Wall Street is holding its breath ahead of Nvidia’s fiscal Q3 2026 earnings report, due after the closing bell today, November 19, in what has become the most consequential earnings event of the year.

Analysts expect revenue of $54.9 billion (up 57% year-over-year) and earnings per share of $1.25, but the bar is extraordinarily high for the world’s most valuable company, which briefly topped $5 trillion in market capitalization last month.

NVIDIA’s stock closed Tuesday at $181.36, down nearly 14.5% from its October 29 all-time high of $212.19, as growing concerns about AI bubble valuations and the sustainability of massive infrastructure spending have triggered a broad tech selloff.

As per Reuters, options markets are pricing in a potential 7-8% swing in either direction following the results, which could translate into a $320 billion move in market value, making it the largest post-earnings volatility in Nvidia’s history.

The pressure on Nvidia comes amid mounting skepticism about the AI trade itself. High-profile investors, including Michael Burry, have disclosed short positions and raised red flags about potential accounting irregularities related to chip depreciation, while Peter Thiel’s hedge fund dumped its entire $100 million Nvidia stake and SoftBank unloaded $5.8 billion in shares to fund its own AI ventures.

The broader market context is equally challenging, with the Nasdaq down over 4% in November, its steepest monthly decline since March, as fading odds of a December Fed rate cut and inflation concerns weigh on risk assets.

Data center revenue is expected to account for roughly $49 billion of the quarter’s total, driven by continued demand for Hopper chips and the highly anticipated ramp of the Blackwell platform, which CEO Jensen Huang has described as experiencing “incredible” demand from hyperscalers and foundation model makers.

Despite the recent selloff and bubble concerns, most Wall Street analysts remain bullish, with Stifel raising its price target to $250 ahead of earnings and Wedbush’s Dan Ives calling Nvidia “a foundational piece” of the AI revolution.

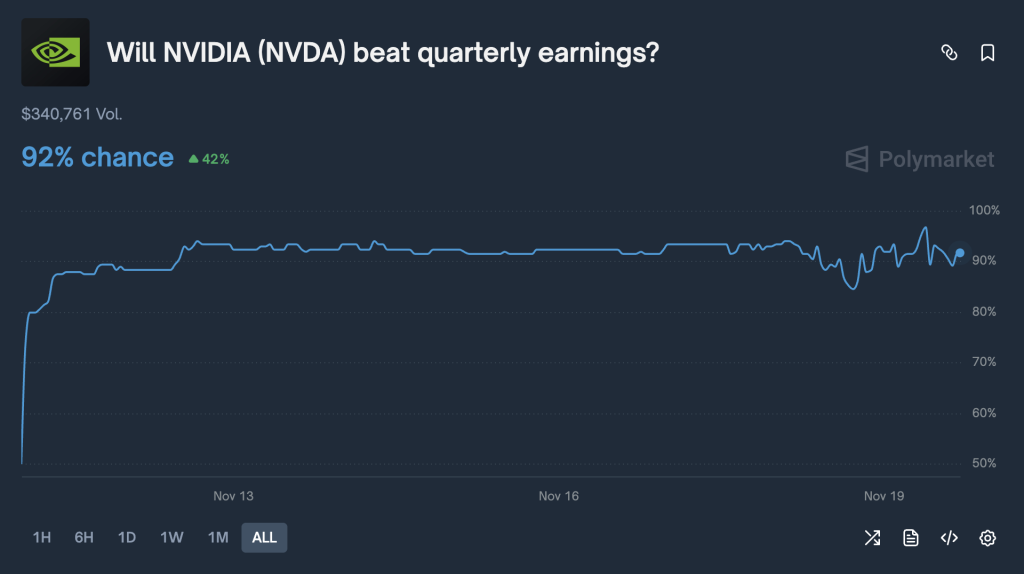

The company has beaten earnings expectations in 19 of the past 21 quarters, and the consensus view is another “beat and raise” scenario.

However, the real test will be Q4 guidance as analysts expect around $61.5 billion, and anything below that level could trigger a sharp selloff.

Geopolitical headwinds loom large, with Q3 results excluding any H20 chip sales to China due to export restrictions and new Chinese regulations mandating that state-funded data centers use only domestic AI chips.

Yet retail sentiment remains overwhelmingly bullish, with Polymarket traders chancing in at 96% that the company will beat its quarterly earnings.

Market Update: Nvidia Earnings Set to Test AI Trade

Credit: Source link