Tether may become the world’s most profitable company if the stablecoin issuer continues its explosive growth trajectory, according to Bitwise Chief Investment Officer Matt Hougan.

In a September 29 investor memo, Hougan suggests that Tether could surpass even Saudi Aramco’s record-breaking $120 billion profit from 2024, which is the most lucrative year in corporate history.

Hougan’s analysis hinges on Tether reaching $3 trillion in assets, which would represent approximately 3% of the global money supply.

“At current interest rates, if Tether got to $3 trillion in assets—about 3% of the global money supply—it would top that, becoming the most profitable company in history,” Hougan stated.

Why Tether Could Become the World’s Most Profitable Company

The ambitious valuation projections for Tether first caught Hougan’s attention when news emerged that the stablecoin issuer was seeking to raise capital at a $500 billion valuation.

This would place Tether among the world’s most valuable startups, alongside artificial intelligence pioneer OpenAI and aerospace manufacturer SpaceX.

“OpenAI is working to create artificial general intelligence and SpaceX wants to put people on Mars. Tether basically runs a digital money market fund.”

However, Hougan argues that the comparison becomes less far-fetched when considering Tether’s market positioning and growth potential.

The stablecoin issuer commands nearly 100% of the stablecoin market in non-Western countries, giving it a dominant foothold in emerging markets where dollar-denominated digital currencies are increasingly preferred over volatile local currencies.

“There’s a chance that many emerging market countries will convert from primarily using their own currencies to using USDT,” Hougan noted.

If that happens, Tether could end up managing trillions of dollars and capturing all of the interest.

Hougan’s bullish outlook on Tether reflects a broader thesis about the sheer size of the markets the digital assets aim to disrupt.

He illustrated this concept using Bitcoin, which currently holds a $2.3 trillion market capitalization, equivalent to Amazon’s valuation.

While Amazon serves millions of customers daily, Bitcoin’s value stems from its competition with gold, a $25 trillion asset class.

“To be worth $2.3 trillion, [a company trying to disrupt] Amazon would need to take 100% of the market, forcing the Seattle-based giant into bankruptcy,” Hougan explained.

The same logic applies to stablecoins and the traditional payment systems they could potentially replace.

