Last updated:

Why Trust Cryptonews

Key Takeaways:

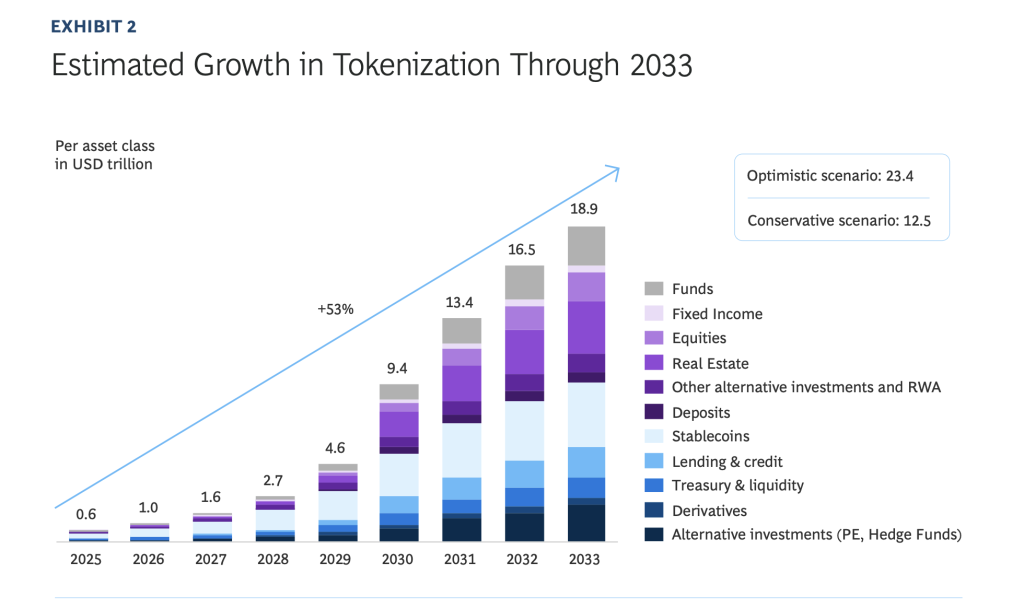

- Tokenized real-world assets are projected to surge from $0.6 trillion to $18.9 trillion by 2033.

- The report was a collaboration between Ripple and Boston Consulting Group (BCG).

- This surge reflects a fundamental transformation of global financial infrastructure.

- Growth is driven by regulatory clarity, mature technology, and institutional momentum.

A Ripple report released on April 7 shows that tokenized real-world assets are projected to soar from $0.6 trillion in 2024 to $18.9 trillion by 2033.

This growth shows a compound annual growth rate of 53% and marks a new period where financial assets are no longer static instruments but dynamic, programmable tools that operate on shared digital ledgers.

he report, which was conducted in collaboration with Boston Consulting Group (BCG) and shared with Cryptonews, outlines a three-phase evolution of tokenization that is already underway.

The financial industry is experiencing a period of low-risk adoption, during which institutions are tokenizing familiar financial instruments such as money market funds and bonds.

As confidence in the technology grows, the second phase is expected to see the expansion into more complex asset classes including private credit and real estate.

Tokenization will culminate in a market transformation where the technology becomes fully integrated into both financial and non-financial products. This push is being driven by a combination of regulatory clarity, maturing technological infrastructure, and the momentum of institutional investments.

Tokenized Assets Adoption Led by BlackRock, Fidelity, and JPMorgan

Key players in the financial sector are already embracing this shift. Major institutions such as BlackRock, Fidelity, and JPMorgan have begun to operationalize tokenization.

Tibor Merey, Managing Director and Partner at BCG, explains that tokenization transforms financial assets into programmable, interoperable tools that enable 24/7 transactions, fractional ownership, and automated compliance.

Regulatory clarity is emerging as a critical factor for this transition, with markets in the European Union, the United Arab Emirates, and Switzerland largely establishing clear guidelines.

Similar progress is expected in the United States, pushing institutional momentum.

Alongside regulatory advancements, the maturation of technology—evidenced by sophisticated wallets and custody platforms—and strategic investments through bank-fintech mergers and acquisitions are creating a reinforcing “flywheel effect.”

This effect is formed by a self-reinforcing cycle in which institutional supply and investor demand continuously push the adoption of tokenized assets.

Markus Infanger, Senior Vice President of RippleX, says the market is shifting from tokenized assets simply existing on a blockchain to being fully integrated into real economic activity.

This integration promises to streamline processes, reduce reliance on intermediaries, and unlock new revenue streams.

By allowing instant 24/7 transactions and fractional ownership of assets, tokenization is expected to break down barriers that have slowed down access to global capital markets.

However, the journey is not without its challenges. Fragmented infrastructure and regulatory divergences remain notable hurdles

Yet, industry stakeholders are collaborating on common standards and infrastructures to overcome these obstacles.

Tokenization No Longer a Speculative Concept

As Bernhard Kronfellner, Partner & Associate Director at BCG, notes, tokenization is no longer a speculative concept but the cornerstone of the future of global finance.

The Ripple report makes it clear that institutions will transition from pilot projects to fully scaled operations.

Credit: Source link