- SOL saw relatively muted interest from traders during the weekend pump

- However, Santiment deemed the lag as a bullish cue for the altcoin

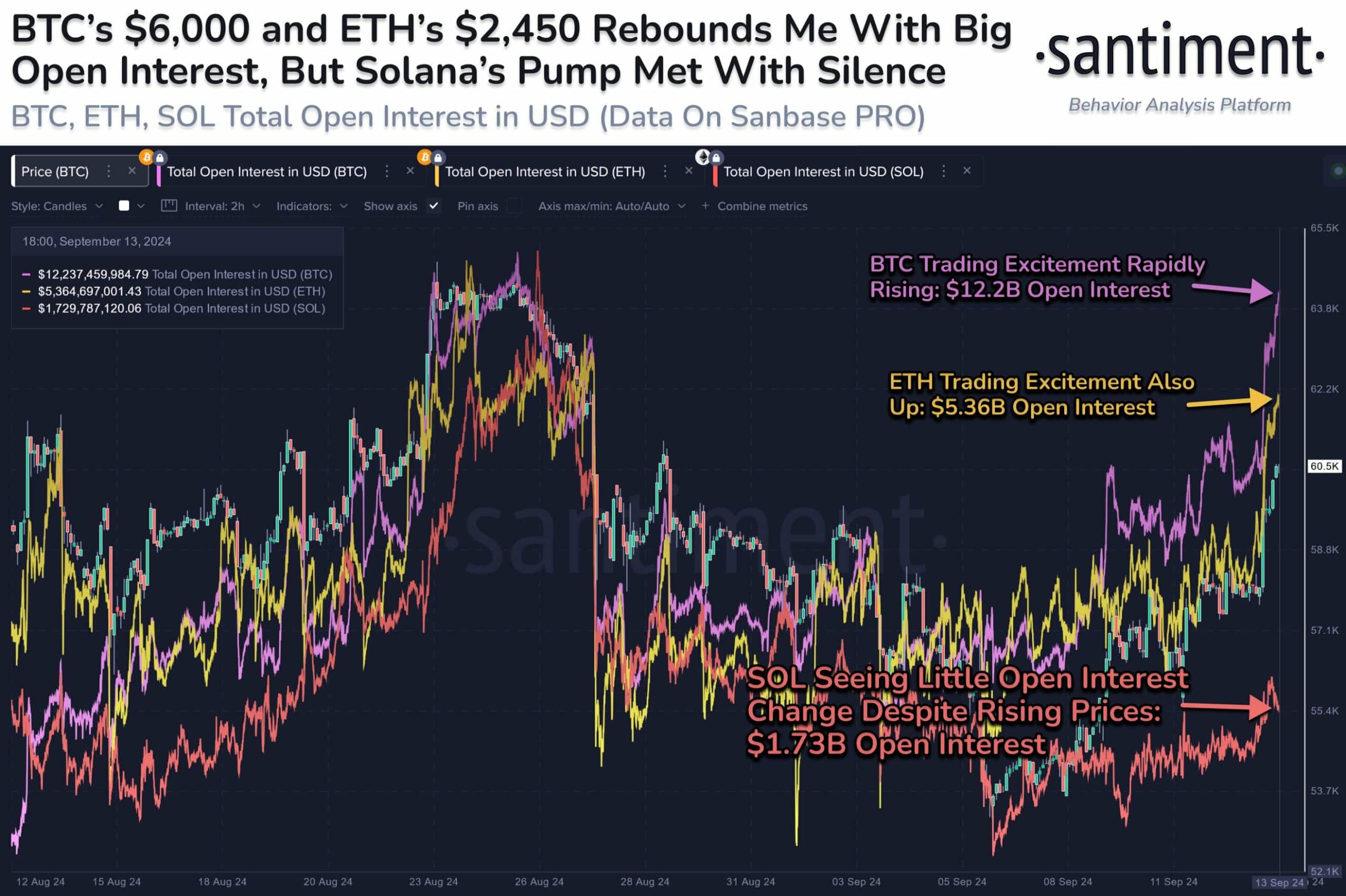

Friday’s market rebound saw varied interest from traders among Bitcoin [BTC], Ethereum [ETH], and Solana [SOL]. SOL trailed others in Open Interest (OI) rates, which track interest from Futures traders and overall liquidity injection. SOL saw only $1.7B in OI, compared to BTC’s $12B and ETH’s $5.3B.

However, according to Santiment, the lag could be a bullish cue for SOL. The crypto-analytics firm stated,

“However, Solana’s own return above $140 is seeing very little. Consider this a bullish sign for SOL, as euphoric traders are looking elsewhere.”

