Bitcoin: The impact of predominant long positions

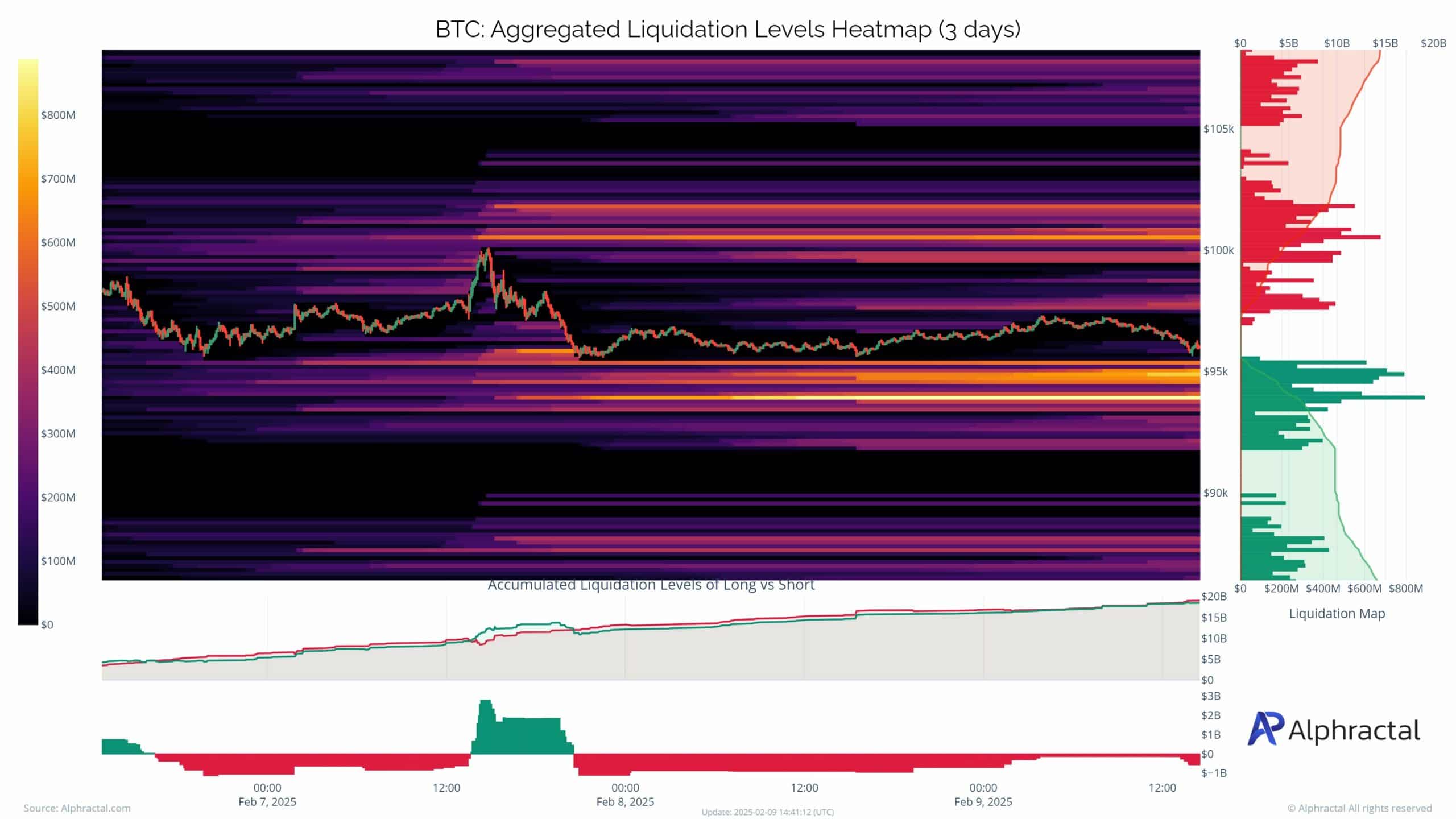

At press time, Bitcoin is trading at approximately $97k. Despite a strong bullish narrative, Bitcoin faces significant resistance at the $100,000 psychological barrier.

Recent data highlights a market heavily skewed toward long positions, a dynamic that could be contributing to the stagnation in price action.

Source: Alphractal

The liquidation heatmap provides a clearer picture of the market’s current state. It shows dense clusters of potential liquidation levels near $100,000, with a significant accumulation of liquidations around $95,000 on the downside.

