- Stablecoins are disrupting global financial systems, influencing remittances, P2P payments, and currency trading.

- Tether’s dominance grows with over 61 billion USDT on Tron and 54 billion USDT on Ethereum.

Reaching a critical tipping point, stablecoins show evidence of upsetting conventional worldwide money movement. Recent data from Artemis shows that the third quarter (Q3) of 2024 shows notable patterns across foreign currency (FX), remittances, cross-border payments, and peer-to-peer (P2P) activities.

As stablecoins start to change financial infrastructure, their evolution is no more a future prediction but rather a current reality. Stablecoins are a great tool in global finance as the disturbances in sectors like currency trading, remittances, and P2P transactions show themselves most clearly.

Our Q3 Stablecoin Update shows stablecoins at the tipping point of disrupting all forms of money movement. We see inflecting trends across FX, remittances, cross border payments, and P2P.

A on how stablecoins are enabling Digital Financehttps://t.co/uNA2Glh6ms

— Artemis (@artemis__xyz) October 22, 2024

Stablecoins Drive DEX Growth and Revolutionize US-Mexico Remittances

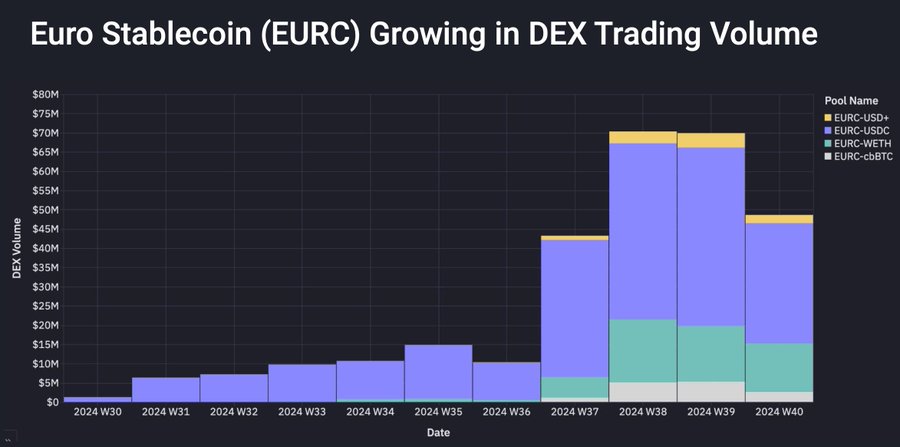

EURC, Circle’s Euro-backed stablecoin, shows how quickly decentralized exchanges (DEXs) are becoming popular in currency trading. Particularly in areas where fiat currencies suffer inflationary pressures or limited liquidity, stablecoins like EURC are beginning to upset established currency markets as DEX volumes explode.

This graph shows how steadily stablecoins are becoming a necessary component of the currency trading ecosystem rather than only a speculative tool.

One of the biggest corridors worldwide, the US-to-Mexico one, has undergone an amazing change in the remittances industry, and annualized remittances currently surpass $1.2 billion and show no indication of slowing down.

The explosive expansion in this market reflects how stablecoins—especially US dollar-backed tokens—offer a more affordable and quick means of cross-border money transfer. Workers sending money home to their families clearly benefit from being able to avoid conventional banking systems and the related expenses.

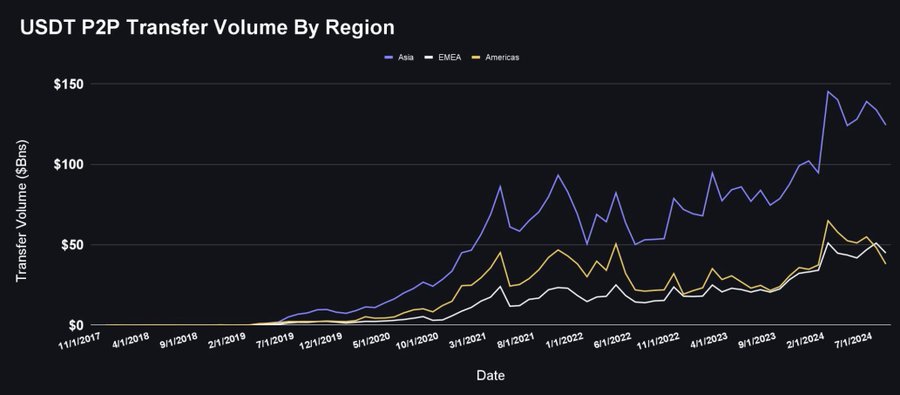

P2P volume utilizing Tether (USDT) has eclipsed that of the Americas in Europe, the Middle East, and Africa (EMEA), implying that the stablecoin’s acceptance is fast extending beyond North America.

Asia dominates P2P stablecoin use, and it begs the issue of whether EMEA could eventually catch up in terms of transaction volume. Stablecoins might provide the backbone of financial transactions in areas without advanced banking systems while this change takes place.

