- Holders of the token decided to send many XRPs to cold wallets moments after Ripple’s action

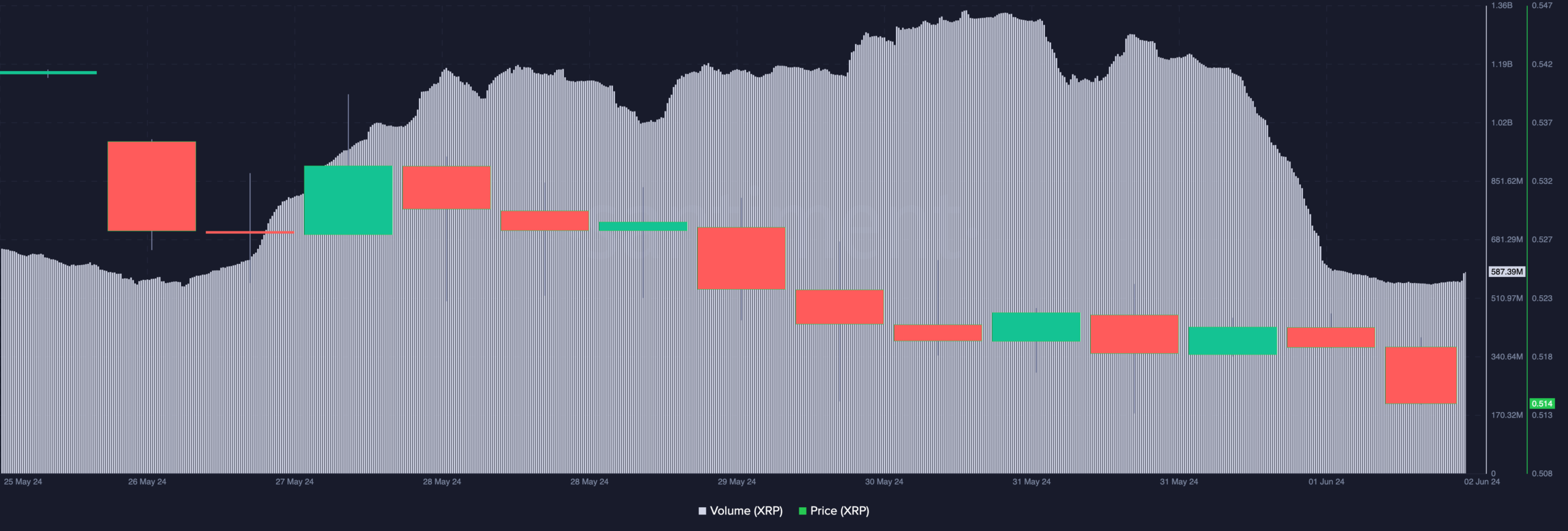

- Declining volumes and price suggested the altcoin might rebound in the short term

On 1 June, Ripple performed its customary act of locking tokens. This time, the blockchain payments firm completed the activity in two separate 500 million XRP transactions, according to data from Whale Alert.

For those unfamiliar with the market terrain, Ripple has been locking this amount since 2017. This idea behind this action is to provide cover for the large token supply over 55 months. This means that 55% of the total XRP supply would take part in this scheme. Most of the time, XRP’s reaction to this development is usually negligible.

Hence, the question – Was it the case this time too?