These zones are critical as they represent areas where abrupt price movements could be triggered by forced liquidations, amplifying volatility.

In the short term, breaking the $100,000 resistance remains essential to sustaining Bitcoin’s bullish momentum.

However, failure to hold above the $95,000 support level could push prices toward the $92,000 range, where further liquidation zones could intensify bearish pressure.

Traders should closely monitor these key levels to anticipate shifts in market dynamics.

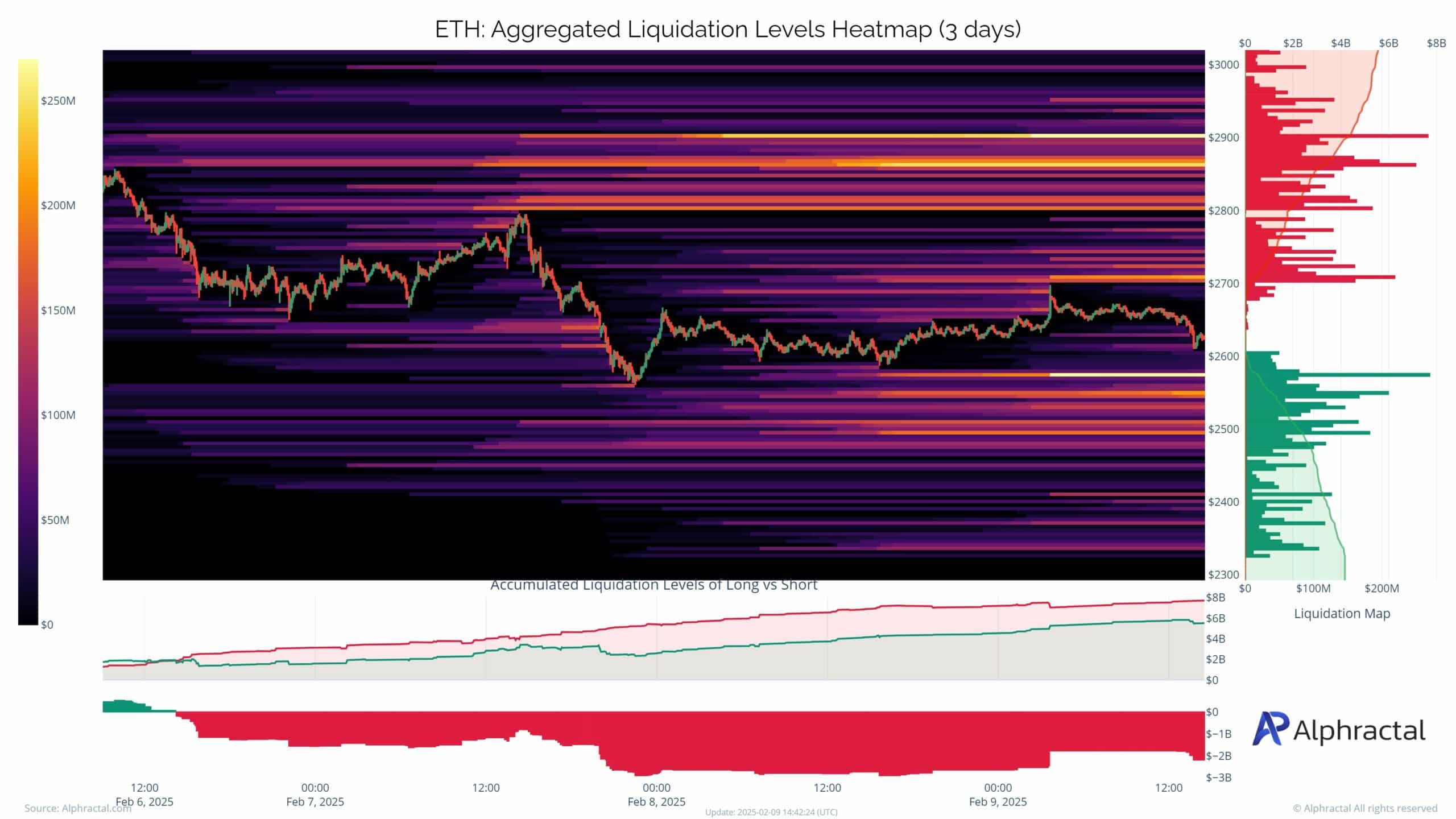

ETH liquidation zones: A cascade waiting to happen?

