- SOL could rally 900% in the long run and hit $1000 per analyst.

- Short-term price action seems uncertain as the market awaits the US spot ETH ETFs.

During the week of 15th-21st July, Solana [SOL] reclaimed $150 and climbed higher, posting 17% based on the press time value of $173. The trend followed a broader market relief recovery.

However, an extra 900% gain was still possible for the altcoin, per Ali Martinez, a prominent crypto analyst.

‘Solana is eyeing $1,000! Early signs of a breakout from a bull pennant suggest a potential 900% rally ahead.’

Source: X/Ali Charts

Ali’s argument was based on technical analysis, particularly the bullish pennant pattern formed on SOL’s weekly chart.

The pattern is a typical bullish continuation trend. In most cases, it ends up in a breakout equivalent to the flagpole. For SOL, that meant a possibility of hitting the $1000 level in the long term.

Evaluating SOL’s $200 short-term target

However, in the short term, SOL must mount above $200 to push forward. Daniel Cheung of Syncracy Capital, like most market observers, believes that SOL could surge beyond $200 by the end of July.

‘Have a feeling $SOL is going to lead the run for broader crypto markets again on this next leg. August is setting up for a giga bull candle, and we likely see $200+ by end of July.’

The short-term rally and possible further upside were supported by a recent surge of active addresses to a two-monthly high above 2 million users.

Source: Artemiz

This meant that there were more users and addresses engaging with the altcoin.