Source: X

Times have changed

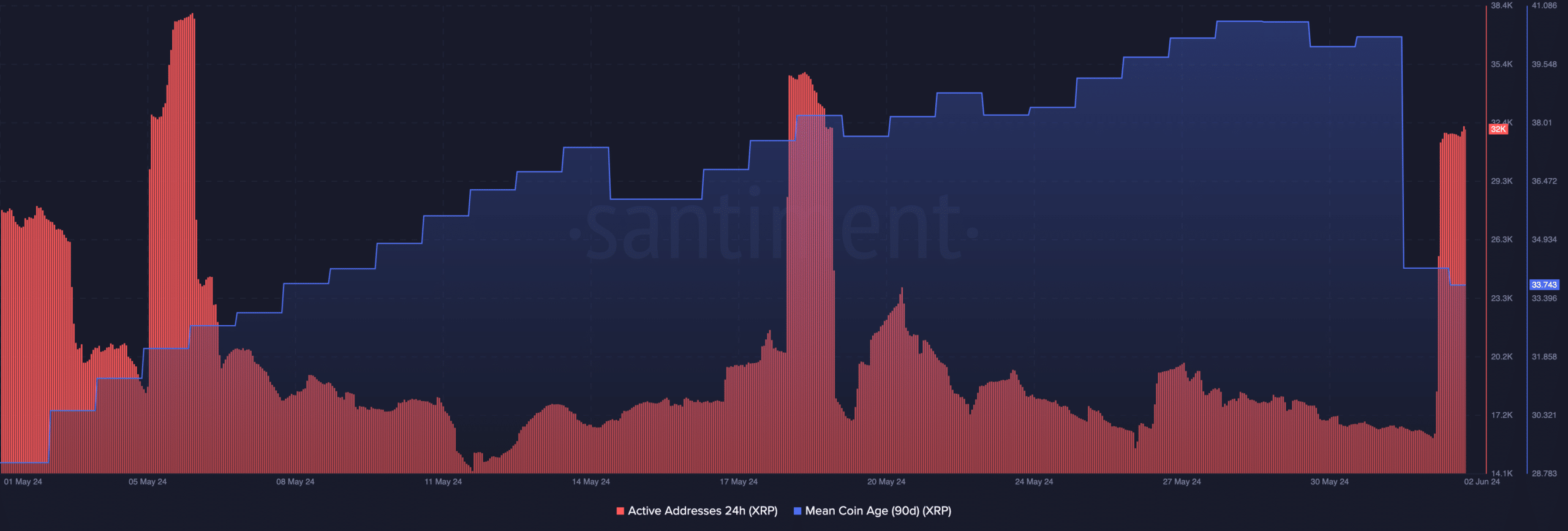

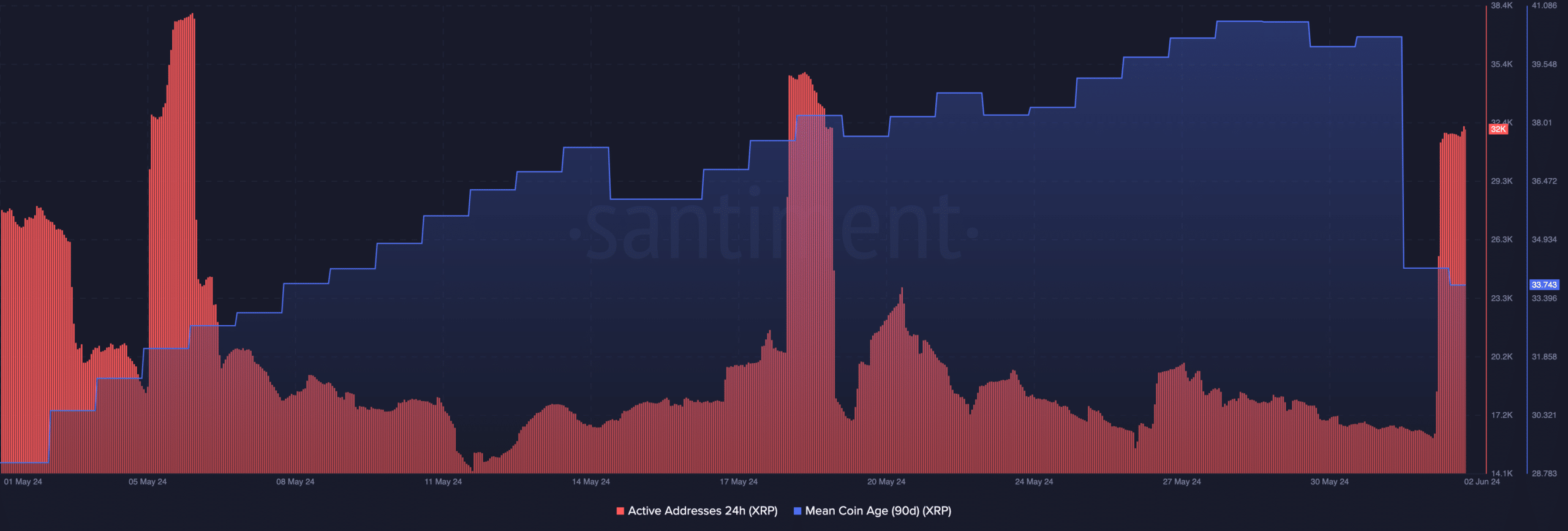

Well, not quite. AMBCrypto noticed a change on the XRP Ledger this time, with the first observation being a notable increase in active addresses.

