- NOT followed TON’s price direction as demand pushed the volume to $1.37 billion

- Token seemed overbought, pointing to a possible fall to $0.016 on the charts

Notcoin [NOT] defied the broader market “red period” as the price climbed by 7.22% in the last 24 hours. According to CoinMarketCap, this happened at a time when Bitcoin [BTC] slid to $65,103 before slightly recovering above $66,000.

Ethereum [ETH] also registered a decline to $3,381 around the same time. The performance underscores Notcoin’s next-to-nothing correlation with the top two cryptocurrencies.

At press time, NOT changed hands at $0.020. On 14 June, however, the token had initially tapped $0.022 on the price charts.

NOT sentiment bullish, goes with TON

However, Notcoin is not alone in its rise as fellow Telegram-linked project Toncoin [TON] joined in too. A few weeks ago, AMBCrypto had reported how NOT did not follow the same trend as TON.

On the back of the latest price hike, it would seem now that the two have aligned.

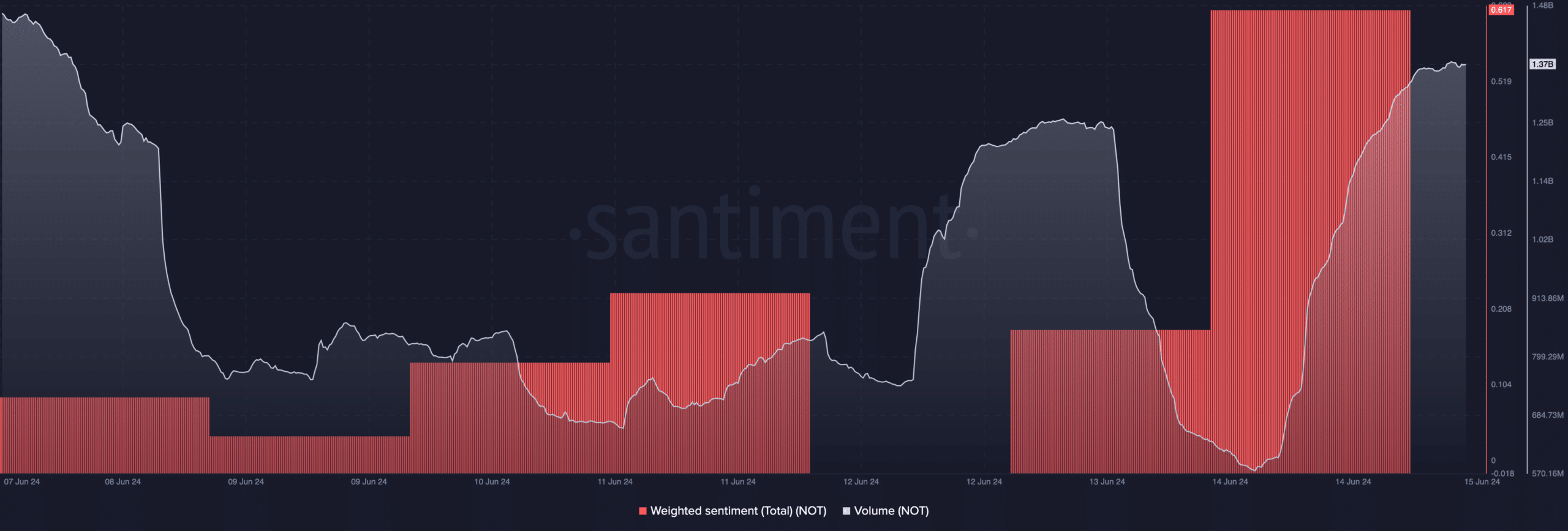

From an on-chain perspective, we also found that sentiment around Notcoin has been incredibly bullish. Using the Weighted Sentiment metric, for instance, AMBCrypto observed that the reading was 0.178 on 13 June. However, at press time, the same metric had hit 0.617.

The notable hike within a short period implies that online comments about NOT were much more positive than those that were bearish about the token.

Source: Santiment

Apart from the price hike and bullish sentiment, Notcoin’s volume surpassed the $1 billion mark. The increase in volume constituted a 131% hike in the last 24 hours.

Trading volume is crucial for a cryptocurrency’s price and direction. It indicates if market participants are interested in a token.

Heavy movement of the volume, alongside a price increase, suggests an increase in buying pressure. On the other hand, if the spike comes with a price fall, it implies a hike in selling pressure.

Notcoin’s price may go down later

For NOT, it was the former. However, it is unlikely that NOT’s volume would hit $4 billion like it did when the price hit an all-time high of $0.029 on 2 June.

Evidence of this was reflected in the Relative Strength Index (RSI). The RSI is an oscillator that measures speed and changes in price movements.

A value of over 70 indicates that an asset is overbought. When it is less than 30, it means that it is oversold. In Notcoin’s case, the RSI on the daily chart had a reading of 74.27.

Simply put, the token was overbought. Thus, the price might begin a slow reversal down the chart. If this happens, the price of NOT might fall to $0.016 within a few days.

Source: Santiment

However, this prediction would be invalidated if the broader market condition changes. Assuming prices across the board begin to move north, NOT might follow suit.

Realistic or not, here’s NOT’s market cap in BTC terms

Should this be the case, the value of the token might jump to $0.022 once more. Besides that, market participants should be on the lookout for developments or announcements around the project as this could also impact the price.

Credit: Source link