Crypto Exchanges and Self-Custody Options Redefine Global Financial Systems

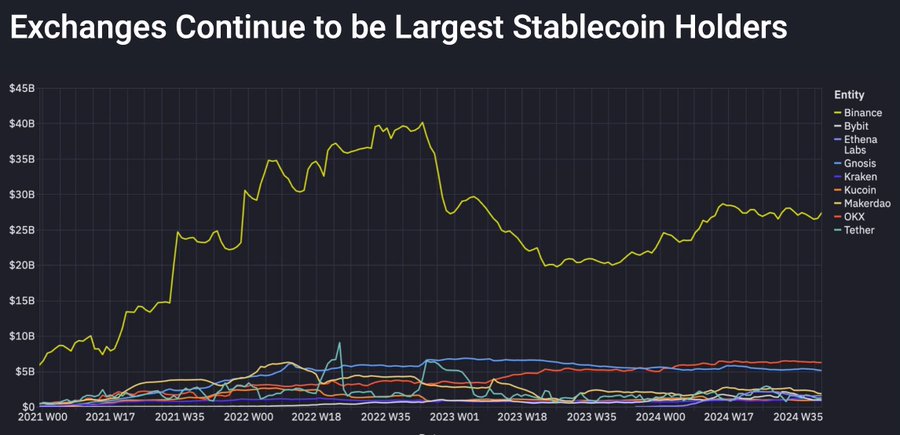

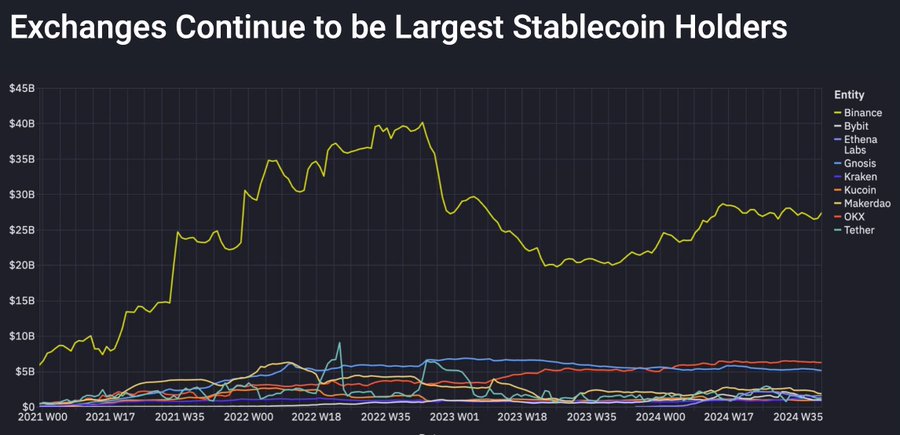

Currently seen as the “global banks” of the new financial era are crypto exchanges like Binance and OKX. These platforms have the most stablecoins, which suggests their increasing importance in offering liquidity for worldwide trading and investment.

This increase in stablecoin ownership points to crypto exchanges replacing more conventional positions occupied by big banks as vital middlemen in worldwide finance.

Self-custody choices for stablecoin users are growing concurrently, providing them more control over their money and less dependence on outside custodians. This change to distributed financial management is empowering consumers and changing their interactions with digital currencies.

Furthermore, fast bridging the gap between conventional payment systems and stablecoins is the acceptance of credit card use via sites like Gnosispay and Monerium. Stablecoins are therefore considerably more useful and accessible since they let users use their balances for daily purchases.

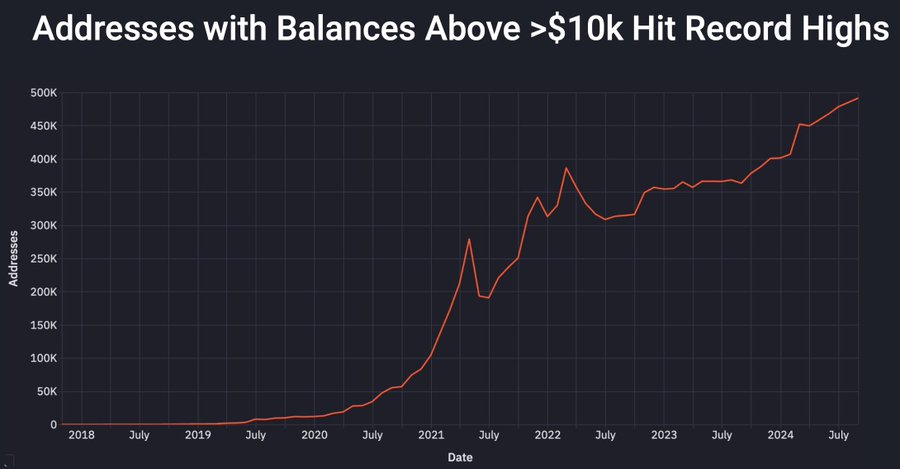

Moreover, the quantity of addresses containing more than $10,000 in stablecoins keeps reaching record highs, thereby highlighting the growing faith in these digital assets as repositories of wealth and means of transaction.

On the other hand, CNF previously reported that the USDT market value has exceeded $120 billion, confirming its supremacy in the worldwide stablecoin and digital finance industries.

According to the data, 54.48 billion USDT, or 45.34%, is circulating on Ethereum, while over 61.49 billion USDT, or 51.17%, is currently traversing the Tron network.

Credit: Source link