Texas’ role as a center of U.S. crypto activity is set to expand further after Bitcoin Bancorp said it plans to deploy up to 200 licensed Bitcoin ATMs across the state beginning in the first quarter of 2026.

The state is adding to an already dense network of crypto kiosks operating under one of the country’s clearest regulatory frameworks.

Bitcoin Bancorp Enters Texas, Citing Clear Rules and Strong ATM Demand

Bitcoin Bancorp, which trades over the counter under the ticker BCBC, said the planned rollout would mark its entry into what it described as a strategically important market.

The company is one of only three publicly traded Bitcoin ATM network owners in the United States and says it holds foundational patents tied to Bitcoin ATM technology.

Eric Noveshen, a director at the firm, said agreements are already in place that could support faster revenue growth as the company moves from planning into execution.

Following the announcement, Bitcoin Bancorp shares rose 7.83% on the day and are up 29.53% over the past five days, reflecting increased investor confidence in the expansion strategy.

The expansion comes at a time when Texas already hosts more than 4,000 live crypto ATMs, the highest number of any U.S. state.

Large national operators, including Athena Bitcoin, Bitcoin Depot, Coinhub, Cryptobase, and Byte Federal, have established broad coverage across major cities such as Houston, Dallas, Austin, and San Antonio.

The presence of this existing infrastructure has lowered barriers for new deployments and signaled sustained consumer demand for in-person crypto access.

Why Bitcoin ATM Operators Keep Flocking to Texas

Texas’ appeal to ATM operators largely stems from its regulatory structure. State law treats virtual currency as a form of money under the Texas Money Services Act, placing Bitcoin ATM operators within a familiar licensing regime overseen by the Texas Department of Banking.

Companies must obtain a money transmitter license, meet minimum net worth requirements of at least $500,000, post a surety bond of no less than $150,000, and submit to regular examinations.

Consumer protection has also become a growing focus. In Texas, state rules require Bitcoin ATM operators to clearly disclose fees, exchange rates, and complaint procedures.

Federal Scrutiny Intensifies Around Bitcoin ATMs

Oversight of Bitcoin ATMs in the United States is tightening at the federal level as regulators respond to rising fraud concerns and increased consumer use.

Currently at the federal level, Bitcoin ATM operators are classified as money services businesses under the Bank Secrecy Act, placing them under the supervision of the Financial Crimes Enforcement Network (FinCEN).

This requires operators to maintain formal anti-money laundering programs, conduct customer identity verification, and monitor transactions for suspicious activity.

Identity checks typically scale with transaction size, ranging from basic phone verification for smaller amounts to government-issued identification and enhanced due diligence for larger transfers.

Operators are also required to file currency transaction reports for cash transactions exceeding $10,000, submit suspicious activity reports when necessary, and retain records for a minimum of five years.

At the same time, federal lawmakers are moving to further regulate the sector. Proposed legislation such as the Crypto ATM Fraud Prevention Act of 2025 shows a more focused concern over the role of crypto kiosks in scam-related losses nationwide.

What the Crypto ATM Fraud Prevention Act Proposes

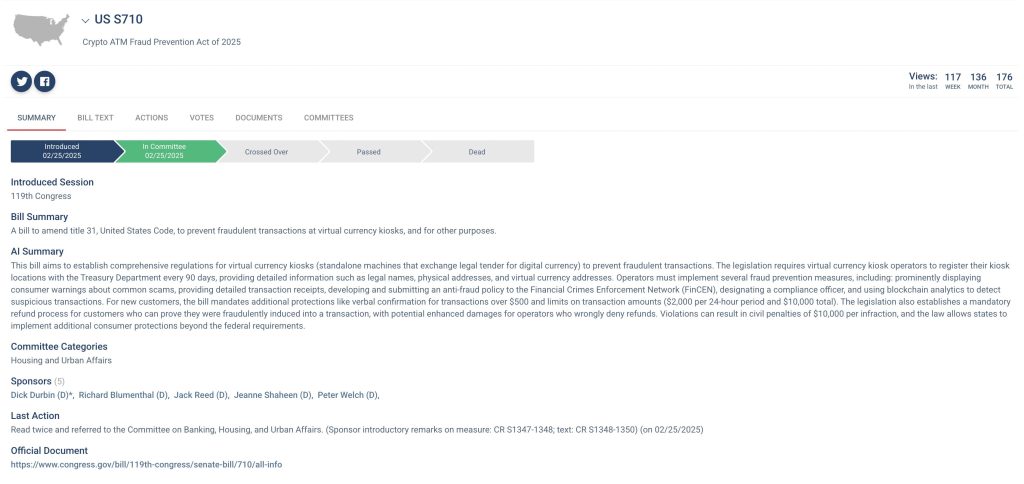

Introduced in the U.S. Senate as Bill S. 710, the Crypto ATM Fraud Prevention Act of 2025, which has been read twice and referred to the Senate Committee on Banking, Housing, and Urban Affairs, is designed to reduce fraud risks while increasing transparency for consumers.

Key provisions of the bill include mandatory registration of virtual currency kiosks with the U.S. Treasury; also, operators are required to provide clear pre-transaction disclosures outlining terms, fees, and a warning that transactions are final and non-refundable.

The bill mandates prominent fraud warnings on kiosks, the issuance of physical receipts containing transaction details and fraud-reporting information, and the implementation of written anti-fraud policies submitted to FinCEN.

Credit: Source link