The Ethereum heatmap reveals significant clusters of liquidation levels concentrated around the $2,700 to $2,800 range for long positions and near $2,500 for shorts.

These zones represent areas of heightened vulnerability, where price movements could trigger a cascade of liquidations, amplifying volatility.

Source: Alphractal

Notably, the liquidity map suggests a gradual buildup of sell-side pressure as prices approach the $2,700 mark, with substantial activity evident in the $2,800 zone.

On the downside, shorts remain heavily concentrated below $2,500, indicating robust support for ETH unless broader market sentiment shifts.

This dynamic creates a narrow trading band for ETH, with liquidations potentially acting as the catalyst for a breakout or breakdown.

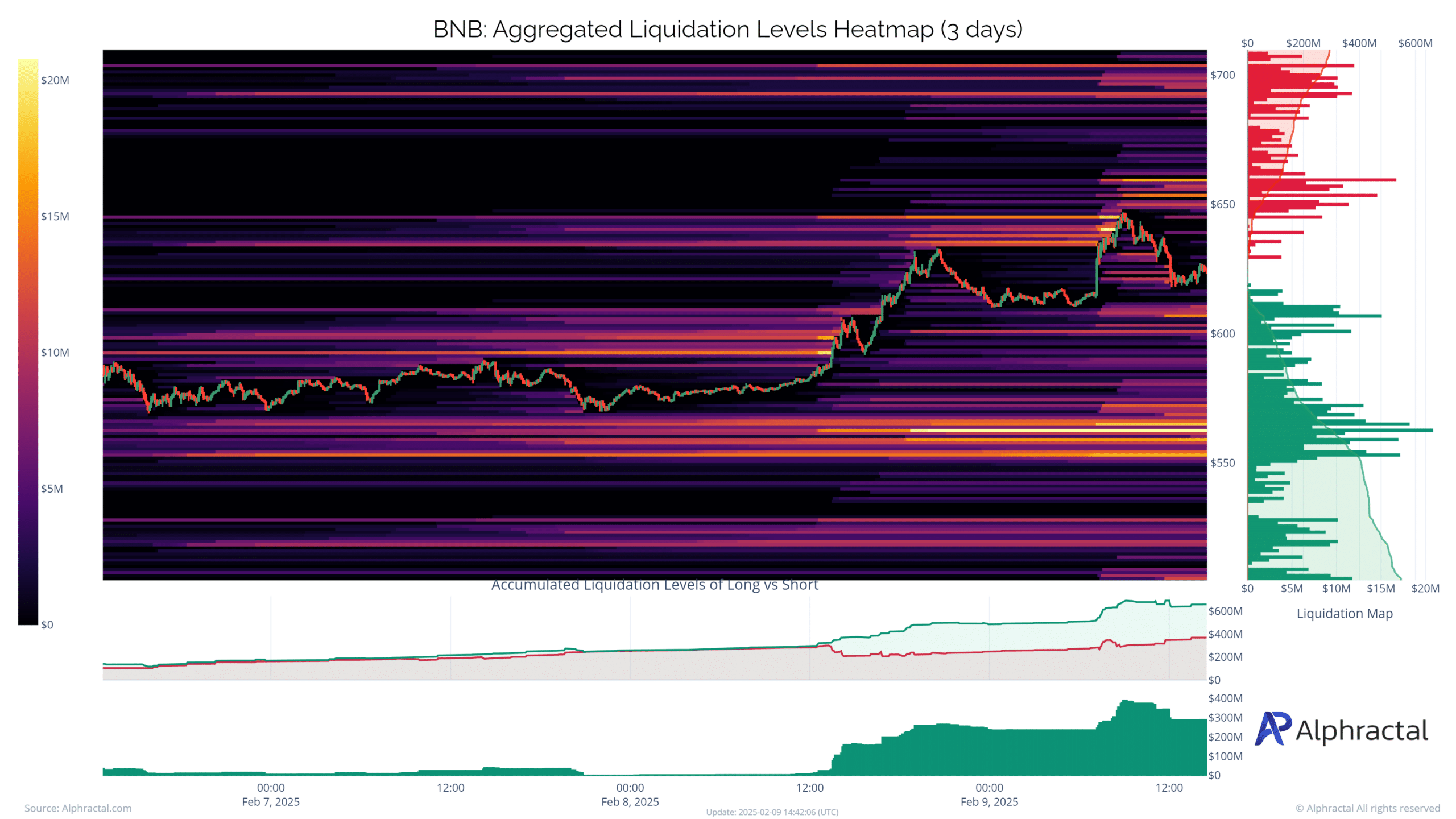

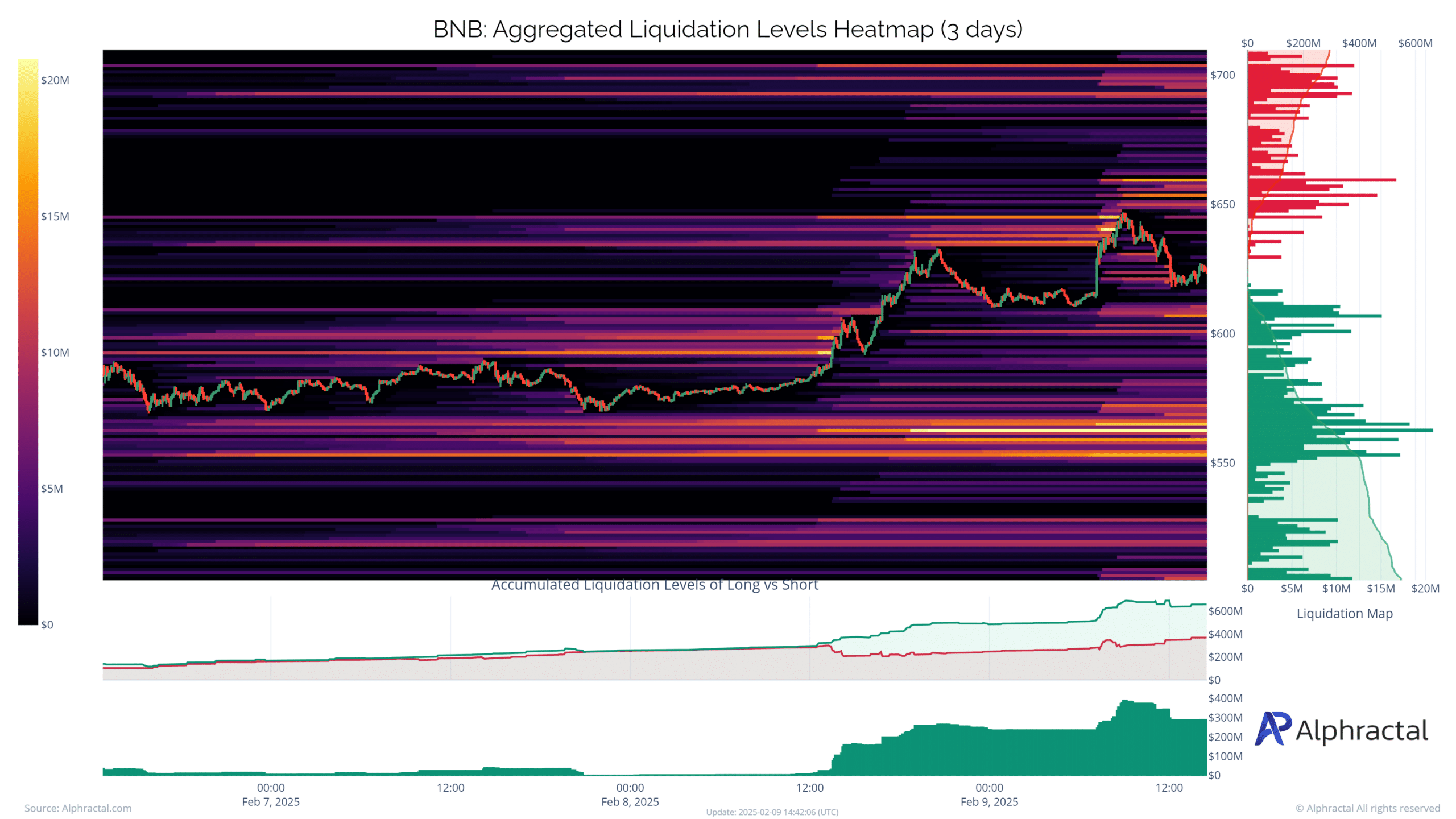

BNB’s market stalemate

Source: Alphractal

The BNB liquidation heatmap highlights concentrated activity at $650 for longs and $600 for shorts, creating a tight trading range. The buildup of liquidation levels above $650 suggests strong resistance, while dense short clusters near $600 indicate support.