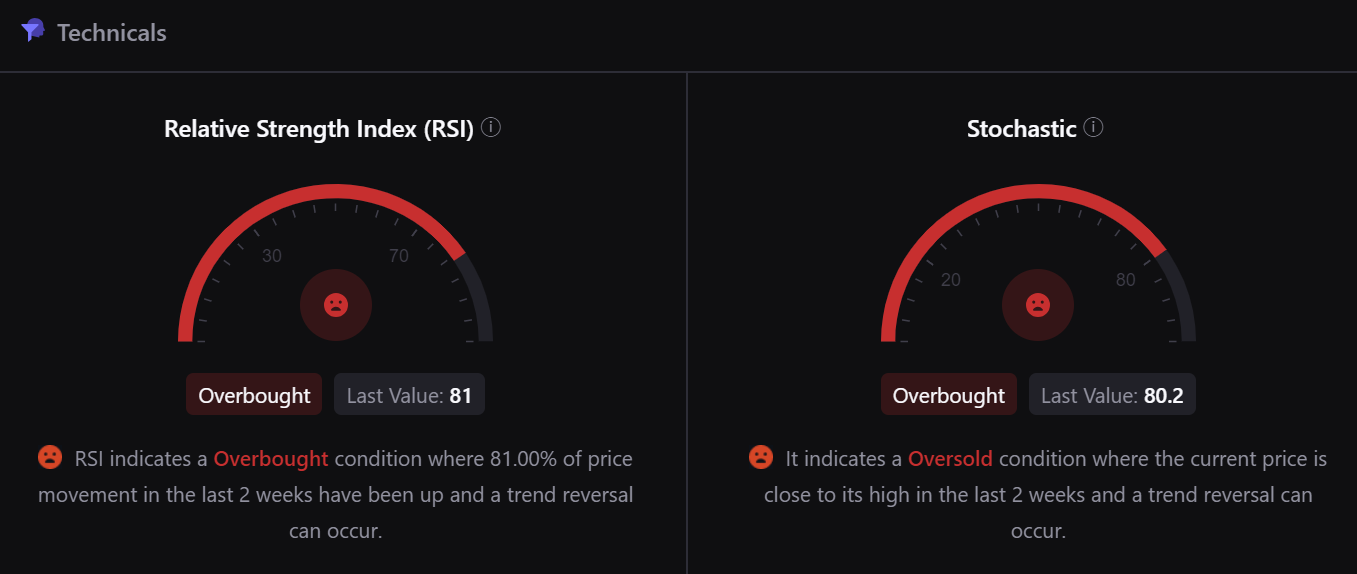

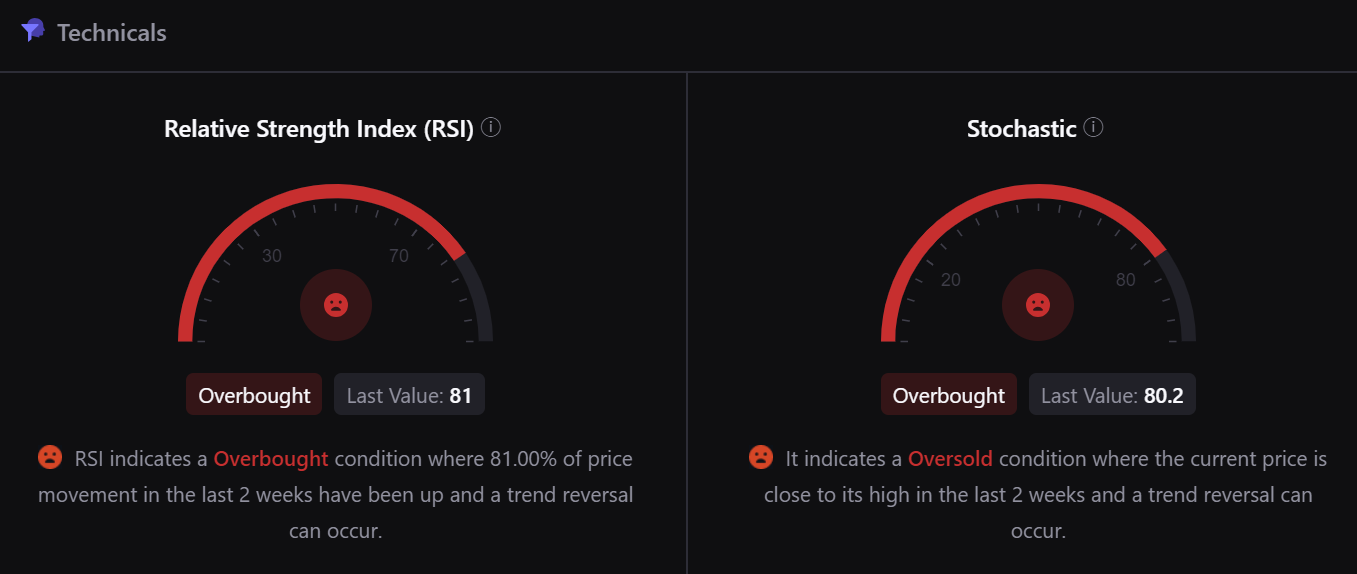

However, price chart technical indicators revealed that the rally could stall in the short term. In fact, CryptoQuant data flashed overbought conditions for the RSI (Relative Strength Index) and Stochastic indicators.

This suggested a bearish reversal couldn’t be overruled.

