The U.S. exchange-traded-fund industry climbed to a record $12.70 trillion in assets at the end of September, according to new data from ETFGI, marking a 22.7 percent increase from $10.35 trillion at the close of 2024.

During September, U.S. ETFs gathered $152.50 billion in net inflows, the second-highest monthly total on record, bringing year-to-date inflows to $951.27 billion—already surpassing last year’s full-year record of $740.78 billion. Assets have now posted 41 consecutive months of net inflows, ETFGI said, highlighting sustained investor demand even amid higher rates and market volatility.

The continued growth and demand shows the dominance of ETFs as the preferred vehicle for both institutional and retail investors.

Volatility, Commodities and Crypto Lead September Inflows

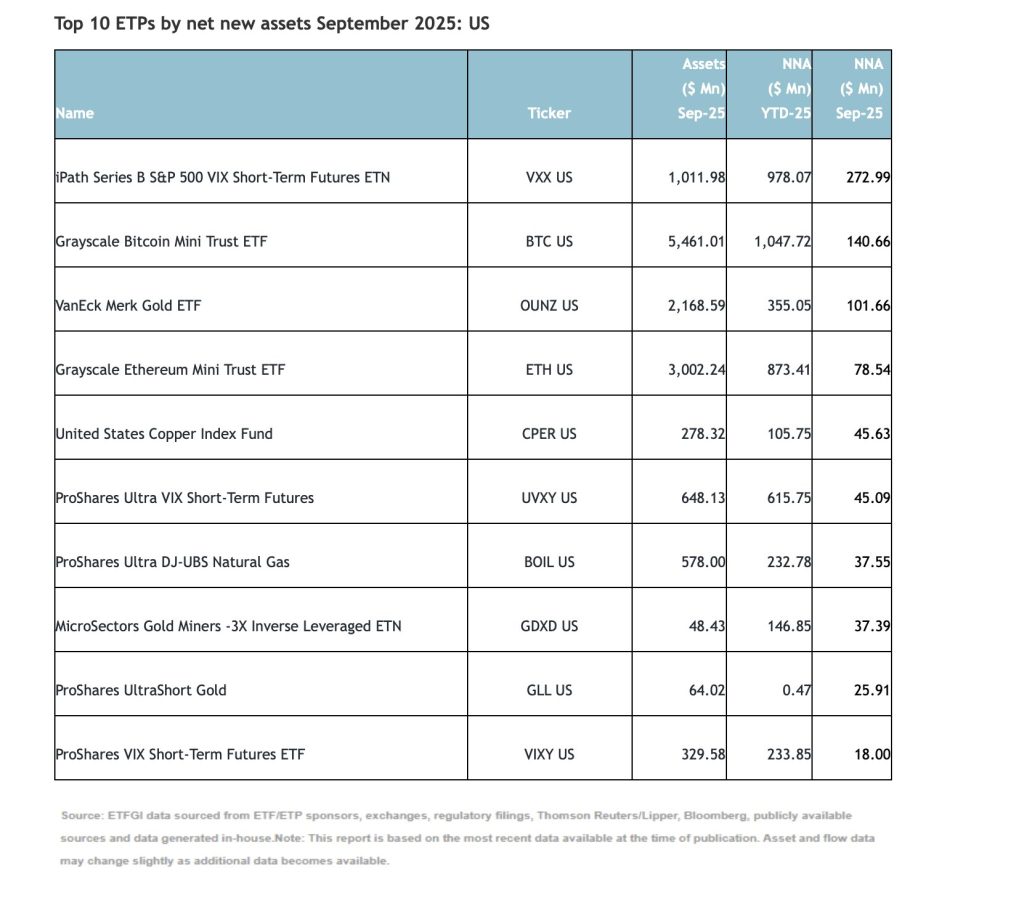

The top 10 U.S. exchange-traded products (ETPs) by net new assets collectively added $803 million during September. The largest single inflow came from the iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX US), which pulled in $272.99 million, reflecting renewed hedging demand as equity volatility resurfaced.

Close behind were crypto-related funds, which continued to rank among the month’s biggest asset gatherers. The Grayscale Bitcoin Mini Trust ETF (BTC US) recorded $140.66 million in September inflows, while its sister product, the Grayscale Ethereum Mini Trust ETF (ETH US), attracted $78.54 million. Together, the two vehicles brought in nearly $220 million, showing investor interest in digital-asset exposure through regulated instruments.

The VanEck Merk Gold ETF (OUNZ US) added $101.66 million, reinforcing gold’s continued role as a hedge alongside crypto. Meanwhile, commodity-linked funds such as the United States Copper Index Fund (CPER US) and ProShares Ultra DJ-UBS Natural Gas (BOIL US) benefited from cyclical demand for raw-material exposure.

Crypto ETFs Cement Their Place in Mainstream Portfolios

ETFGI’s data highlight how digital-asset ETFs have matured from speculative novelty to permanent fixture. The Grayscale Bitcoin Mini Trust ETF now oversees $5.46 billion, while the Grayscale Ethereum Mini Trust ETFmanages $3.00 billion.

Their steady inflows contrast with outflows seen across leveraged and inverse products, suggesting investors are treating Bitcoin and Ethereum as longer-term growth plays rather than short-term trades.

With more than $1.38 trillion in net inflows over the past 12 months, ETFGI said the industry remains on pace to finish 2025 at another all-time high. Rising adoption of spot crypto products and tokenization-themed ETFs could provide an additional tailwind in the fourth quarter.

New ETF launches in the U.S. continue to accelerate, with issuers introducing products across equities, commodities, and digital assets to meet growing investor demand.

Recently Volatility Shares filed for 27 new leveraged exchange-traded funds (ETFs) with the U.S. Securities and Exchange Commission, aiming to deliver 3x and 5x exposure to a mix of leading technology and digital asset-related equities.

The proposed lineup includes single-stock and crypto-linked ETFs tied to firms such as Nvidia, Tesla, MicroStrategy, Palantir, and Coinbase, as well as digital assets like Bitcoin, Ether, Solana, and XRP. The products, which would expand Volatility Shares’ footprint in the leveraged ETF segment, are slated for an effective date of December 29, 2025, with tickers and fees yet to be disclosed.

The filings come amid surging investor interest in high-volatility strategies following record inflows into U.S. ETFs this year.

Credit: Source link