Polymarket is set to reopen to US users after nearly four years of an effective ban by the Commodity Futures Trading Commission, with filings indicating the platform could launch as early as October 2.

The prediction market acquired QCX LLC for $112 million in July, securing a Designated Contract Market license that allows it to self-certify markets for U.S. users, including sports and election betting.

The breakthrough caps a strategic year that positioned the $2.6 billion platform for rapid U.S. expansion, including high-profile board appointments and massive institutional backing.

CEO Shayne Coplan earlier stated that Polymarket “has been given the green light to go live in the USA” following the CFTC’s no-action letter issued in September, crediting the Commission for “impressive work” completed in “record timing.”

Polymarket was forced to exit the U.S. in January 2022 after regulatory enforcement, agreeing to block American users and pay a $1.4 million civil penalty for operating an unregistered exchange.

The platform continued explosive growth overseas despite the ban, processing over $6 billion in bets during the first half of 2025 alone and gaining prominence by accurately predicting Donald Trump’s 2024 presidential victory.

$10B Valuation Target Follows Thiel Investment and Trump Jr. Board Role

Peter Thiel’s Founders Fund led a $200 million funding round in June, valuing Polymarket at $1 billion.

The company is now in discussions to raise new capital that could push its valuation beyond $10 billion, more than tripling the June figure, as it prepares for reentry into the U.S. market.

Donald Trump Jr. joined Polymarket’s advisory board in August, as his venture capital firm 1789 Capital invested tens of millions of dollars, expanding the platform’s U.S. political reach.

The appointment came shortly after the Department of Justice and CFTC closed their investigations into Polymarket without pursuing further action in July.

Polymarket has secured high-profile partnerships, including a collaboration with Elon Musk’s X platform to integrate prediction markets with AI-powered analysis from the xAI chatbot Grok.

The platform introduced a 4% annualized yield in September on certain long-term positions in political and geopolitical markets, including the 2028 U.S. presidential race and leadership outcomes in Russia, China, Turkey, Israel, and Ukraine.

Kalshi Dominance Sets Stage for Fierce Market Competition

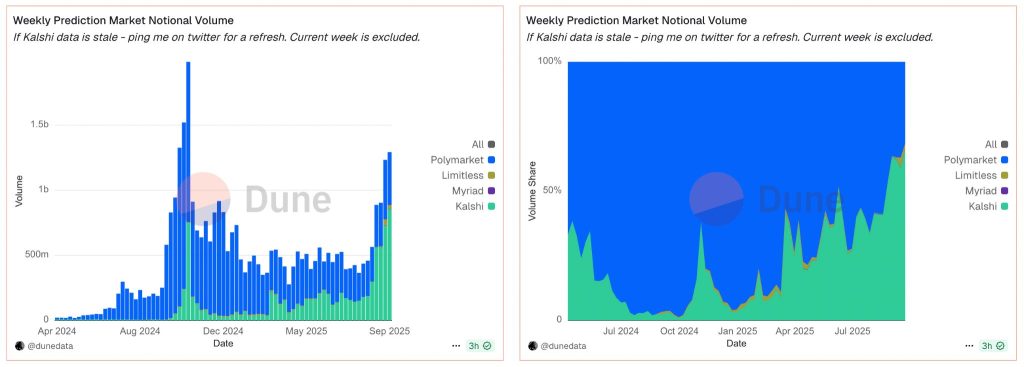

Rival platform Kalshi has dominated U.S. prediction market activity since Polymarket’s 2022 exit, posting higher volumes than Polymarket for three consecutive weeks through September.

Kalshi recorded $728 million in trades in one week, nearly 60% higher than Polymarket’s volume and close to Kalshi’s record $749 million during the 2024 presidential election run-up.

Data from Dune Analytics shows Kalshi captured 66.13% of total on-chain prediction market volume between September 16 and 22, with more than $854 million in trades and $192 million in open interest.

On the other hand, Polymarket saw $405 million in trading volume and $166 million in open interest over the same period.

Kalshi operates as a CFTC-authorized Designated Contract Market, following a 2024 court victory that allowed it to offer contracts on political events.

The CFTC initially contested the ruling but later dropped its challenge, giving Kalshi a regulatory advantage.

The NFL season kickoff reignited market engagement, with Kalshi processing $441 million in trading volume since Week 1.

However, Kalshi faces mounting legal challenges from state regulators.

Massachusetts Attorney General Andrea Joy Campbell filed a civil lawsuit in September, accusing Kalshi of running unlicensed sports betting disguised as “event contracts.”

The suit alleges that between January and June 2025, 70-75% of Kalshi’s $1 billion in wagers came from sports markets, rivaling licensed operators like DraftKings.

Nevada and New Jersey gaming regulators issued cease-and-desist orders forcing Kalshi to suspend sports-related contracts in both states.

Kalshi filed a lawsuit in March challenging the orders, arguing its contracts fall under CFTC jurisdiction rather than state-level gaming regulation.

The company maintains that its event contracts function as two-sided swap markets, unlike traditional sports betting, where the house controls odds.

Polymarket still faces restrictions in France, Belgium, Thailand, and Singapore, where authorities have cited gambling law violations.

However, the new DCM license enables the platform to legally offer real-money markets to U.S. residents while leveraging self-certified markets to differentiate itself with broader event offerings.

Credit: Source link