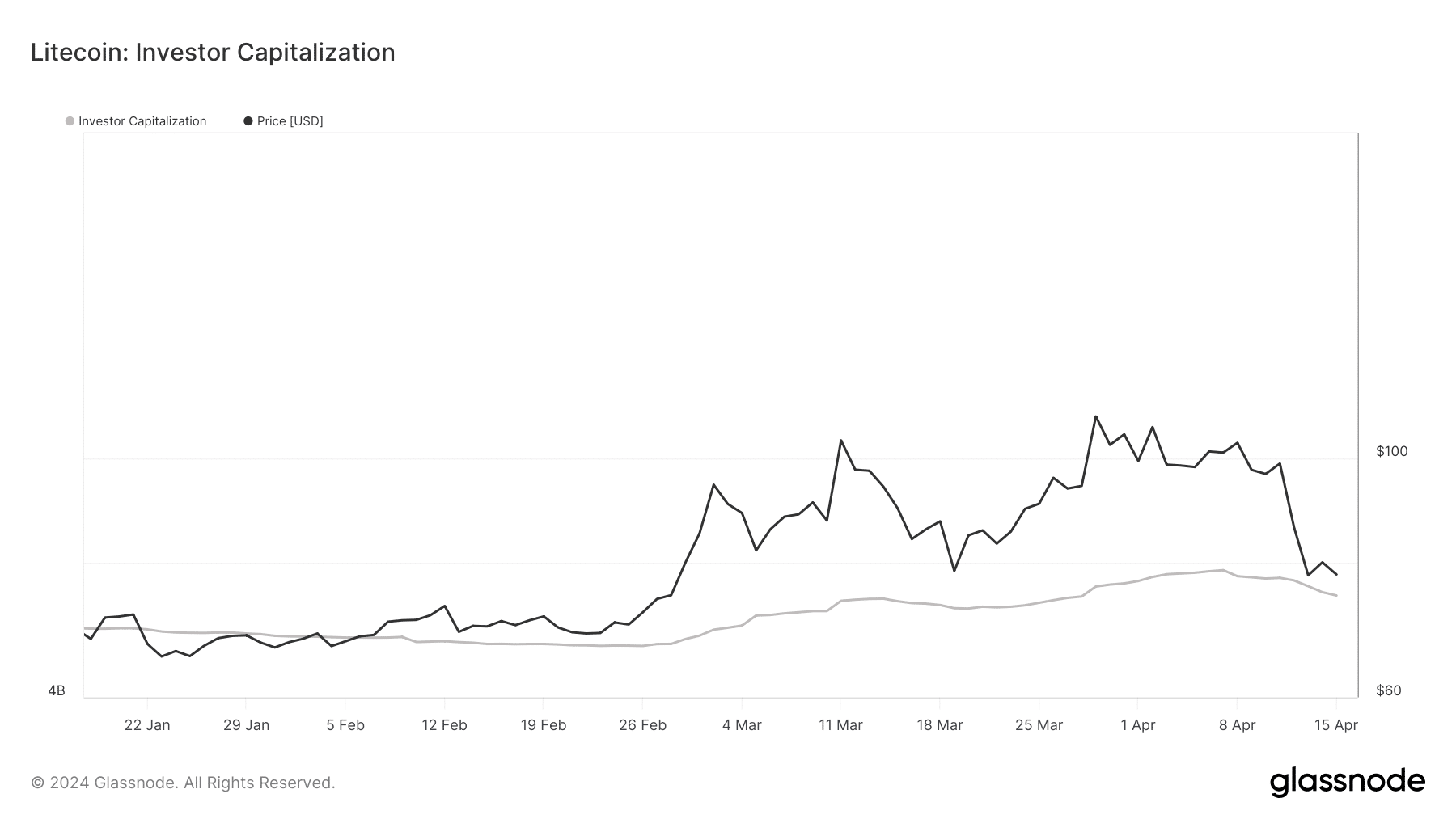

To conclude, AMBCrypto evaluated the Investor Capitalization. This is the difference between the Thermocap and the Realized Cap. It also serves as a way to identify bottoms or tops in a cycle.

Source: Glassnode

Realistic or, not, here’s LTC’s market cap in BTC terms

As of this writing, the Investor Capitalization showed that Litecoin was closer to its bottom than the top.

Therefore, LTC’s price has the potential to swing upwards before Bitcoin’s halving, and after it, the value might also increase.

Credit: Source link