Source: Santiment

Speculators positive about SOL

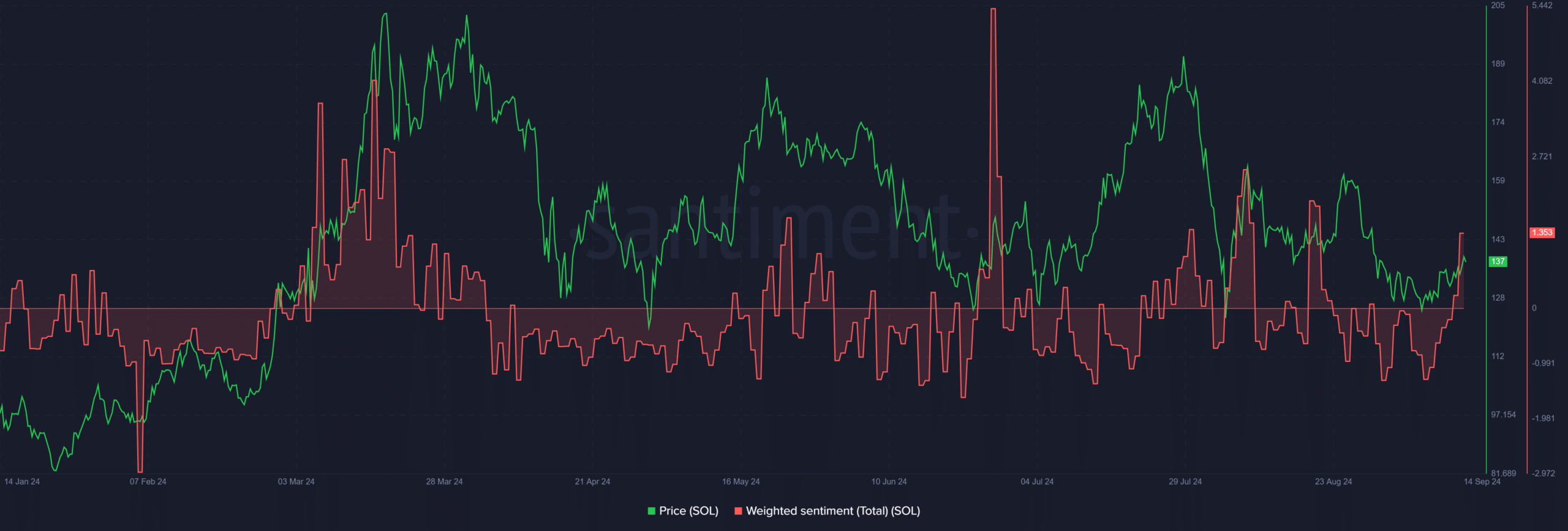

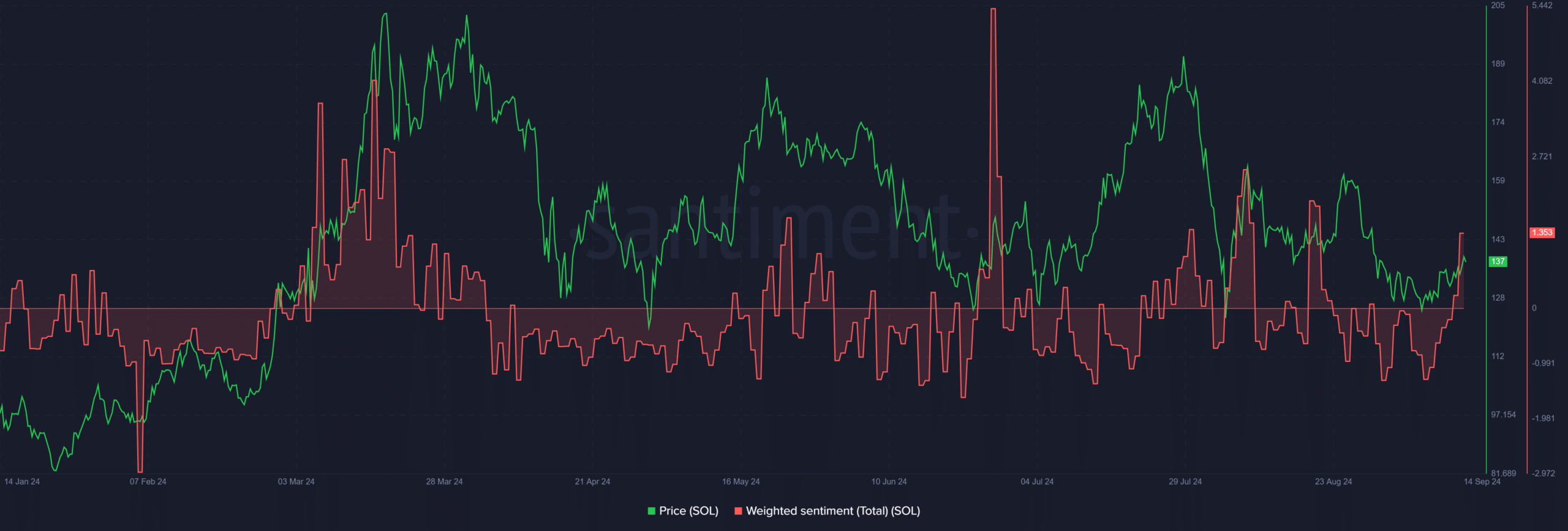

Like the broader market, the weekend rebound dragged SOL out of negative sentiment territory. At press time, speculators were highly positive about the altcoin for the first time since late August.

Source: Santiment

This alluded to a high conviction for further price appreciation. However, lower time frame charts suggested otherwise, at press time.