At the time of writing, XRP’s 24-hour active addresses had risen to 32,000 – Almost double the numbers seen on 1 June. The hike in active addresses revealed that more participants were involved in making successful transactions using the token over the last 12-24 hours.

However, there are times when network activity rises and the price stalls or declines. This was the case here too, with XRP’s price falling marginally to $0.51 on the charts. Will this correction continue though? According to the Mean Coin Age (MCA), no.

The MCA is the average age of all tokens on the blockchain. When the metric spikes, it means that old coins are moving and this could trigger selling pressure and a price depreciation.

However, a notable fall in XRP’s MCA indicated that more tokens are being retired into cold wallets. At press time, XRP’s 90-day Mean Coin Age had fallen from 40.29 to 33.74.

Source: Santiment

Considering the “laws” mentioned above, it would seem that the selling pressure around XRP might soon stop. Subsequently, the price can bounce on the charts and a hike to $0.55 might be possible too.

XRP to fall to $0.50, following which…

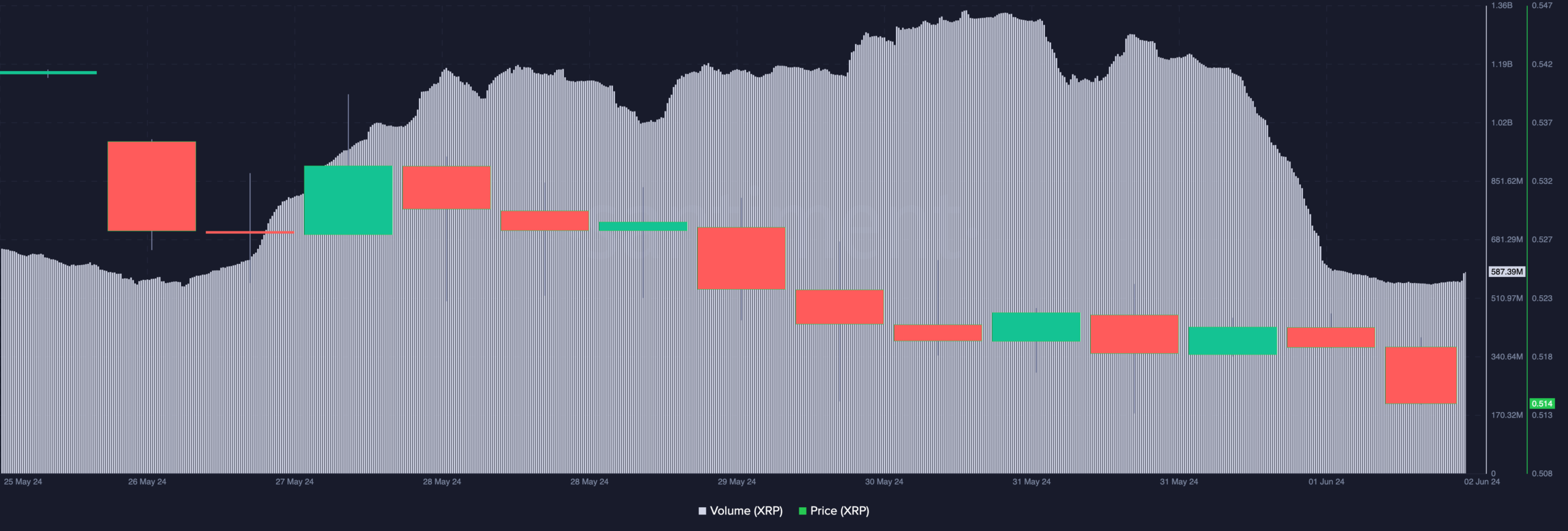

Traders might need to watch out for the altcoin’s volume too. At press time, the same was down to $587.39 million. Volume could serve as strength for the crypto’s price.

Therefore, a decline in the same indicates that XRP’s downtrend has been getting weak. While XRP’s value could still fall to $0.50, a bounce could be close as falling volume and decreasing price, together, can be interpreted a bullish sign.

If XRP does rebound, the $0.55 prediction might come to pass. In a highly bullish situation, the price of the cryptocurrency might rally to $0.60 too.

Source: Santiment

Read Ripple’s [XRP] Price Prediction 2024-2025

Despite the optimistic outlook, however, XRP holders should be wary of changes in the market— especially Bitcoin’s [BTC] influence.

If Bitcoin’s price appreciates on the charts, then XRP might be able to hike too. However, a collapse in BTC’s value could invalidate the thesis explained above.

Credit: Source link