As Bitcoin [BTC] and other top cryptos consolidated their dominance, altcoins have been left struggling for relevance. The chart shows a steady decline in the dominance of altcoins outside the top 10 over the years.

Source: TradingView

This diminishing focus on smaller tokens stems from Bitcoin’s growing reputation as a “safe haven” asset and Ethereum’s dominance in smart contract applications.

Both giants have captured the lion’s share of market capitalization, leaving limited room for speculative altcoin surges.

With institutional investments and increasing public trust flowing predominantly toward the top players, the days of altcoins driving market excitement might be waning.

Are there too many altcoins?

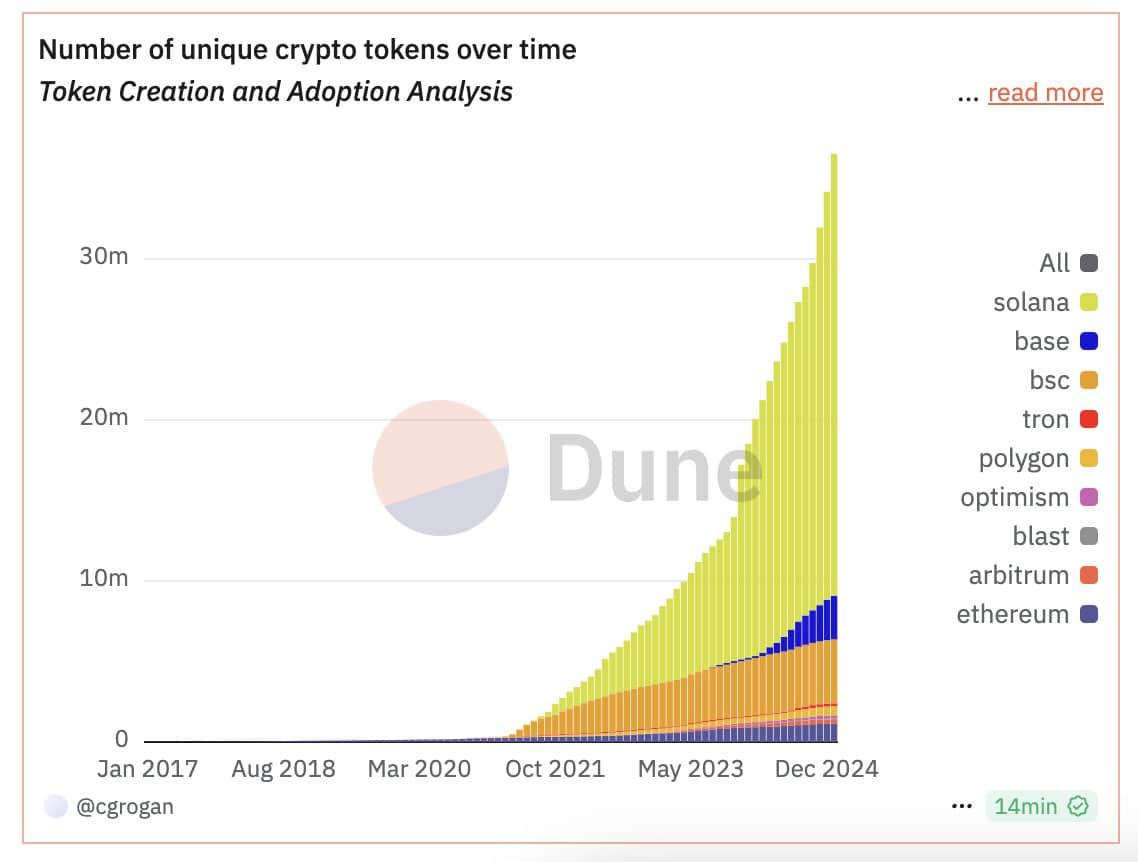

The exponential rise in the number of unique crypto tokens highlights a major shift in the market landscape. Since 2017, the sheer volume of token creation has surged, surpassing 30 million unique tokens by late 2024.

Source: X

This rapid growth has fragmented investor attention and diluted capital allocation.

Platforms like Solana [SOL], Ethereum [ETH], and Polygon [POL] continue to dominate token creation, but the overwhelming supply of new projects has made it increasingly difficult for individual tokens to gain traction.

As more tokens flood the market, questions about quality, utility, and long-term viability emerge, making it harder for investors to distinguish between promising altcoins and fleeting trends.

The decoupling of Bitcoin and crypto market caps

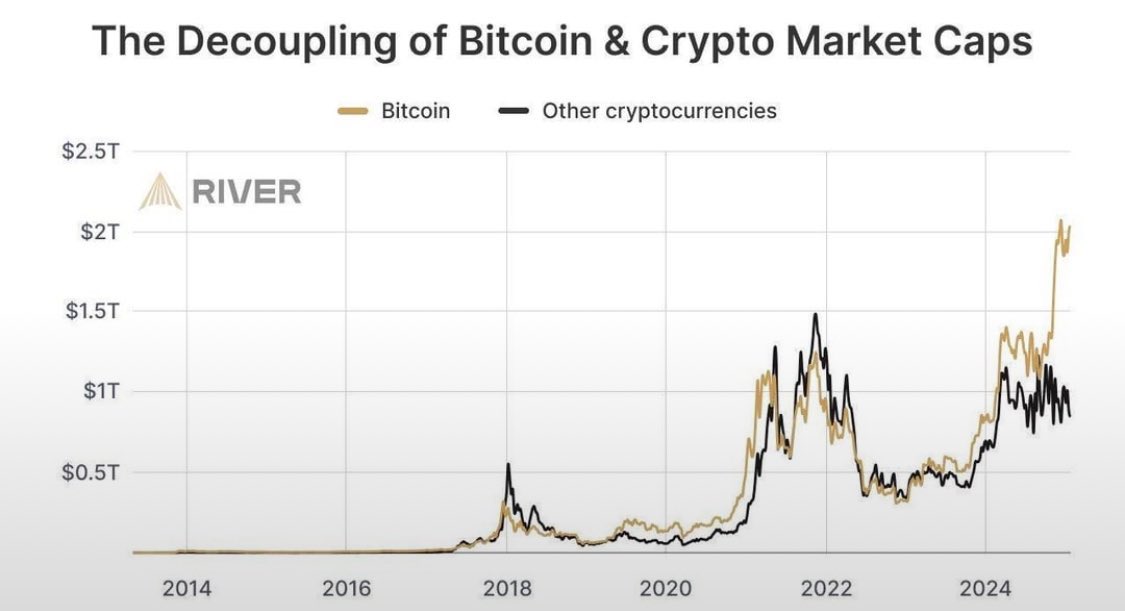

While Bitcoin has traditionally been the dominant force in the crypto space, its market cap trajectory diverged sharply from other cryptocurrencies post-2022.

Bitcoin reached a market cap exceeding $2 trillion in 2024, maintaining a steady climb despite volatility in the broader crypto market.

Source: X

Conversely, other cryptocurrencies experienced significant fluctuations, with their collective market cap lagging behind Bitcoin.

This decoupling further proves Bitcoin’s unique role as a store of value and highlights fragmentation in the altcoin market.

Is altseason never going to arrive?

The persistent dominance of Bitcoin raises questions about the future of “altseason.”

Credit: Source link