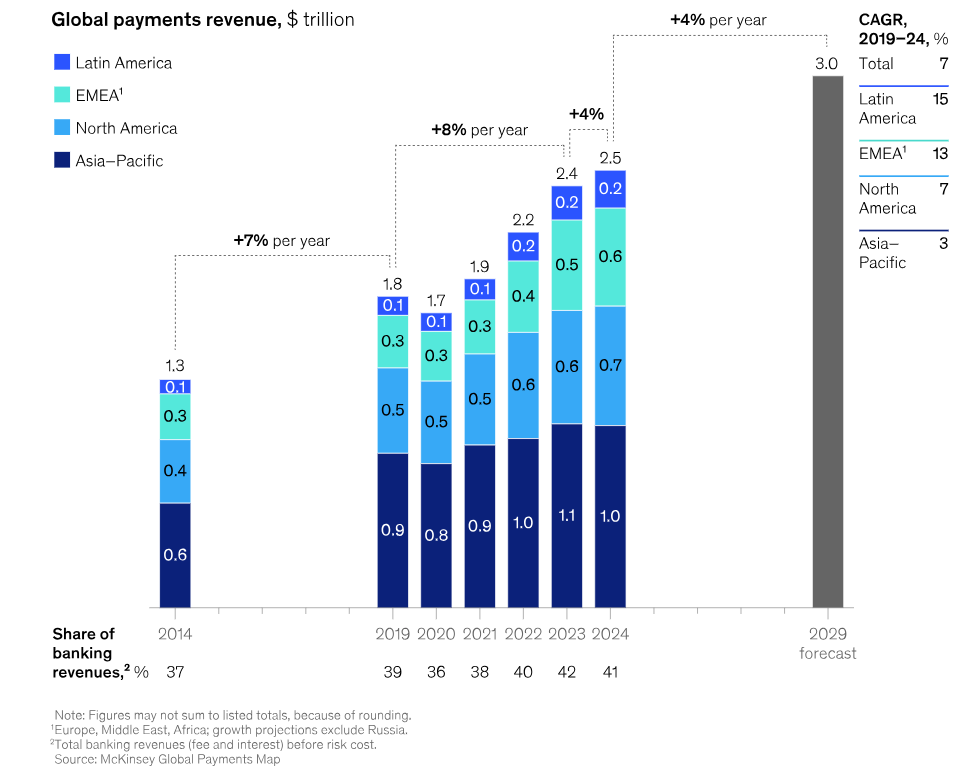

According to McKinsey data cited by Hougan, the global payments industry processes 3.4 trillion transactions worth $1.8 quadrillion annually.

In such massive markets, capturing even a small percentage could potentially make Tether’s historic profit projections more plausible than they initially appear.

Tether’s Path to Record-Breaking Profitability

Paolo Ardoino, the CEO of Tether, told CryptoNews last year that he is confident Tether USDT will maintain its dominance amid increasing competition from other stablecoins due to the team’s deep understanding of usage.

Regarding Tether’s business model and profitability, Ardoino highlighted the impact of current interest rates.

“We made $12 billion in profits in the last two years,” he said.

Even if rates were to drop to 2%, Ardoino noted that Tether has $100 billion in the U.S. Treasuries, and 2% on that is still $2 billion per year.

Data from DeFiLlama shows that stablecoins’ total market capitalization is now worth $297 billion, with Tether USDT alone taking 58.65% of the entire market share at exactly $174 billion.

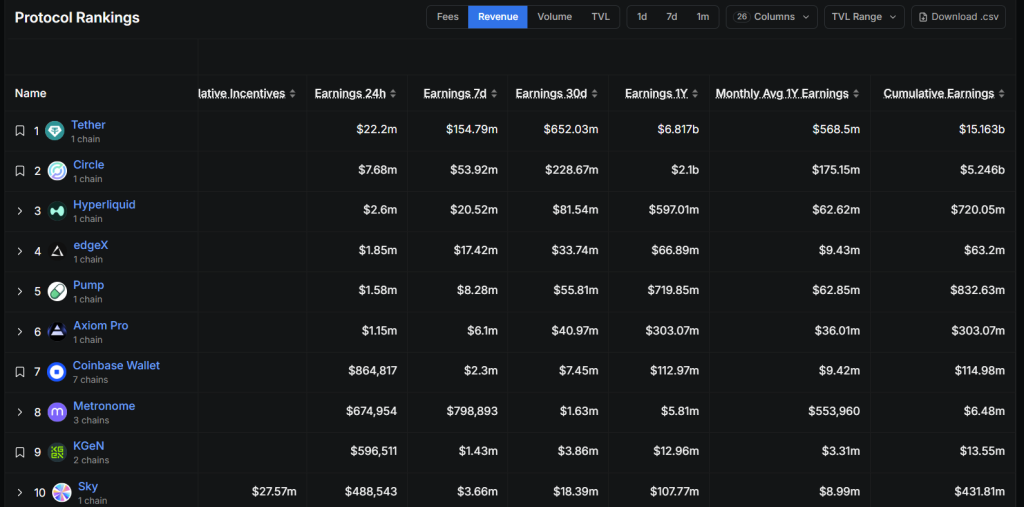

Beyond that, Tether is the most profitable company in crypto, averaging $652 million monthly and $6.81 billion annually in revenue.

The projection that Tether may become the world’s most profitable company comes as institutional adoption of stablecoins accelerates across the financial sector.

Major payment processors, including Stripe, Mastercard, and Visa, have rolled out infrastructure allowing consumers to transact with stablecoins through existing payment networks.

Digital wallet providers such as MetaMask, Kraken, and Crypto.com now offer card services that support stablecoin spending.

Traditional banks, including Citi and Bank of America, have publicly stated plans to broaden their digital asset services, with some indicating potential launches of proprietary stablecoins in the future.

Credit: Source link