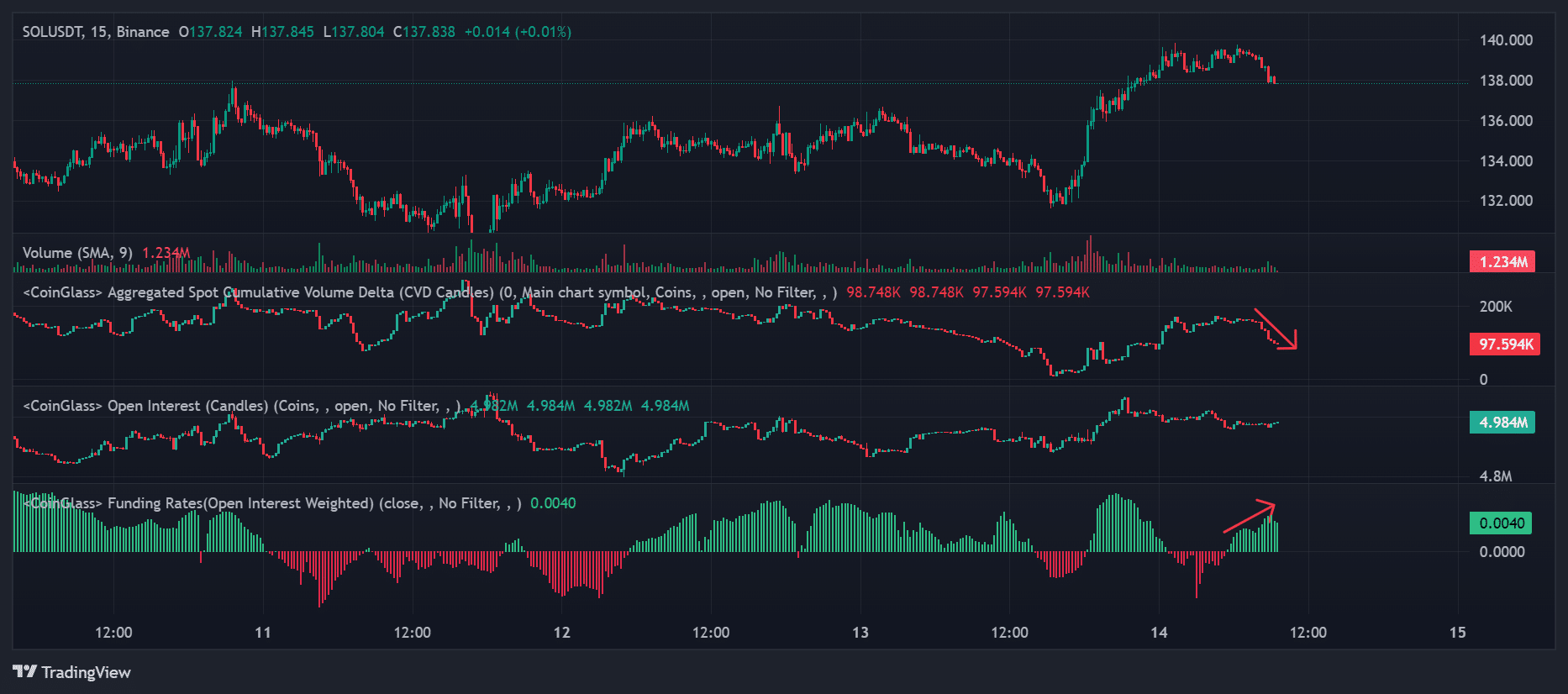

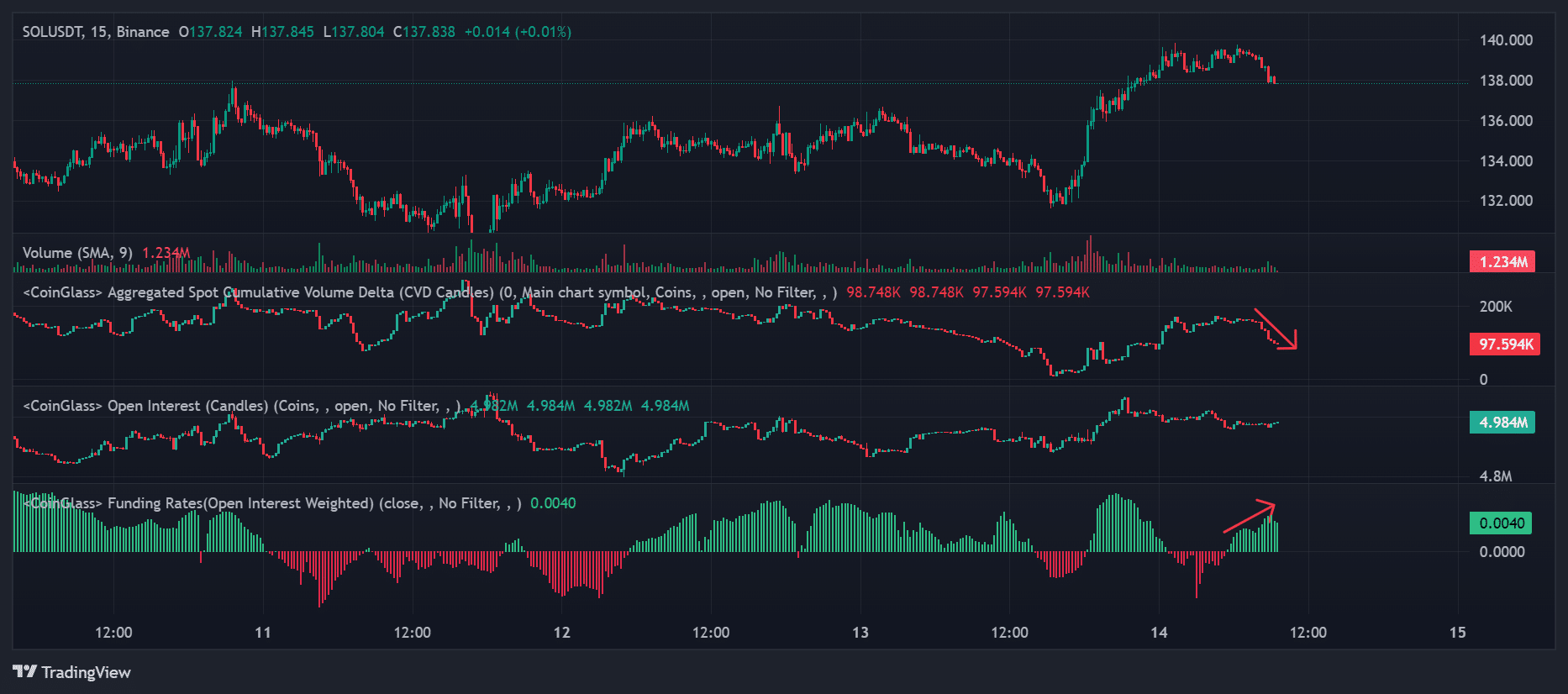

In fact, the aggregated Spot Cumulative Delta (CVD) trended lower. This highlighted that SOL’s selling volumes eclipsed its buying volumes, indicating that short sellers hiked as SOL surged towards $140.

At the same time, the OI remained flat. This signaled that some speculators were making short bets on the altcoin over the weekend.

Source: SOL/USDT, Coinglass

Additionally, funding rates fluctuated, illustrating that short bets could derail a strong weekend move above $140.

