According to CoinCodex’s data, Dogecoin (DOGE) is currently the best-performing cryptocurrency among the top 10 projects by market cap. DOGE’s price has risen by 6.9% in the last 24 hours, 10.1% in the last week, and 2.1% in the 14-day charts. Despite the rally, DOGE’s price has dipped 1.2% over the previous month. Dogecoin (DOGE) is currently outperforming Bitcoin (BTC) and Ethereum (ETH) in the daily and weekly charts. BTC has rallied 0.5% in the last 24 hours and 3.1% over the last week. ETH, on the other hand, has fallen 0.1% in the daily charts and 2.4% in the weekly charts.

Why Is Dogecoin Outshining Bitcoin and Ethereum Right Now?

There are a few factors that could be influencing Dogecoin’s (DOGE) latest price rally.

Firstly, there is a lot of talk about Elon Musk’s attorney, Alex Spiro, chairing a $200 million Dogecoin (DOGE) fund. Corporate treasuries have played a key role in this year’s market rally. Bitcoin (BTC) and Ethereum (ETH) have seen incredible adoption among treasury funds. DOGE could also see a similar pattern.

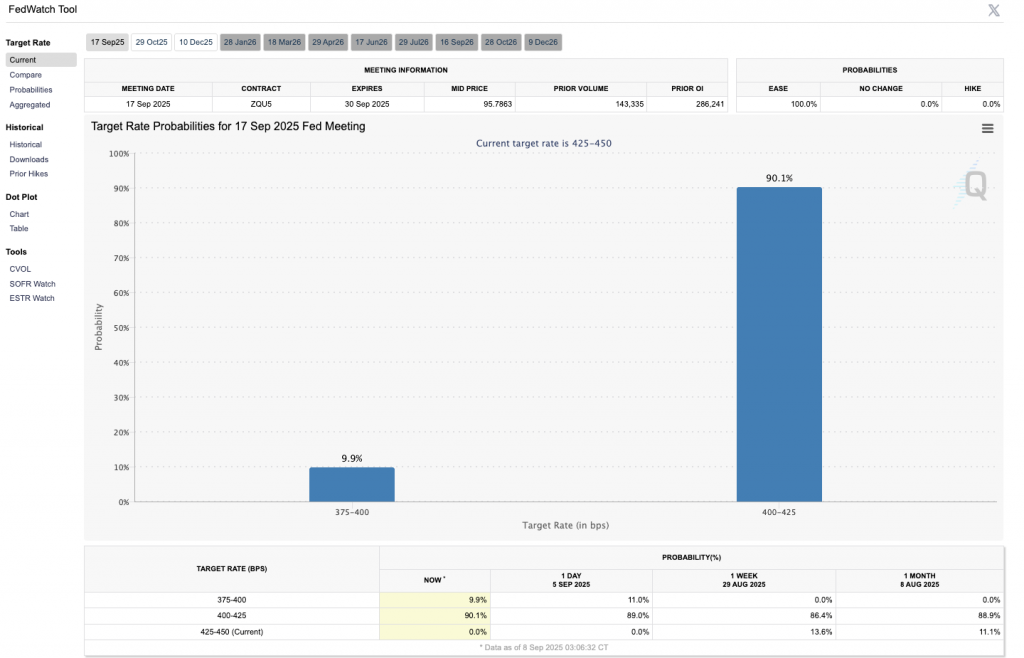

Secondly, there is a very high chance of an interest rate cut later this month. Rate cuts often lead to investors taking on more risks. Dogecoin (DOGE), being a memecoin, carries a lot of risks. A rate cut could lead to the crypto market experiencing another bullish breakout. According to the CME FedWatch tool, there is a 90.1% chance of a 25 basis point interest rate cut and a 9.9% chance of a 50 basis point interest rate cut. Investors may be pricing in the rate cut probability.

There is also a chance of a spot Dogecoin ETF making an appearance sometime this year. Grayscale, Bitwise, and 21Shares have submitted their DOGE ETF applications to the SEC. An ETF approval will make DOGE the only memecoin with an ETF.

Credit: Source link