- On-chain metrics revealed that exchanges have witnessed an outflow of $70.50 million worth of XRP.

- XRP could fall by 10% to reach $2.55 if it fails to hold the $2.88 level.

Amid the current bearish market sentiment, Ripple Labs is gaining attention from crypto enthusiasts following its recent escrow locking.

Ripple locks 700 million XRP into escrow

On the 2nd of February, blockchain transaction tracker Whale Alert posted on X (formerly Twitter) that Ripple Labs has moved 700 million XRP tokens into escrow.

This means these tokens are temporarily locked and cannot be used for trading or any other activity.

This transaction by Ripple Labs comes at a time when the overall cryptocurrency market is experiencing a notable price decline.

It appears that the move was made to prevent a major drop in XRP’s price amid bearish market sentiment.

Escrow locking and price movements

Moving XRP into escrow has its own benefits. Historically, it appears that whenever Ripple Labs locks tokens in escrow, the price experiences some relief and gains momentum in a bearish market.

Conversely, when Ripple unlocks tokens from escrow, the token tends to see a price drop.

Following this current transaction, XRP was trading near $2.90 at press time, with a price drop of 3.60% in the past 24 hours.

Despite the price decline and bearish market sentiment, traders and investors have shown strong interest in the token, resulting in a 65% increase in the asset’s trading volume.

Bullish on-chain metrics

However, some long-term holders and investors seemed to be taking advantage of the recent price drop, as they accumulated tokens, according to the on-chain analytics firm Coinglass.

Data from spot inflows/outflows revealed that exchanges have witnessed an outflow of a significant $70.50 million worth of XRP in the past 48 hours, which indicated potential accumulation.

This substantial outflow further suggested an ideal buying opportunity.

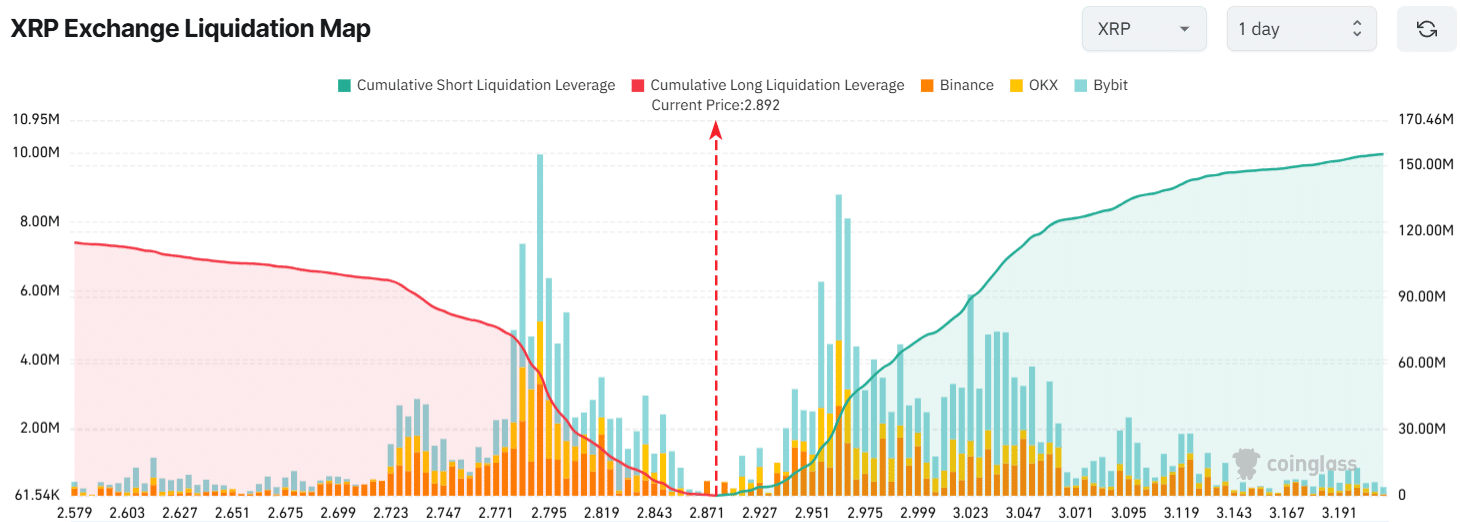

At press time, the major liquidations were at $2.791 on the lower side and $2.963 on the upper side, with traders being over-leveraged at these levels.

Source: Coinglass

If the market sentiment doesn’t improve and the price falls to the $2.791 level, nearly $55.10 million worth of long positions will be liquidated.

Conversely, if the sentiment shifts and the price rises to the $2.963 level, nearly $35 million worth of short positions will be liquidated.

