Last updated:

Why Trust Cryptonews

The first quarter of 2025 saw a significant market pullback, divergence between price and sentiment, and a shift to the fundamental technology, says the CoinMarketCap’s “According to CMC” Q1 2025 Report. Yet, there may be a twist awaiting in the second quarter.

The report concluded that Q1 2025 recorded “a broad market pullback.” The reasons lie in Bitcoin (BTC) and Ethereum (ETH) underperformance, declining retail activity, macro uncertainty, a dropping exchange-traded fund (ETF) momentum, regulatory doubts, and decreasing investor interest resulting in thinning liquidity.

Volume peaked early, the analysts found, but then decreased along market confidence. Overall, trading volume fell 40.65% in Q1, while market sentiment hit its lowest point since early 2023.

At the same time, BTC ended the first quarter with a 10.52% drop, breaking a streak of increases in Q1 2023 (+71.77%) and Q1 2024 (+68.68%). While January started strong (+9.29%), February and March saw pullbacks. failed to recover momentum. This pullback signals growing caution in the market, driven by macro uncertainty, ETF saturation, and declining retail activity.

As for ETH, it fell 43.85% in Q1. This is the largest quarterly loss since 2018. “This massive underperformance versus BTC again echoes the sharp drop in the Altcoin Season Index, and showcases why market capital rotated into BTC for relative safety,” the report argues.

Furthermore, 55 of the top 100 cryptocurrencies per market capitalization have recorded declines YTD. Some lost more than 25% of their value.

Notably, meme coins “overwhelmingly populate the list of top losers, constituting 9 of the top 20 biggest losers.”

Return to Fundamentals

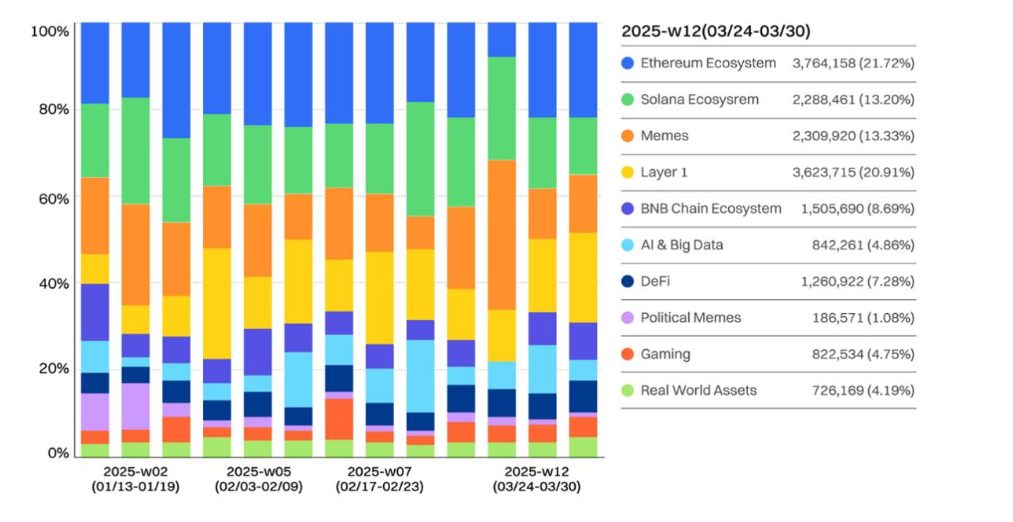

The report found that the crypto market shifted from “hype to fundamentals” in Q1. More precisely, it moved from meme coins and AI back to Layer 1s and DeFi.

BNB Chain, Solana, and DeFi saw particular interest in late March. “This could indicate that after periods of excitement, investors return to proven ecosystems as they look for sustainable opportunities,” the report argues.

BNB Chain Ecosystem is seeing a surge in retail interest, it says. It’s followed by various DeFi, infrastructure, and meme assets.

At the same time, DeFi total value locked (TVL) did drop in Q1, from $118 billion in January to $92.9 billion by the end of March. Therefore, it fell to the November 2024 levels. This suggests decreased faith in on-chain financial applications, analysts say.

Meanwhile, the stablecoin sector saw a strong quarter. Its market capitalization increased by 8.6% in 2025 so far.

The total top 10 market cap stood $209.9 billion at the time of the report, briefly exceeding $210 billion at several points in time.

CMC Notices a Sentiment Shift

Notably, the report noticed a divergence between price and market sentiment. While Bitcoin stood above $78,000–$80,000, sentiment was “disproportionately negative.” Sentiment was likely weighed down by high volatility, thinning liquidity, and fading altcoin interest.

Even by late March, as Bitcoin price and volume showed “some resilience,” sentiment was resisting recovery.

“The market failed to break into Neutral or Greed zones at any point during Q1, despite ETF inflows and high BTC dominance,” the analysts note.

This suggests that traders lacked confidence and likely expected a reversal or correction, says the report.

Meanwhile, sentiment is rising around modular chains, layer 1s, and community-led projects.

Is It Alt Season Yet?

There is a “slight uptick” from the Altcoin Season Index March low, the analysts have found. This may suggest a capital rotation.

“With many altcoins heavily oversold and BTC nearing psychological resistance above $85,000, any stall or consolidation in BTC could prompt traders to rotate into beaten-down alts,” the report argues.

However, there are two key factors that must occur first before an altcoin season would really start, CMC says. There needs to be a stabilization in BTC price, as well as a macro or regulatory catalyst (e.g., Ethereum spot ETF approval or L2 scaling successes).

It further added that “unless macro or regulatory catalysts reverse this psychological drag, capital rotation into risk assets like altcoins may remain limited heading into Q2.”

Furthermore, historically, BTC typically sees moderate April returns, with weaker May and June. Still, a Q2 breakout is possible if macro conditions improve (e.g., interest rate cuts or stablecoin demand).

At the same time, following its Q1 capitulation, ETH “may be setting up for a relief rally,” while its underperformance could attract rotational inflows. That said, technicals and sentiment are weak, so an upside will need BTC stability as a base, the report concludes.

Credit: Source link