- POL has surged by 17.17% over the past month.

- An analysts eyes a “hated rally” citing three key factors.

Over the past month, Polygon [POL] has traded in an uptrend. As such, the altcoin has surged to hit a 3 month high of $0.4778 as reported earlier by AMBCrypto.

However, during this period, POL has also experienced high volatility dipping by 12.52% in three days. This volatility means prices have been swinging both ways.

In fact, at the time of writing, POL was trading at $0.4375. This marked a 1.65% increase over the past day. Also, the altcoin has gained on weekly and monthly charts rising by 14.26% and 17.17% respectively.

This sustained uptrend has left analysts talking about the altcoin’s future trajectory. One of them is Ali Martinez who has suggested that POL could see a ‘hated rally’ citing three key factors.

3 reasons why POL could see a hated rally

In his analysis, Martinez argued that although there are bearish sentiment in the market, bullish signals are continually piling up.

Source: X

According to him, three key factors signal, a potential rally. Firstly, Polygon’s price has bounced off the triangle’s axis. A bounce off the triangle’s X-axis often signals that buyers are entering the market preventing further downside. This also helps in validating the significance of the upside, signaling a possibility of a breakout.

Secondly, Stoch has flipped bullish. This occurs when the K line crosses over D indicating a potential reversal or a shift in momentum toward the upside.

Thirdly, the MACD is on the verge of a bullish crossover in a 2-week timeframe. When the MACD line crosses over its signal, it indicates the beginning of an uptrend.

However, the analyst points out that it could be a “hated rally” implying that many traders might remain skeptical thus missing out on the early stages of the rally. Historically, the market often moves against the majority’s sentiment.

Can POL finally rally?

As observed above, POL is experiencing favorable market conditions that could position the altcoin for more gains on price charts.