Technical analysis and upcoming levels

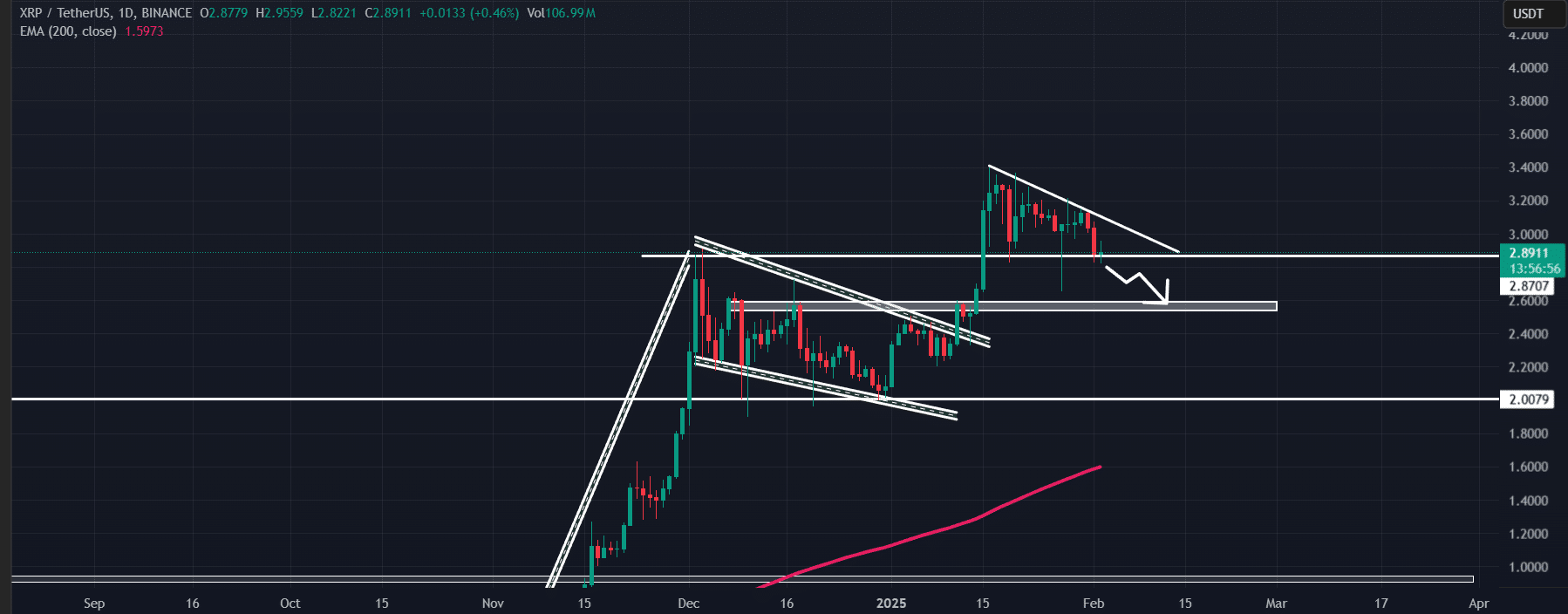

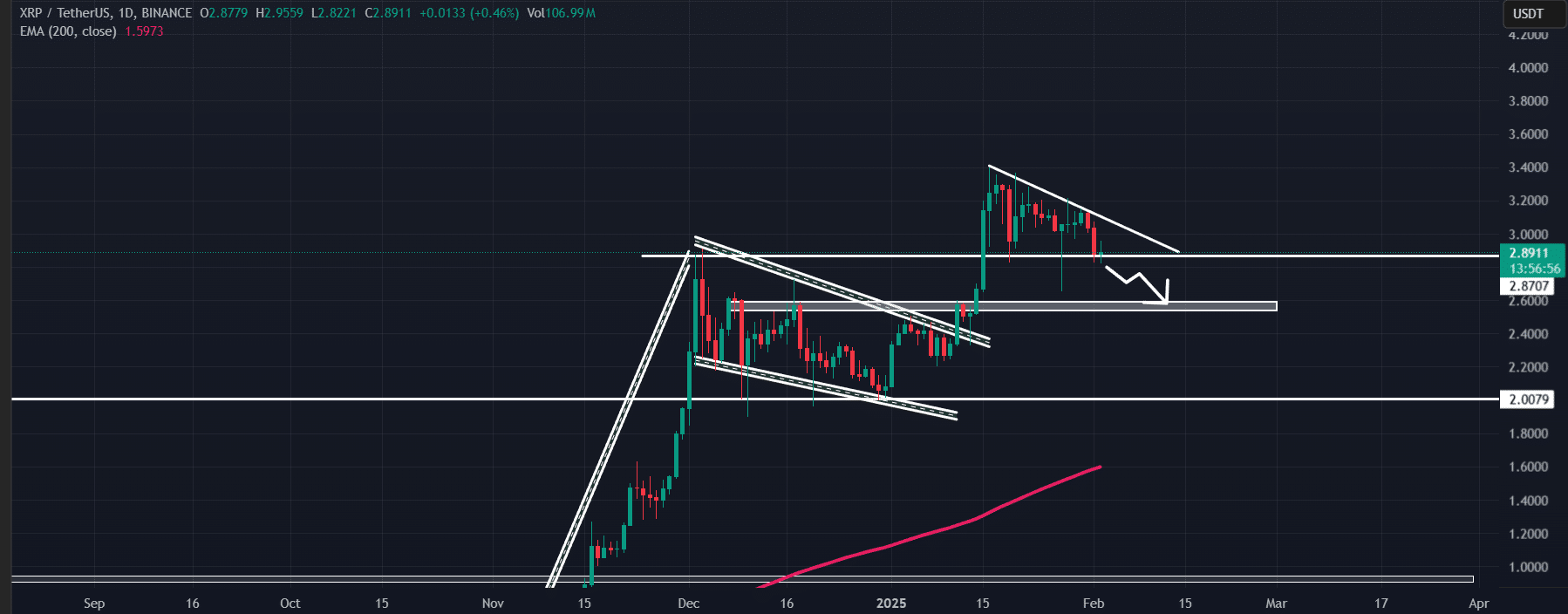

According to AMBCrypto’s technical analysis, XRP was at a crucial support level of $2.88, while momentum seemed to be declining.

Source: TradingView

Read XRP’s Price Prediction 2025–2026

Based on the recent price action, if XRP fails to hold the $2.88 level, there is a strong possibility it could fall by 10% to reach its next support at $2.55.

On the positive side, XRP is trading above the 200 Exponential Moving Average (EMA) on the daily time frame, suggesting the asset is in an uptrend.

Credit: Source link