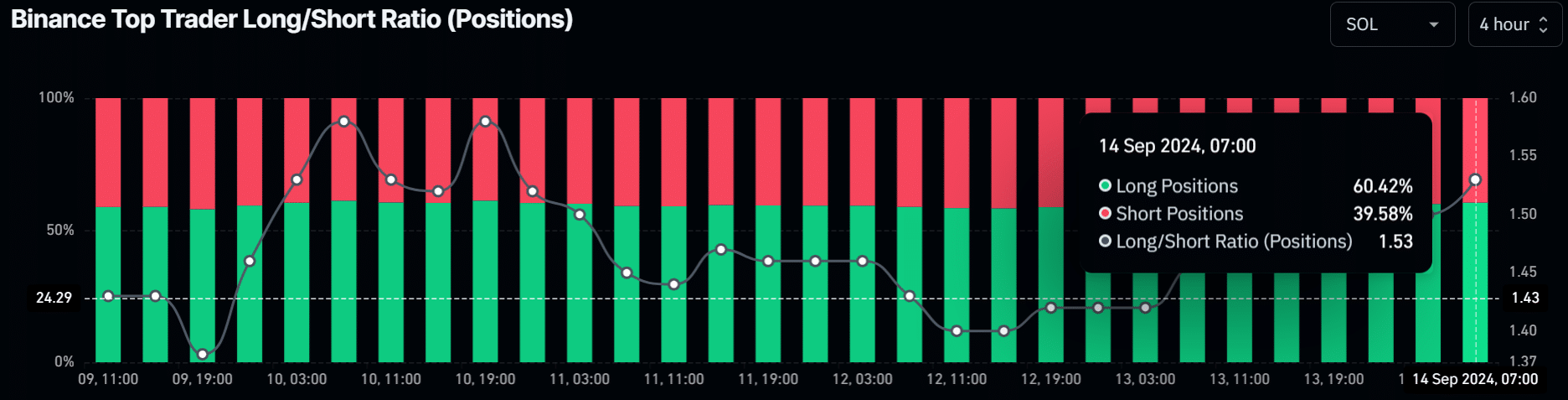

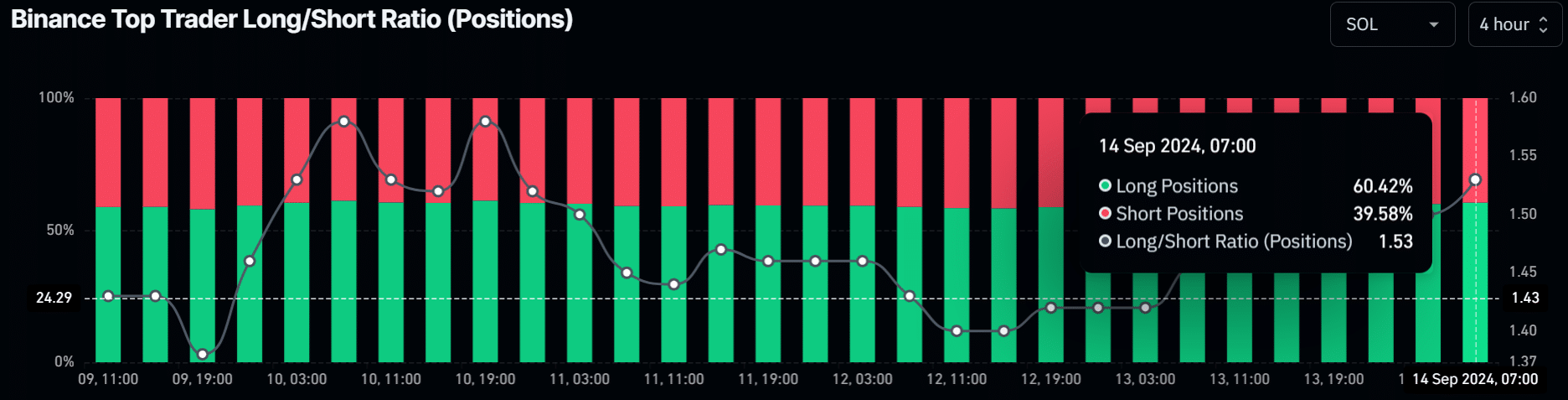

Despite the short bets from retail traders, smart money on Binance doubled down on long positions. In fact, according to Binance Top Trader Long/Short Ratio, long positions accounted for 60% of all positions.

Although this demonstrated a high conviction for SOL’s upside potential, it could also mean a hedge for spot positions.

Source: Coinglass

SOL was valued at $137 at press time, up 7.5% in the last seven trading days after tapping a monthly high of $139.8.

Overall, next week will be action-packed for the altcoin. Apart from the expected bullish pivot from Fed rate cuts on 18 September, Solana’s BreakPoint 2024 event could further induce momentum for the token.

The event will be held in Singapore on 20-21 September and is typically associated with a price rally. Especially since insiders often unveil the latest updates from the Solana ecosystem.

Credit: Source link