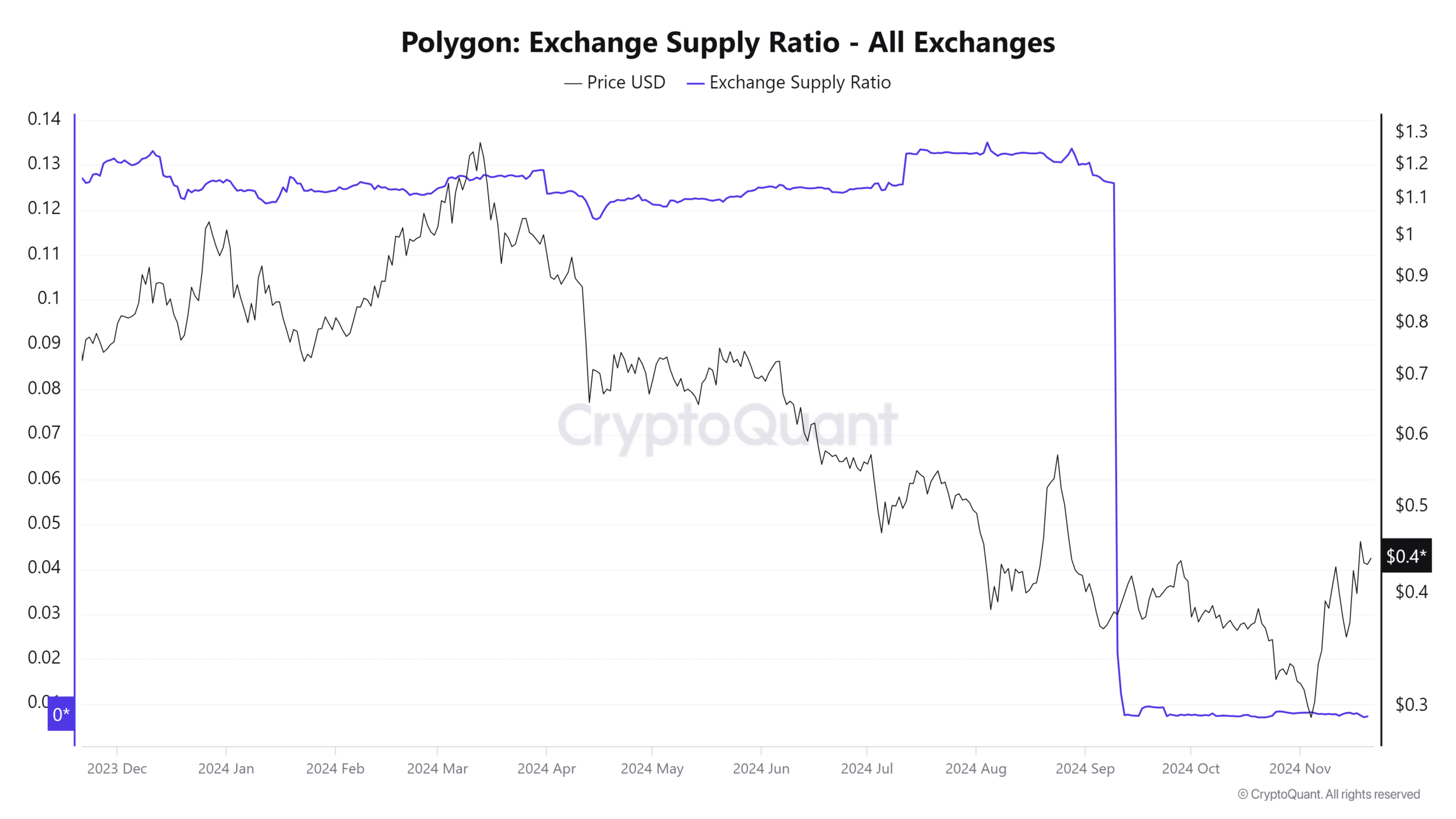

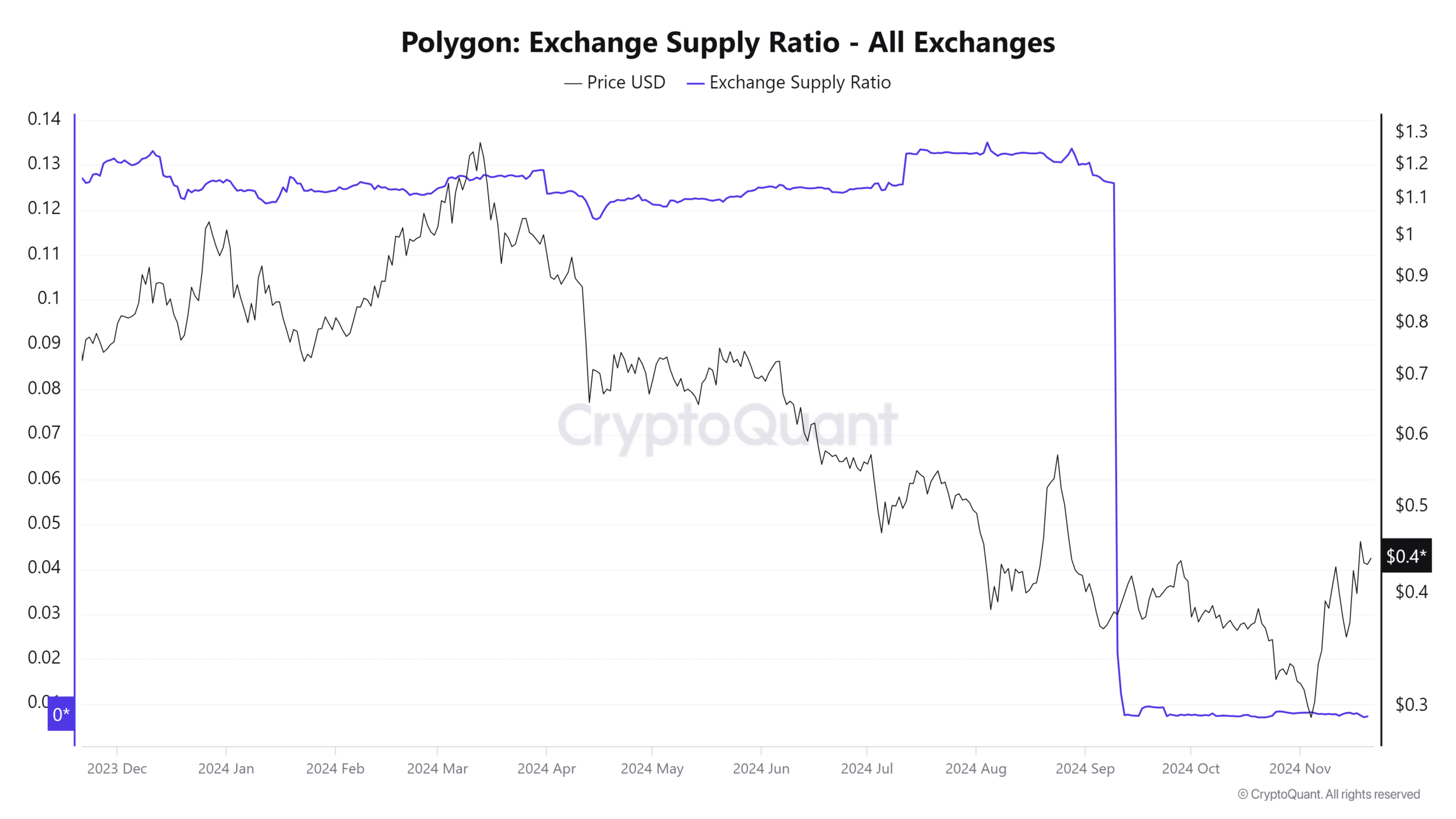

Source: Cryptoquant

For starters, Polygon’s Exchange supply ratio has declined over the past month to settle at 0.0072. When supply on exchanges declines, it suggests that investors are keeping their POL tokens in cold storage or private wallets.

This suggests that investors are bullish and anticipate prices to rise.

Source: IntoTheBlock

This bullishness is especially predominant among large holders (whales) as evidenced by Large Holders’ Netflow to Exchange Netflow Ratio. This has dropped from 3917% to -55%.

When this turns negative, it implies that whales are moving more funds out of exchanges. This trend aligns with accumulation or hoarding market behavior.

Is your portfolio green? Check out the POL Profit Calculator

Simply put, Polygon is currently seeing a strong trend reversal. With the market conditions favoring a potential rally, POL could see more gains on price charts.

If this happens, we can see POL reclaim the $0.46 resistance level. From here, the altcoin will see a significant resistance around $0.57 where it has faced multiple rejections.

Credit: Source link