Source: CryptoQuant

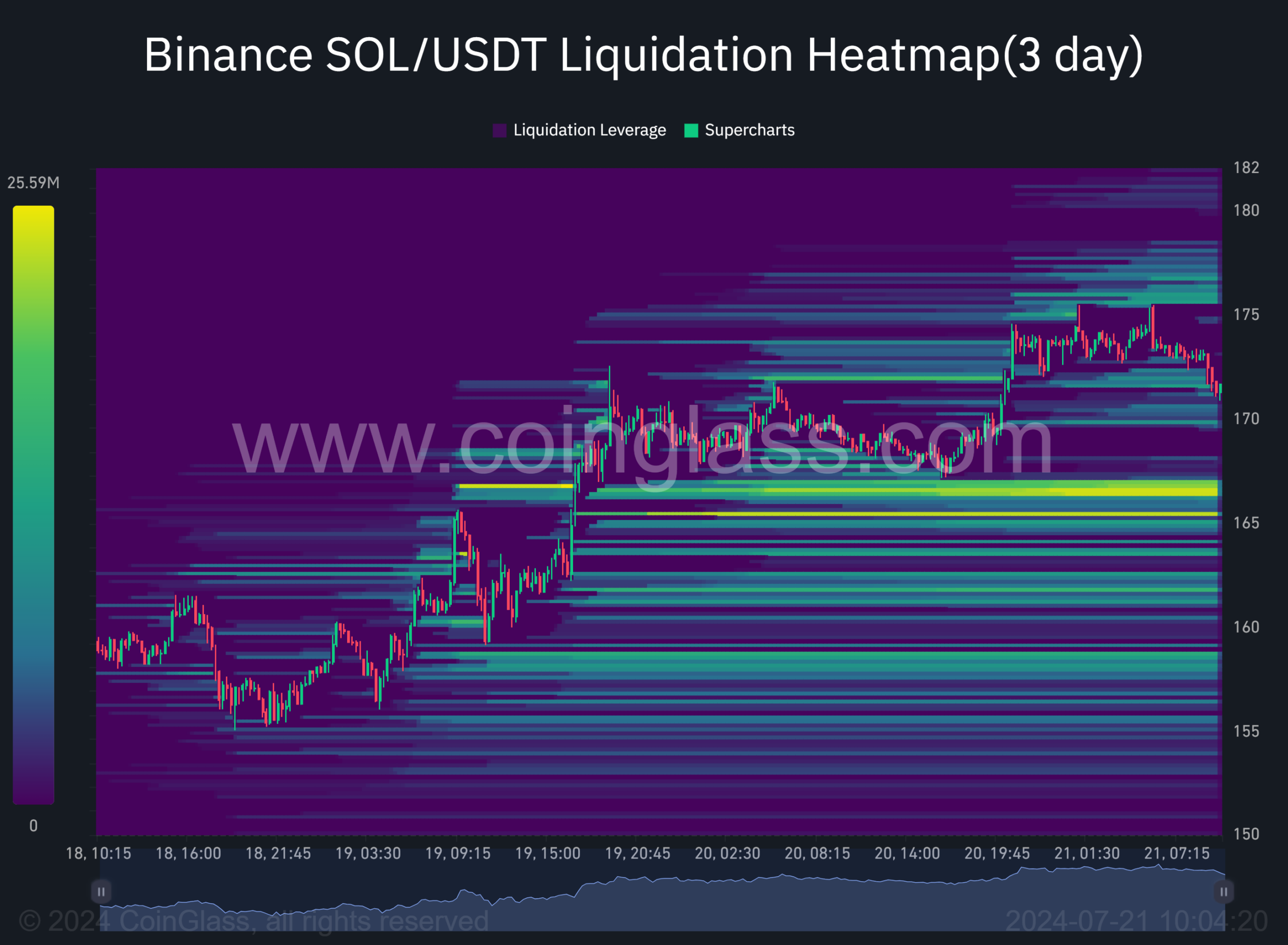

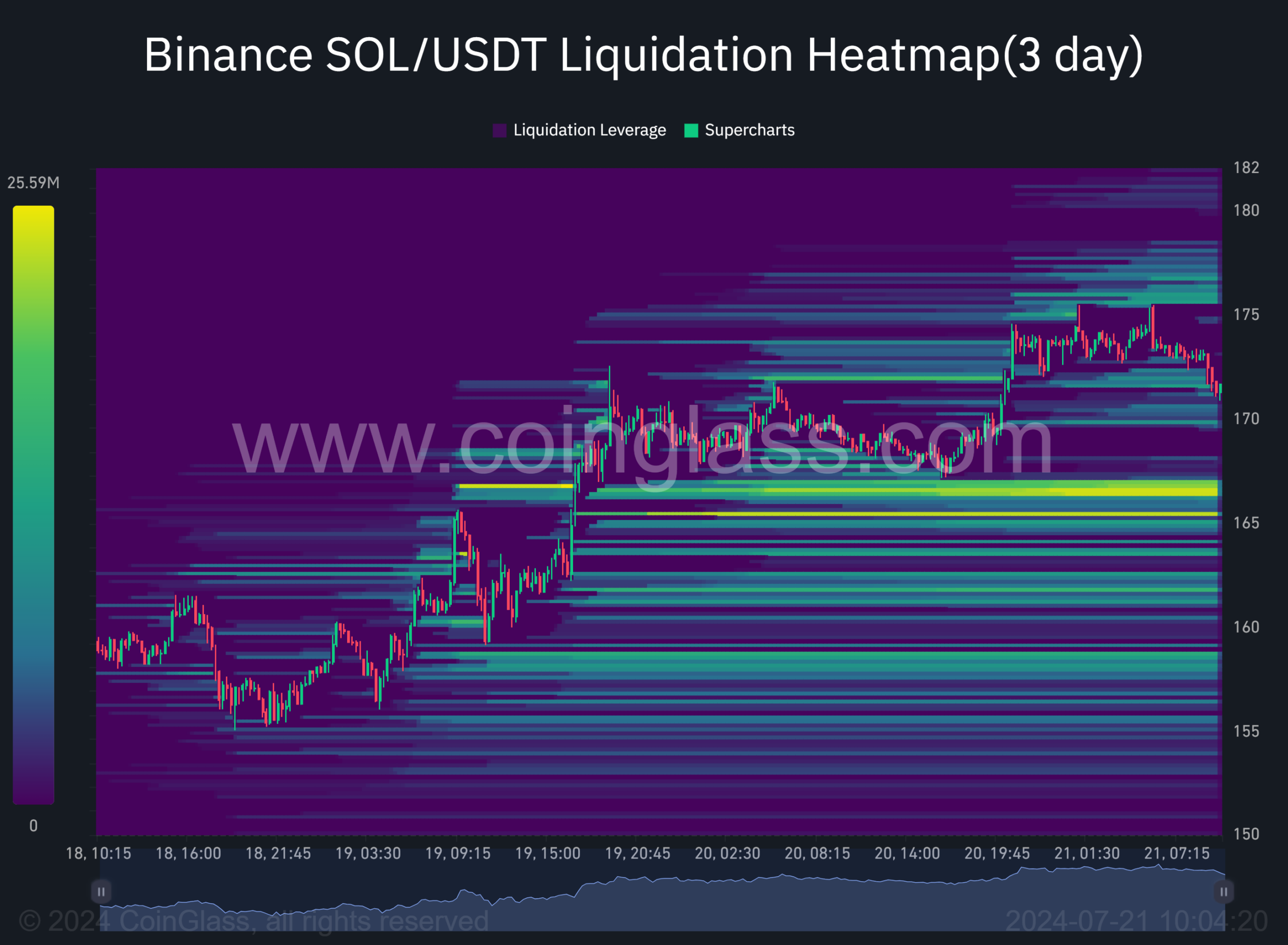

Additionally, on the derivatives side, as of Sunday, the market volume declined by over 40%, per Coinglass data. However, this wasn’t unexpected, given the limited liquidity during weekends.

However, the upcoming market catalyst, Ethereum [ETH] ETFs, which will go live on 23rd July, could set the pace for the next SOL price direction.

Meanwhile, the $166 and $176 price levels were key targets to watch out for next week, given the significant liquidity clusters located at each level.

Source: Coinglass

Credit: Source link