Despite recent price stagnation, any decisive move could trigger a cascade of liquidations, intensifying volatility. A break above $650 may fuel bullish momentum, while a slip below $600 could lead to rapid downside movement as shorts get liquidated.

With liquidity imbalances on both sides, BNB appears primed for a strong directional move.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

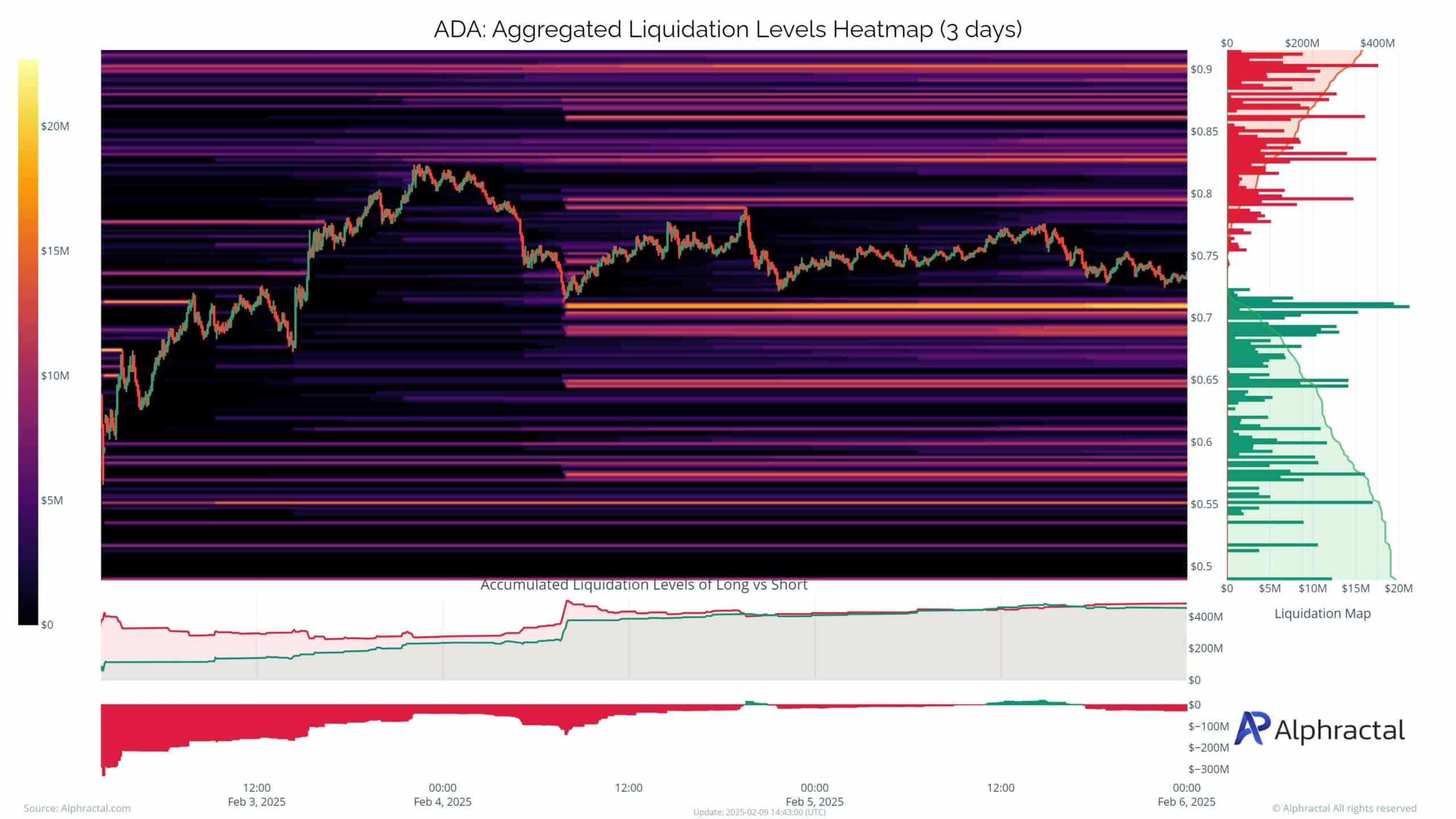

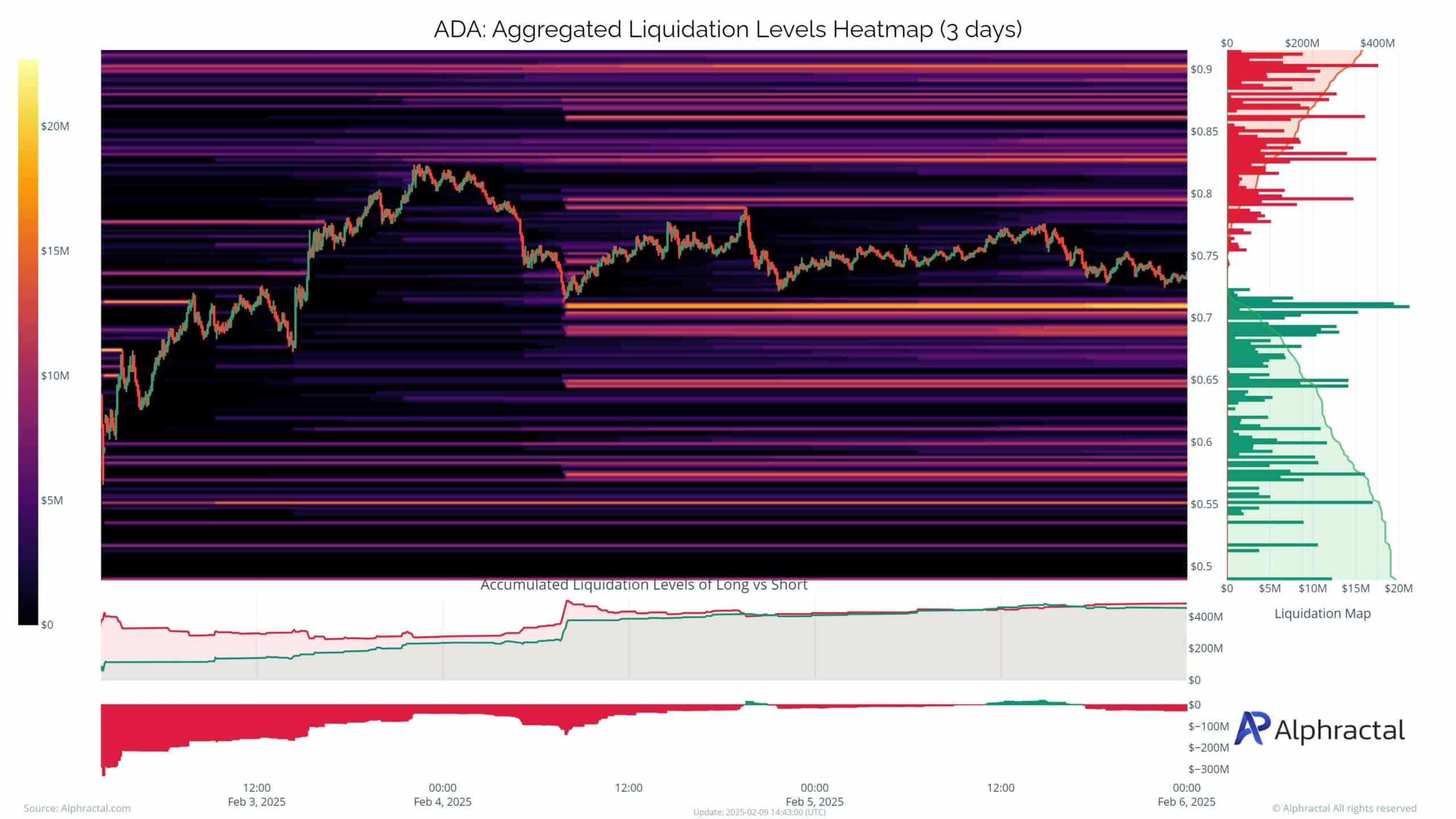

Cardano’s support and risk zones: A squeeze on the horizon?

Source: Alphractal

The ADA liquidation heatmap shows substantial support near $0.70, where significant long positions are concentrated.

This indicates a safety net for ADA in case of downward pressure. However, the high density of longs around this level could make it a risk zone if the price dips further, triggering a cascade of liquidations.

Resistance builds near $0.90, limiting immediate upside potential. If ADA experiences sharp sell-offs, the $0.70-$0.65 range becomes a potential squeeze zone, where forced liquidations may intensify downward momentum.

Conversely, holding this level could reinforce bullish sentiment, setting the stage for a rebound toward $0.85 and beyond.

Credit: Source link